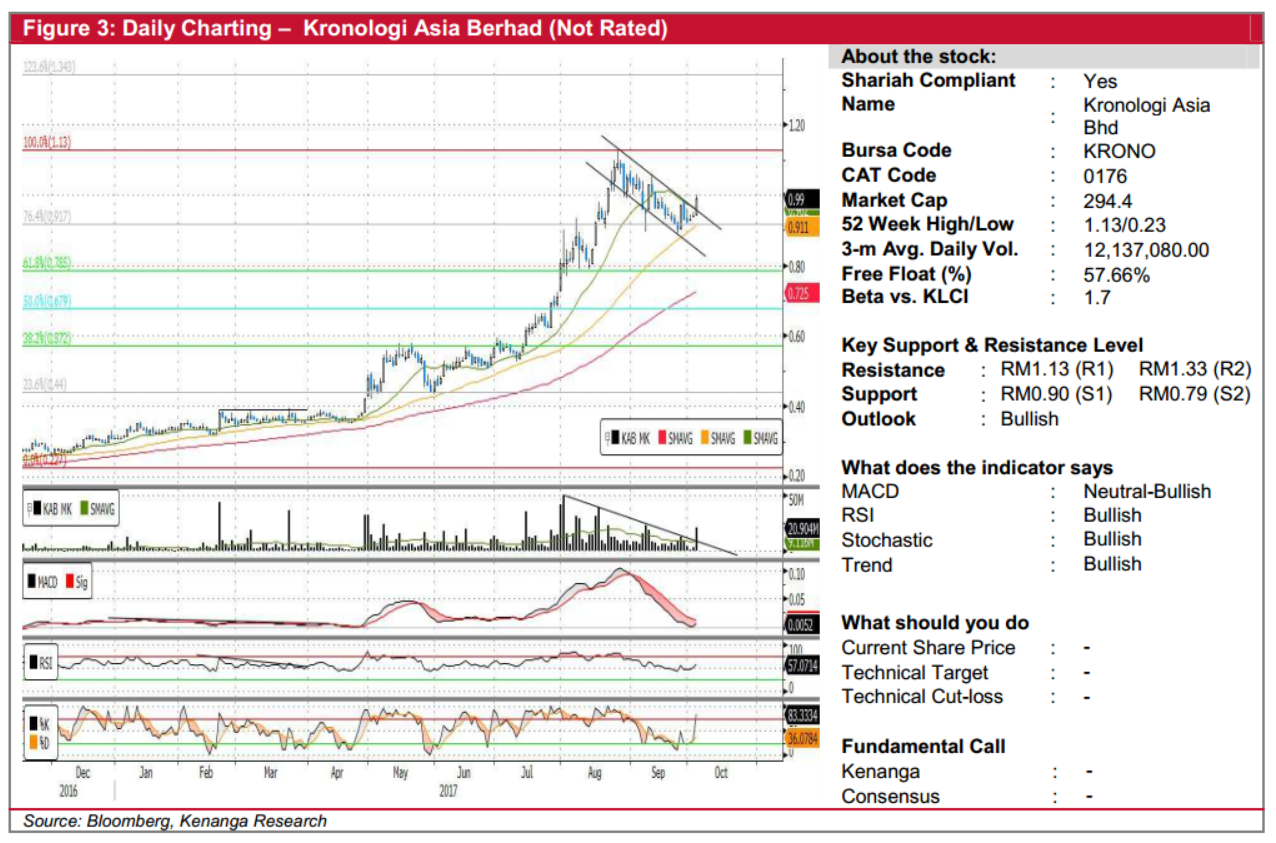

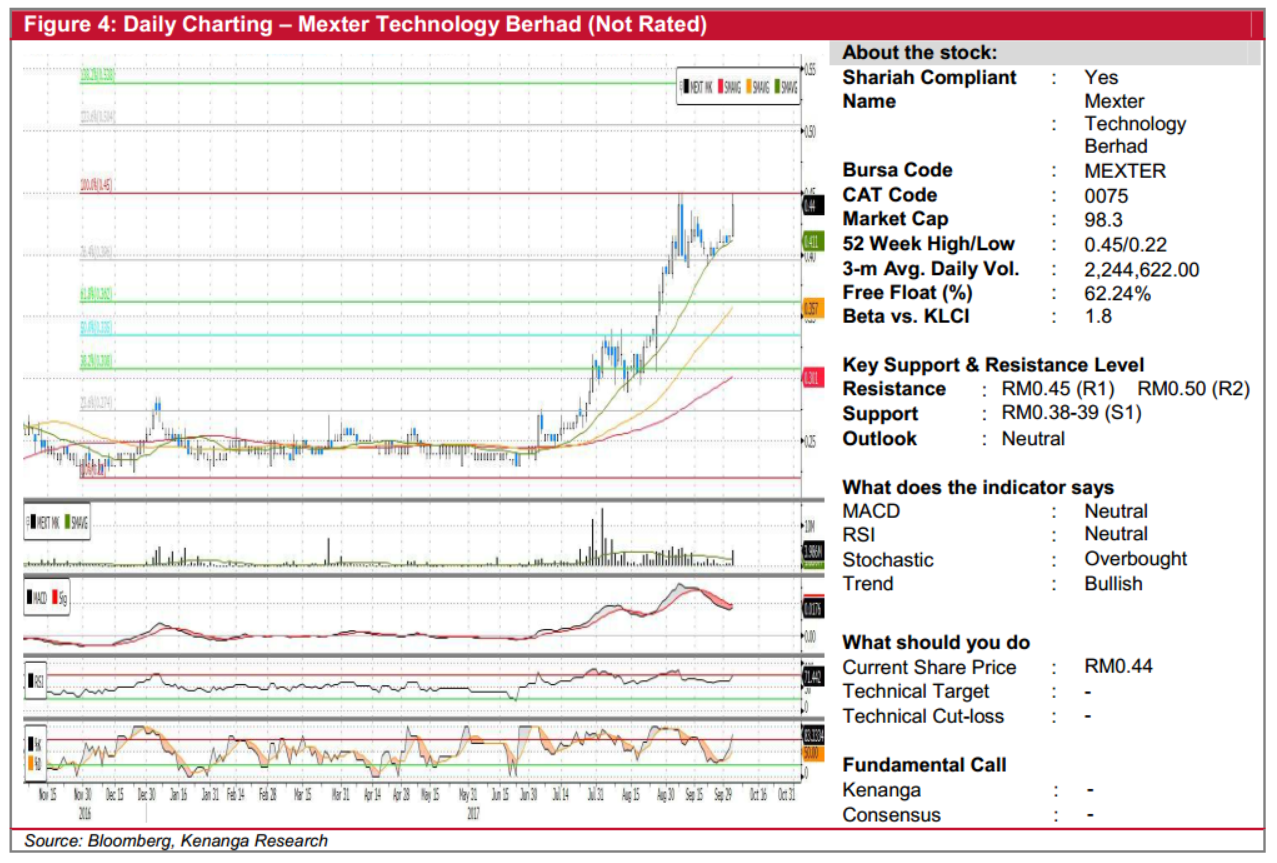

Daily Technical Highlights - (KRONO, MEXTER)

kiasutrader

Publish date: Thu, 05 Oct 2017, 09:31 AM

KRONO (Not Rated). KRONO’s share price climbed 5.0 sen (5.3%) yesterday to close at RM0.99. Overall, KRONO’s short-to-longer term trend is positive with the key SMAs in a “Golden Crossover”. More recently this past six weeks, the share price staged a minor pullback following a strong run-up since its May lows. However, the share price has now broken out of its this healthy pause to signal a resumption of its prior uptrend. Trading volume jumped, alongside the uptick in the momentum indicators. As such, we expect further gains ahead, with an eventual retest of its August high at RM1.13 (R1). Should this level be taken out next, we would then set our sights on RM1.33 (R2) further up. Downside support levels are RM0.90 (S1) and RM0.79 (S2) below.

MEXTER (Not Rated). MEXTER gained 2.5 sen (6%) yesterday to close at RM0.44. This marks as a bullish breakout after a healthy 3-week pause from its prior uptrend since early July. More importantly, the share retested its overhead resistance of RM0.45 yet again during yesterday's intra-day trade - the third retest in a month. Key indicators still remain positive, as shown by the upticks in the RSI and Stochastic indicators, while its MACD continues to hover well above the zero level. Likewise, the underlying trend continues to remain positive, with the share still trading above all key SMAs, which are also currently in an upward fanning state. From here, sustained momentum would see the share breaking through its aforementioned immediate resistance of RM0.45 (R1), with higher resistances placed at RM0.50 (R2) and RM0.54 (R3). However, a failure to do so would render yesterday's move as a mere retest, with the share potentially capitulating towards its support level at RM0.38-0.39 (S1) upon tapering buying interests.

Source: Kenanga Research - 5 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|