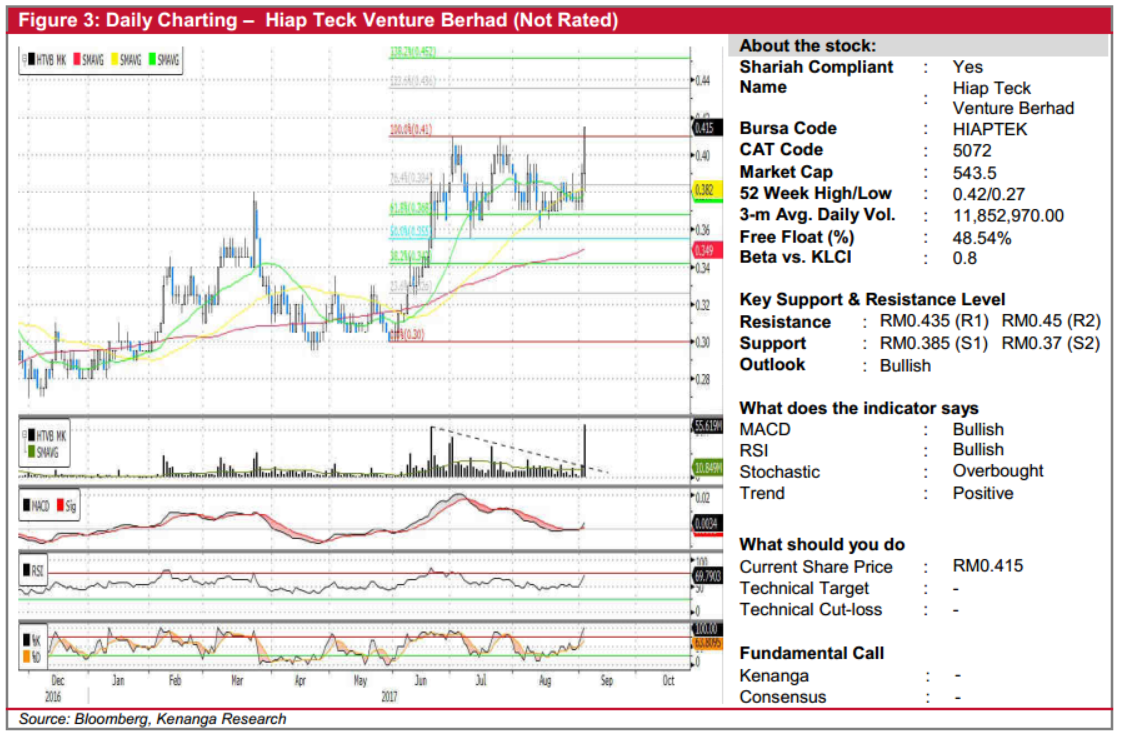

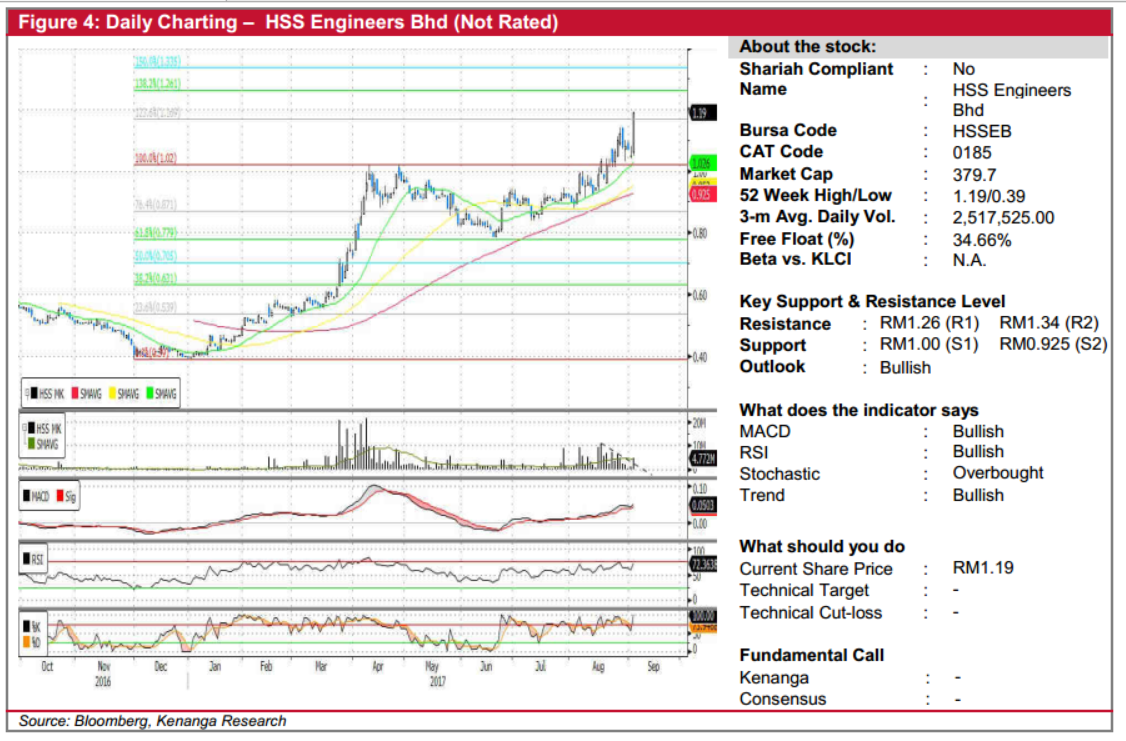

Daily Technical Highlights - (HIAPTEK, HSSEB)

kiasutrader

Publish date: Thu, 07 Sep 2017, 10:02 AM

HIAPTEK (Not Rated). Yesterday, HIAPTEK’s share price rose 2.5 sen (6.4%) to finish at the highest level in more than a year at RM0.415. Earlier in June, HIAPTEK’s share price kicked off a rally which saw its share price climb from a low of RM0.30 to as high as RM0.41 within a month before trading range-bound in the subsequent months. Nevertheless, yesterday’s bullish move signalled a continuation of its prior run after the two-month pause. With the volume indicator also breaking out, we expect buying momentum to continue in the weeks ahead. Immediate resistance levels to target are RM0.435 (R1) and RM0.45 (R2) while downside support levels are RM0.385 (S1) and RM0.37 (S2) below.

HSSEB (Not Rated). HSSEB’s share price rallied 14 sen (13.3%) to finish at a fresh all-time high of RM1.19. The share price started its uptrend earlier in the year (January) and has since quadrupled over these recent eight months. Nevertheless, HSSEB’s overall technical picture remains positive with its primary trend remains intact and its key momentum indicators in a bullish state. With little indication of any let up in its bullish trajectory, we expect the balance of evidence to favour the upside from here. Overhead resistance levels to target include RM1.26 (R1) and RM1.34 (R2) while support levels RM1.00/RM1.03 (S1) are likely to experience buying-on-dips. Further below, the next key resistance is located at RM0.925 (S2) although a break below would be highly negative.

Source: Kenanga Research - 7 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|