Daily Technical Highlights - (STERPRO, SDRED)

kiasutrader

Publish date: Fri, 15 Sep 2017, 09:45 AM

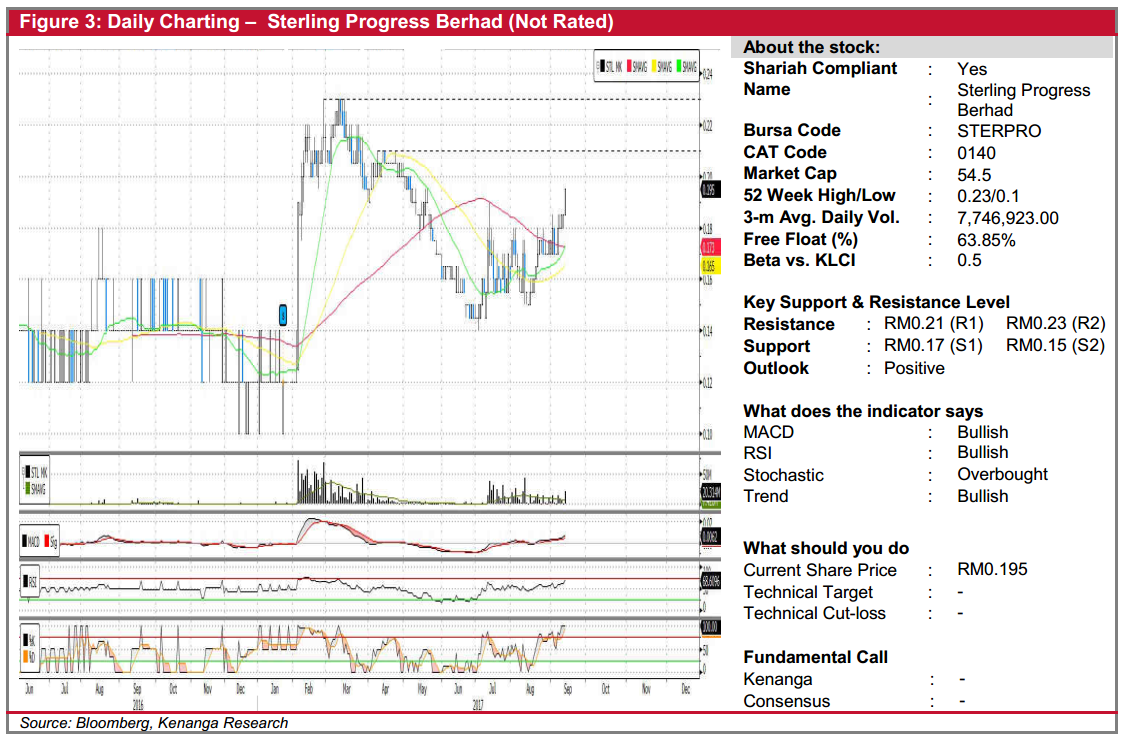

STERPRO (Not Rated). STERPRO’s share price climbed 1.0 sen (8.3%) to finish at RM0.195 yesterday – the highest level since May. Of note, yesterday’s bullish move signalled that the share price has bottomed out, having previously traded within a downtrend for the past six months. Note also that the 20-day SMA had recently completed a “Golden Crossover” with the 50-day SMA, and is now in the midst of intersecting the 100-day SMA. At the same time, key momentum indicators are now in a bullish state. Hence, we expect bias to be on the upside over the coming weeks, with immediate resistance levels at RM0.21 (R1) and RM0.23 (R2). Downside support levels are RM0.17 (S1) and RM0.15 (S2).

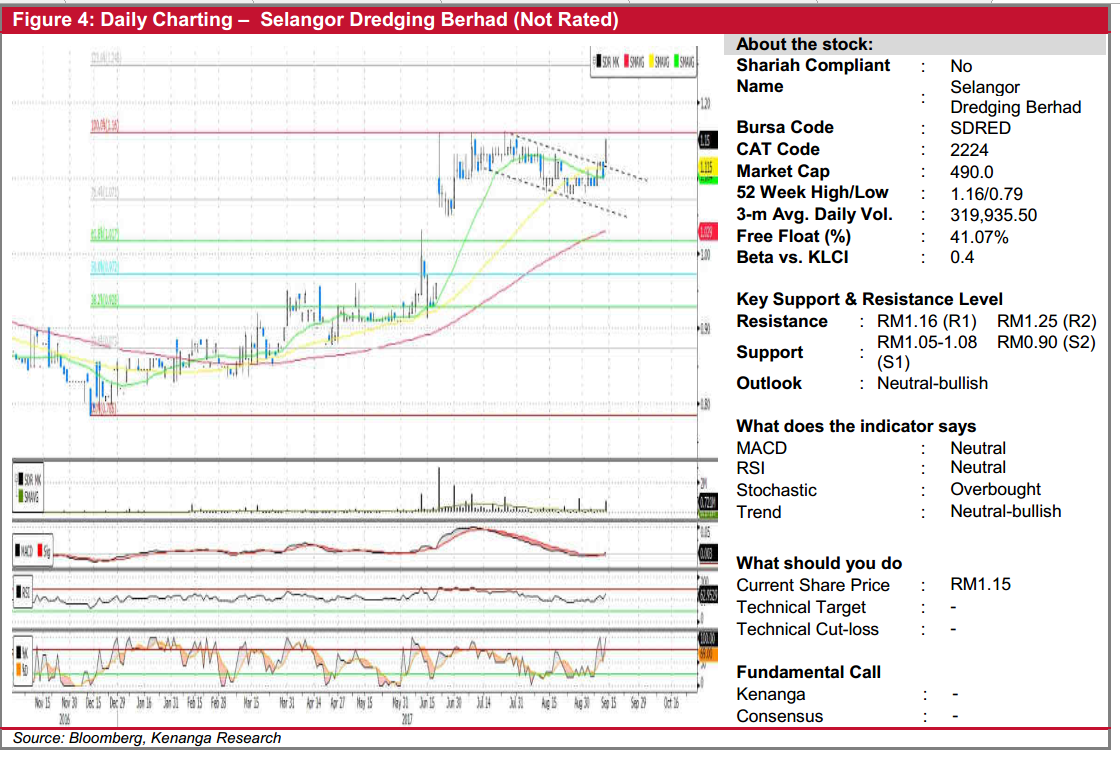

SDRED (Not Rated). SDRED gained a healthy 5.0 sen (4.5%) yesterday to finish at day’s high of RM1.15, supported by exceptionally high trading volume with 721k shares exchanging hands – more than 4x its daily average. More importantly, yesterday’s surge marked the first positively decisive move throughout a period of sideways consolidation for the past 3 months. However, despite the positive display, we are wary over the immediate overhead resistance at RM1.16 (R1), which saw multiple retesting throughout the last few months, while a decisive break beyond should see the share trending towards its next resistance at RM1.25 (R2). Conversely, a failure to take out the immediate resistance could see the share retreating back to its range bound trading mode, with an immediate support range at RM1.05-1.08 (S1). A break below that would be highly negative, with the share most likely to capitulate to its lower support at RM0.91 (S2).

Source: Kenanga Research - 15 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|