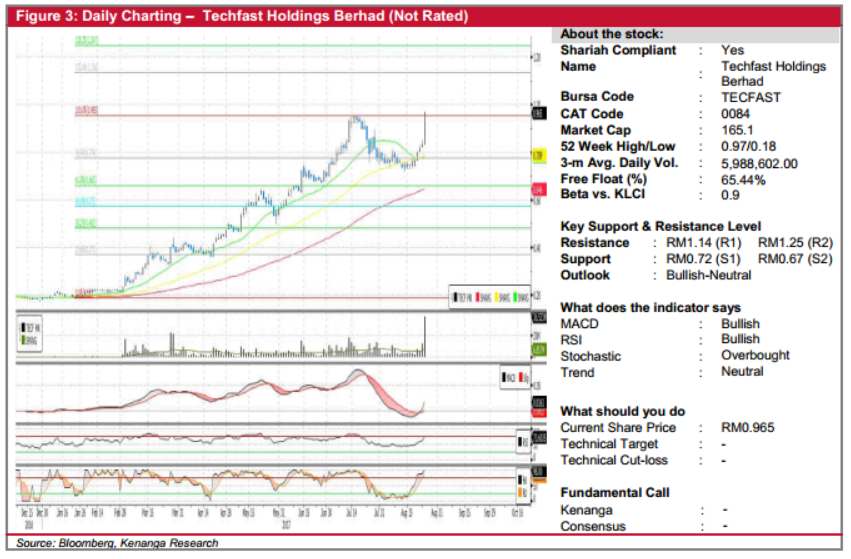

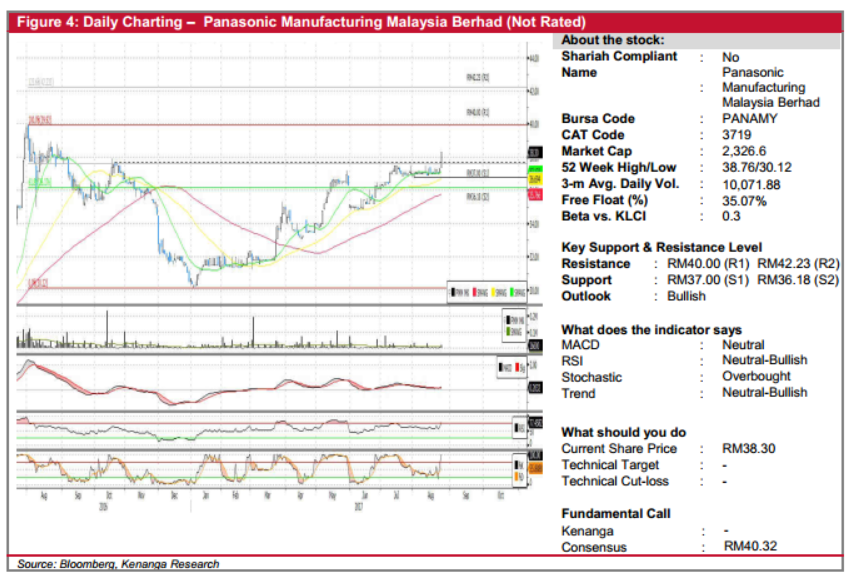

Daily Technical Highlights - (TECFAST, PANAMY)

kiasutrader

Publish date: Fri, 25 Aug 2017, 10:54 AM

TECFAST (Not Rated). TECFAST jumped an impressive 13.0 sen (15.6%) yesterday to close at RM0.965, after previously posting higher 2Q17 net profits coupled with a proposed 1-for-3 bonus issue. This was accompanied by exceptionally high volumes, with 36.5m shares exchanging hands – more than 5-fold its average volume. Yesterday’s move marks as a breakout from a month-long sideways consolidation, and may potentially signal a resurgence of an earlier uptrend that lasted between Feb-July earlier this year. Likewise, key-indicators are also displaying positive upticks following yesterday’s move, especially with the MACD rising above its Signal and zero lines. Follow-through momentum could see the share price trending higher towards resistances at RM1.14 (R1) and RM1.25 (R2). However, failure to do so would render yesterday’s surge as just a retest of its previous high, with the share most likely to continue its sideways direction. With that said, downside support can be found at the base of its retracements at RM0.72 (S1) and RM0.67 (S2).

PANAMY (Not Rated). PANAMY’s share price gained RM1.00 (2.7%) yesterday to finish at RM38.30 on increased volume of 16.6k shares vs. SMAVG (20) of 9.0k. The share price saw a decisive breakout from a one-month sideways consolidation forming a white-Marubozu as bulls dominated the day. Most key-indicators formed an uptick from yesterday’s movement, signalling the momentum is picking up steam for potential rally. Hence, we expect follow-through momentum to continue and retest the key psychological level of RM40.00 (R1) and possibly RM42.23 (R2) next. Downside support level can be found at the previous consolidation period low of RM37.00 (S1) or further below, a stronger support is located at RM36.18 (S2).

Source: Kenanga Research - 25 Aug 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|