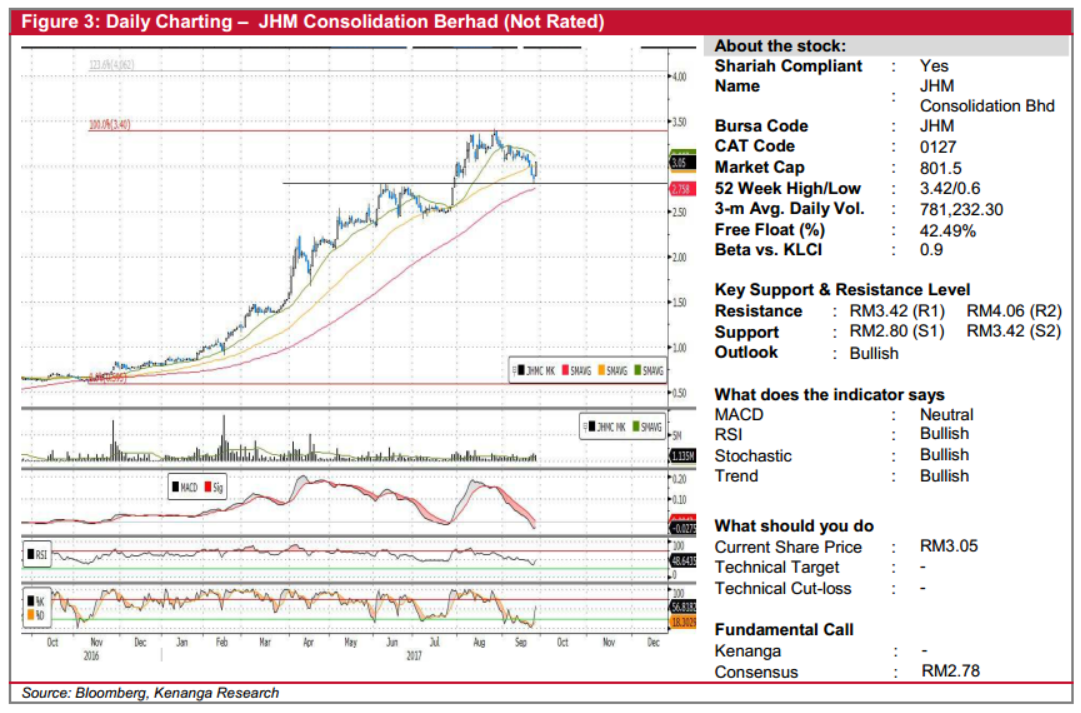

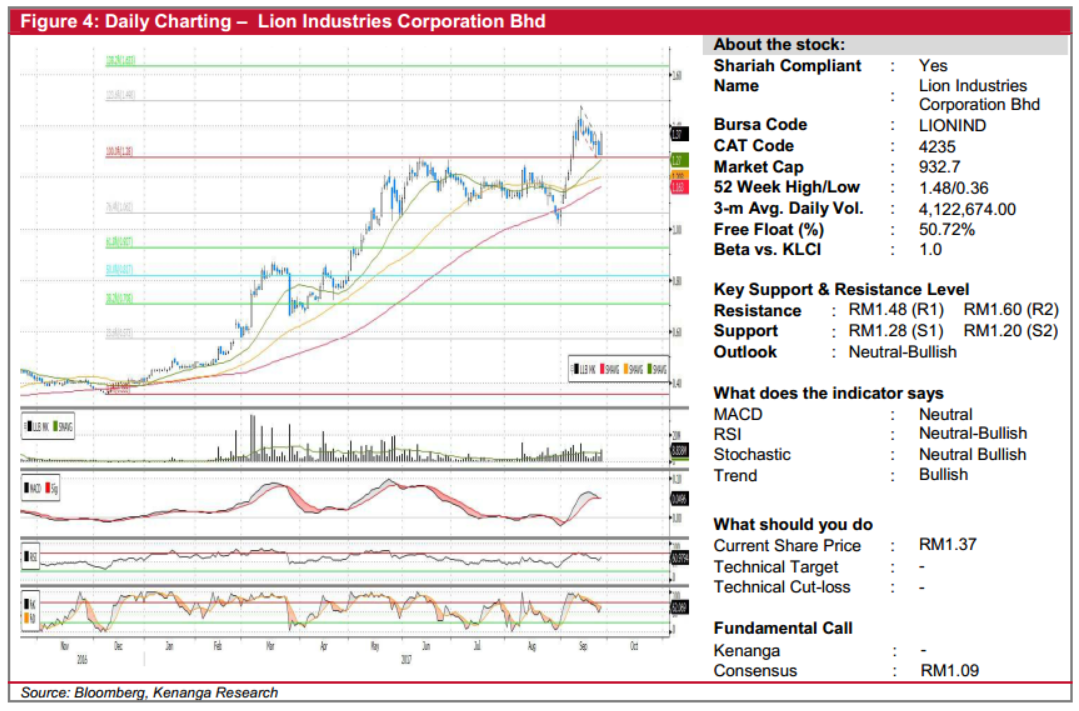

Daily Technical Highlights - (JHM, LIONIND)

kiasutrader

Publish date: Thu, 28 Sep 2017, 11:12 AM

JHM (Not Rated). JHM (Not Rated). JHM’s share price surged 18.0 sen (6.3%) to RM3.05 yesterday, following a corrective pullback that lasted a month. Late last year, JHM kicked off a strong rally which saw its share price rallying from RM0.60 to as high as RM3.42. However, the past month has seen the share price staging a pullback, towards RM2.80 before investors re-emerged. Consequent to yesterday’s bullish move, JHM has confirmed a “Hammer Reversal” candlestick, which is indicative that the share price is poised for a rebound. At the same time, both the RSI and Stochastic indicators have hooked upwards signalling the start of the next leg up. Hence, we expect the share price to retest its recent high of RM3.42 (R1) before a potential move towards RM4.06 (R2) next. Downside support levels include the above-mentioned RM2.80 (S1) level and RM2.50 (S2) below.

LIONIND (Not Rated). LIONIND saw its share price climbing 8.0 sen (6.2%) to close at RM1.37 with high trading volume of 8.84m shares versus SMAVG (20) of 6.69m shares. The share price broke out its two-week downward consolidation phase, marking continuation of its primary uptrend which started at the beginning of the year. Both RSI and Stochastic hooked upwards from yesterday’s movement while MACD is just right above Zero-line signalling the momentum is still positive. Assuming that follow-through buying emerges, we expect the share price to retest its recent high of RM1.48 (R1) while, with a decisive breakthrough, the share price is on a clear path to test the key psychological level of RM1.60 (R2) level. Meanwhile, downside support levels are RM1.28 (S1) and RM1.20 (S2) where traders may buy on weakness.

Source: Kenanga Research - 28 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|