Daily Technical Highlights - (SERBADK, PADINI)

kiasutrader

Publish date: Fri, 08 Sep 2017, 10:01 AM

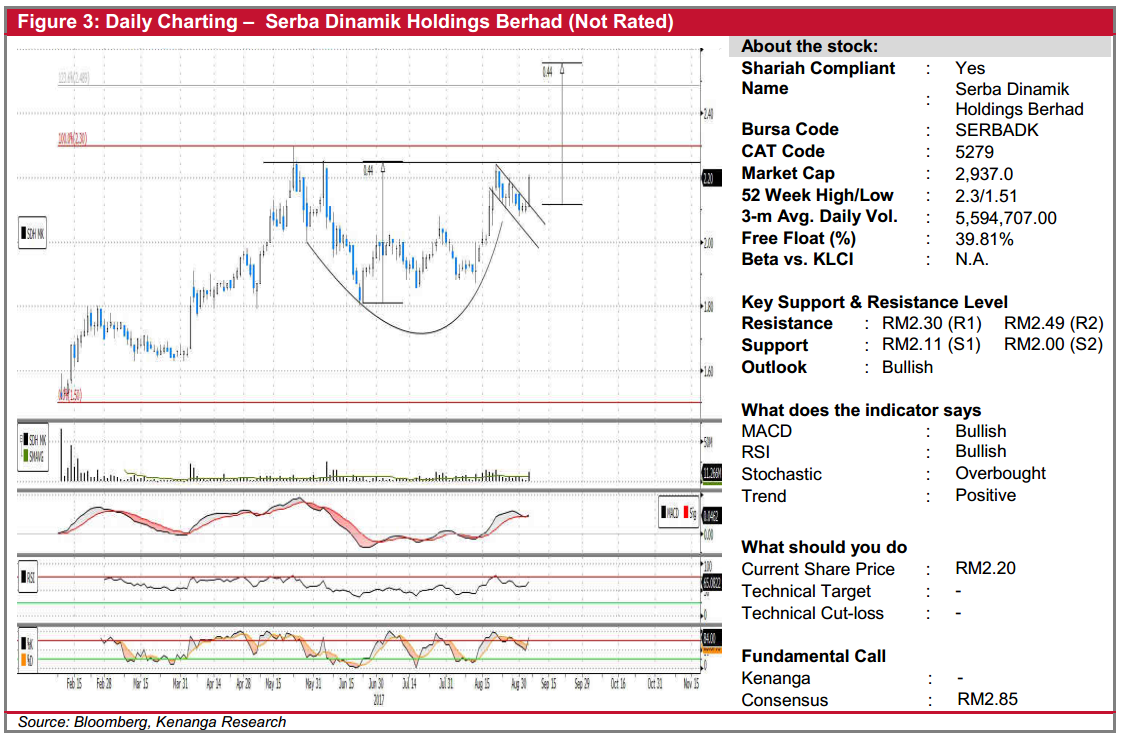

SERBADK (Not Rated). SERBADK’s share price rallied 9.0 sen (4.3%) to finish at RM2.20 on high trading volume. Notably, the bullish movement resulted in a breakout of a bullish “Cup & Handle” pattern, which signaled that the share price is poised to resume its prior run after a two and a half month consolidation. Key momentum indicators have also hooked upwards as a result, and are supportive of a further move higher. The next key level to watch is RM2.30 (R1). Once taken out, the share price would then have a fairly clear path towards RM2.49 (R2) and finally the “Cup & Handle” measurement objective of RM2.60/RM2.66 (R3) further up. Downside support levels are RM2.11 (S1) and RM2.00 (S2) below.

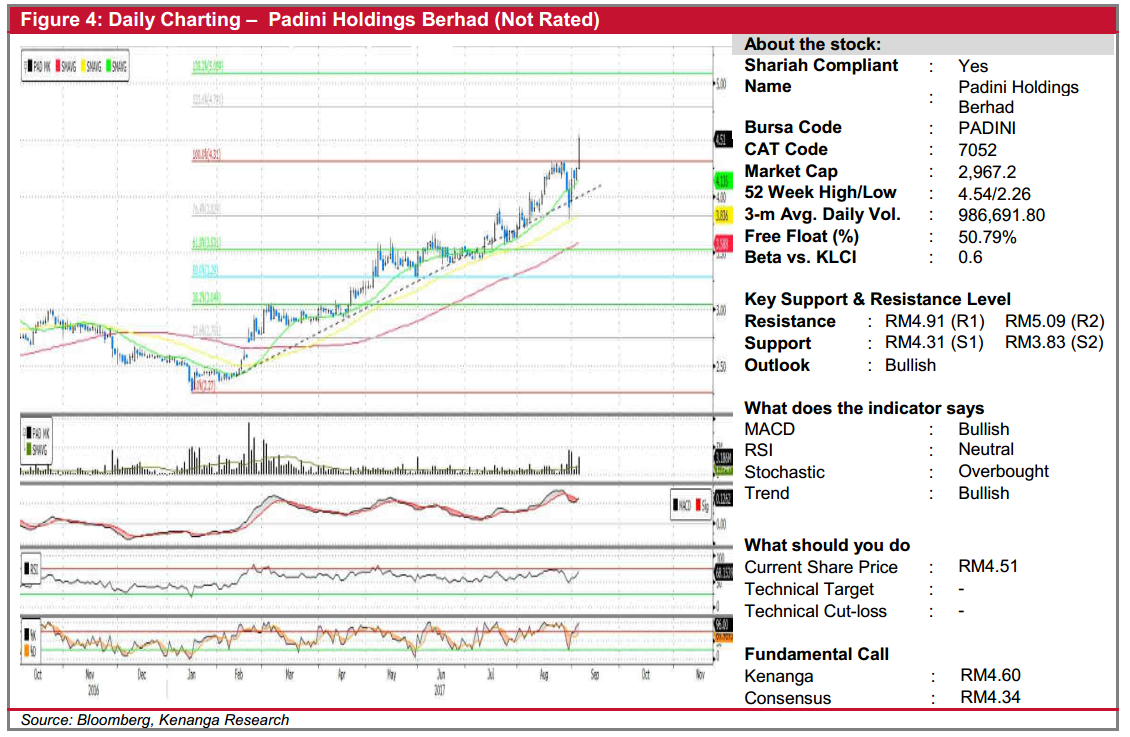

PADINI (Not Rated). PADINI caught our attention yesterday after it rose 26.0 sen (+6.1%) to finish at a record high of RM4.51. This was accompanied by increased trading volume, with 3.2m shares exchanging hands – more than double its 20-day average. We believe yesterday’s move marks as a continuation of an underlying uptrend since the start of the year. More importantly, yesterday’s move also took out its previous resistance at RM4.30, which the share saw multiple retesting over the past month. Likewise, key indicators have also followed with positive upticks, with the MACD staging a bullish crossover above its Signal-line, thus supportive of a move higher. As such, we expect the share to trend towards overhead resistances at RM4.91 (R1) and RM5.09 (R2) on sustained buying momentum. Conversely, an immediate resistanceturned-support can be found at the aforementioned RM4.31 (S1), with another support further lower at RM3.83 (S2).

Source: Kenanga Research - 8 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|