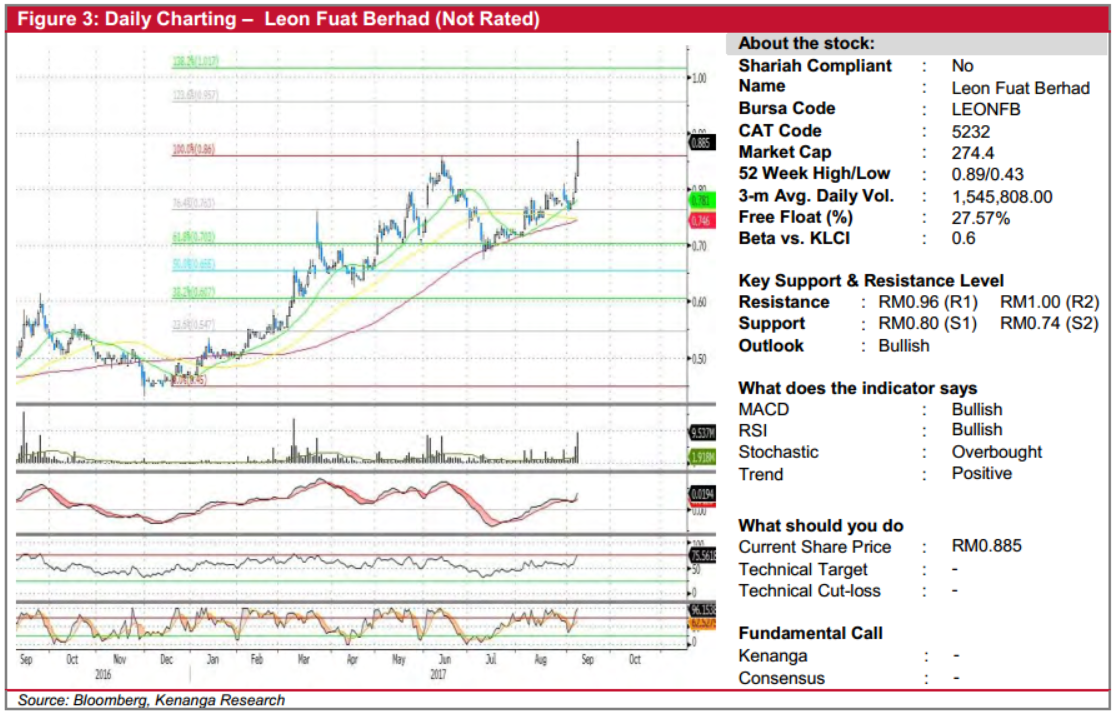

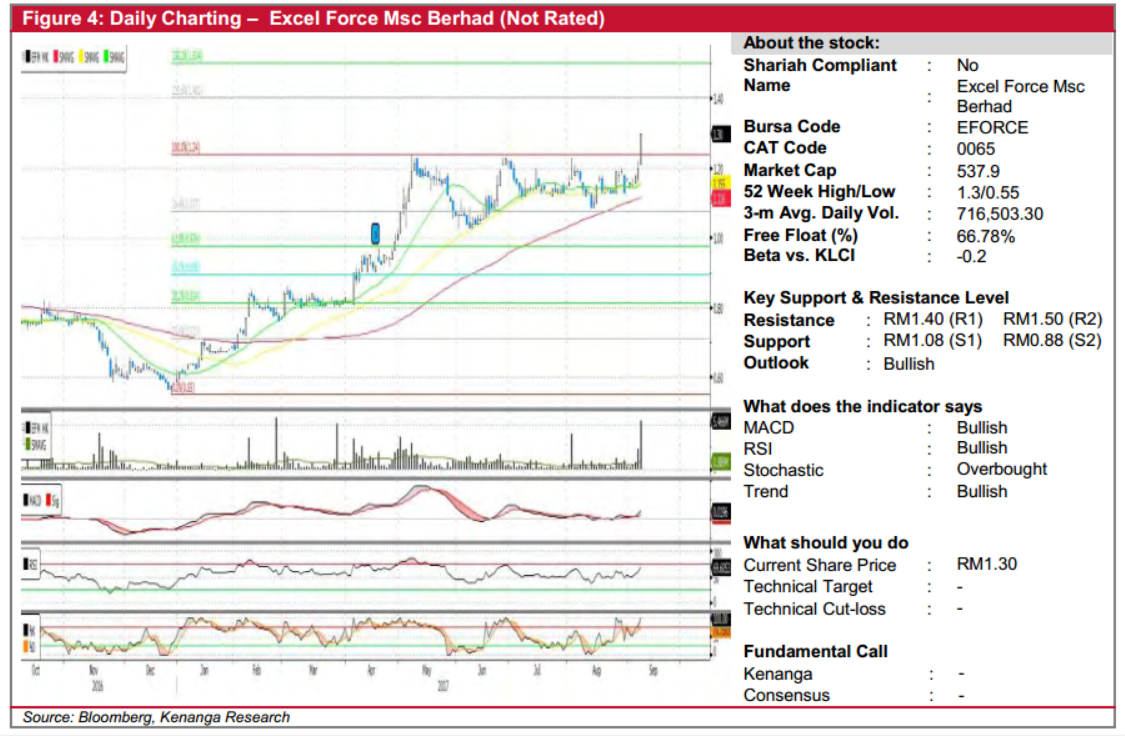

Daily technical highlights - (LEONFB, EFORCE)

kiasutrader

Publish date: Tue, 12 Sep 2017, 09:29 AM

LEONFB (Not Rated). Steel counters extended their rally yesterday in line with higher steel prices as China continued to tighten steel production in the country. Among them included LEONFB, which climbed 6.5 sen (7.9%) to finish at a fresh all time high of RM0.885. Chart-wise LEONFB kicked-off an uptrend earlier in January, climbing from a low of RM0.46 to as high as RM0.86 in June before staging a meaningful correction over the following month. Although the share price has recovered gradually, it wasn’t until yesterday’s decisive move that LEONFB’s chart signaled a continuation of its prior uptrend. Key momentum indicators have also hooked upwards as a result, and as such, we see the potential for a further move towards RM0.96 (R1) and RM1.00 (R2) next. Downside support levels are RM0.80 (S1) and RM0.74 (S2).

EFORCE (Not Rated). EFORCE caught our attention yesterday it surged a remarkable 10.0 sen (+8.3%) to close at record-high of RM1.30 with a white “Marubozu” candlestick. This was accompanied with exceptional trading volumes, with 5.5m shares exchanging hands – more than 6x its average volume. More importantly, yesterday’s move marked a significant breakout above the previous resistance band of RM1.20-1.23, which saw multiple retesting during its sideways consolidation since May. From here, we expect the share to be bullish biased, with a golden-crossover among all key SMAs, coupled with positive showings from key indicators. Sustained momentum would see the share trend higher towards resistances levels at RM1.40 (R1) and RM1.50 (R2). Conversely, a reversal in sentiment could find some supports at RM1.08 (S1) and RM0.88 (S2).

Source: Kenanga Research - 12 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|