Daily Technical Highlights - (WASEONG, SENDAI)

kiasutrader

Publish date: Tue, 29 Aug 2017, 09:57 AM

WASEONG (Not Rated). WASEONG’s share price rose 4.0 sen (4.0%) yesterday to finish at the highest level since Nov 2015 at RM1.03. Earlier this month, the company announced its first contract win of the year, to design and construction of three substations in Kazakhstan, which has been fueling investors’ interest despite the softer sentiment in the broader market. From a charting perspective, WASEONG’s share price has been on a healthy uptrend since late last year, having climbed from a low of RM0.75. With key indicators still in a bullish state, investors may expect bias to remain on the upside from here. Immediate resistance levels to watch are RM1.05 (R1) and RM1.14 (R2) further up. Any weakness towards the RM1.00 (S1) and RM0.93 (S2) support levels may be viewed as a chance to buy-on-dips.

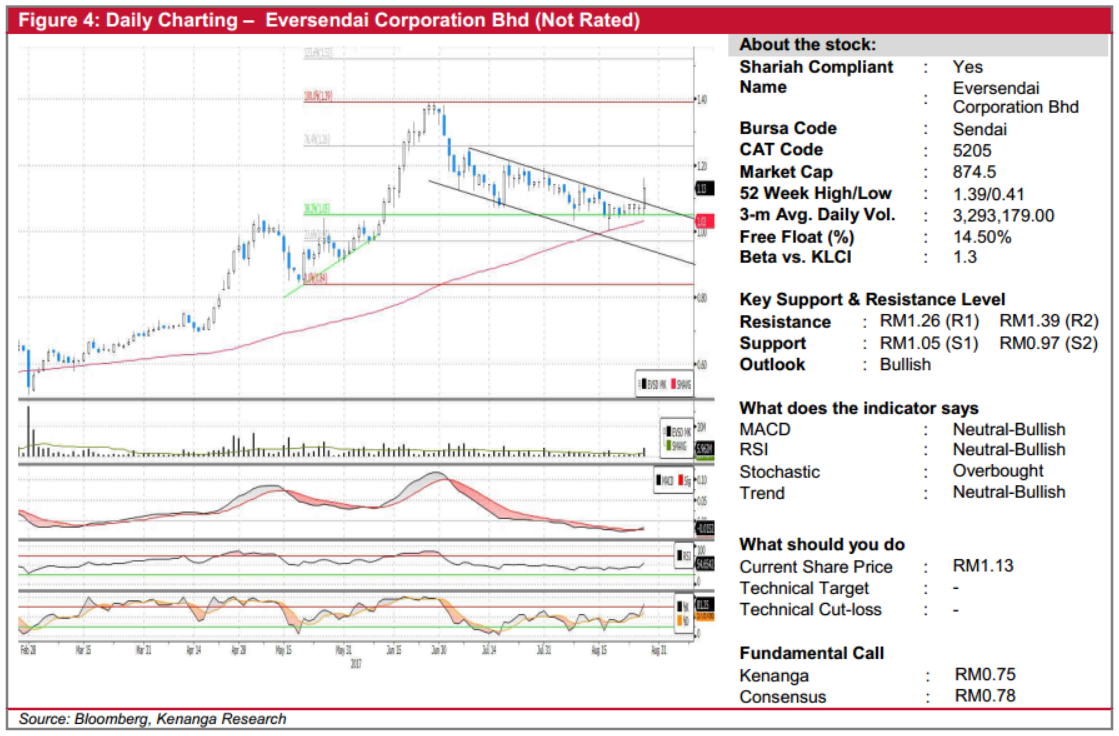

SENDAI (Not Rated). Yesterday, SENDAI rose 6.0 sen (5.6%) to close at RM1.13 after it reported a positive 6M17 set of results with improved net profit of RM35.9m compared to net loss of RM71.1m in the corresponding period last year. The price action was supported by strong volume of 6.0m shares traded vs. the SMAVG (20) of 2.0m shares, marking a breakout from the previous two-month downward consolidation phase to signal potential bullish trend reversal. Upticks in momentum indicators also reflect gains on momentum over yesterday’s movement. As such, there are potential for further climb towards its resistance level of RM1.26 (R1) or further up, to retest its 52-week high of RM1.39 (R2). Meanwhile, strong support levels can be found at RM1.05 (S1) and RM0.97 (S2).

Source: Kenanga Research - 29 Aug 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|