Daily Technical Highlights - (EATECH, GKENT)

kiasutrader

Publish date: Wed, 20 Sep 2017, 09:25 AM

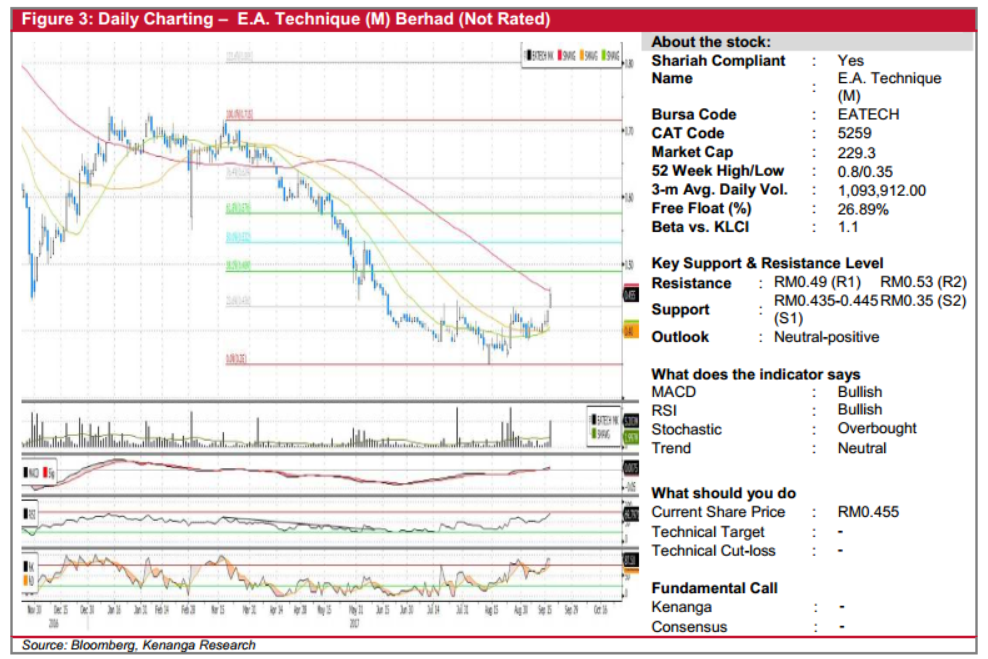

EATECH (Not Rated). EATECH’s share price rose an impressive 2.5 sen (5.8%) yesterday, closing at RM0.455 on the back of exceptionally healthy trading volume, with 5.2m shares exchanging hands - equivalent to around 2.6x of its daily average. Yesterday’s move can be interpreted as a breakout from its previous resistance of RM0.435-0.445, potentially signalling a reversal after its long downtrend since March. Likewise, a “Golden Crossover” had emerged between its 20-day and 50-day SMAs, with key-indicators also showing positive signs – MACD rising above zero and Signal line, while RSI continues its uptrend. We believe that combined, these are good indicatives of a move higher. From here, sustained followthrough should see the share having a clear path towards overhead resistances at RM0.49 (R1) and RM0.53 (R2). Conversely, a decisive break-below its aforementioned resistance-turned-support of RM0.435-0.445 (S1) is deemed as highly negative, with the share potentially capitulating back towards its low at RM0.35 (S2).

GKENT (Not Rated). GKENT caught our attention yesterday after the share performed remarkably well to gain 21 sen (7.5%) and close at RM3.02. This was backed by higher volumes, with 4.3m shares traded – slightly more than 3-folds its daily average. From a technical perspective, yesterday’s move can be seen as yet another retest of its immediate resistance at RM3.01 (R1), having already staged two retests over the past 2 months. With that said, positive upticks from key indicators may mildly suggest a move higher, but we do expect slight some slight reconsolidation for the time being until the resistance is decisive taken out. From there, sustained momentum could see the share trending upwards until next resistance at RM3.35 (R1). Conversely, immediate supports can be found at RM2.73 (S1), and RM2.57 (S2) further lower.

Source: Kenanga Research - 20 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|