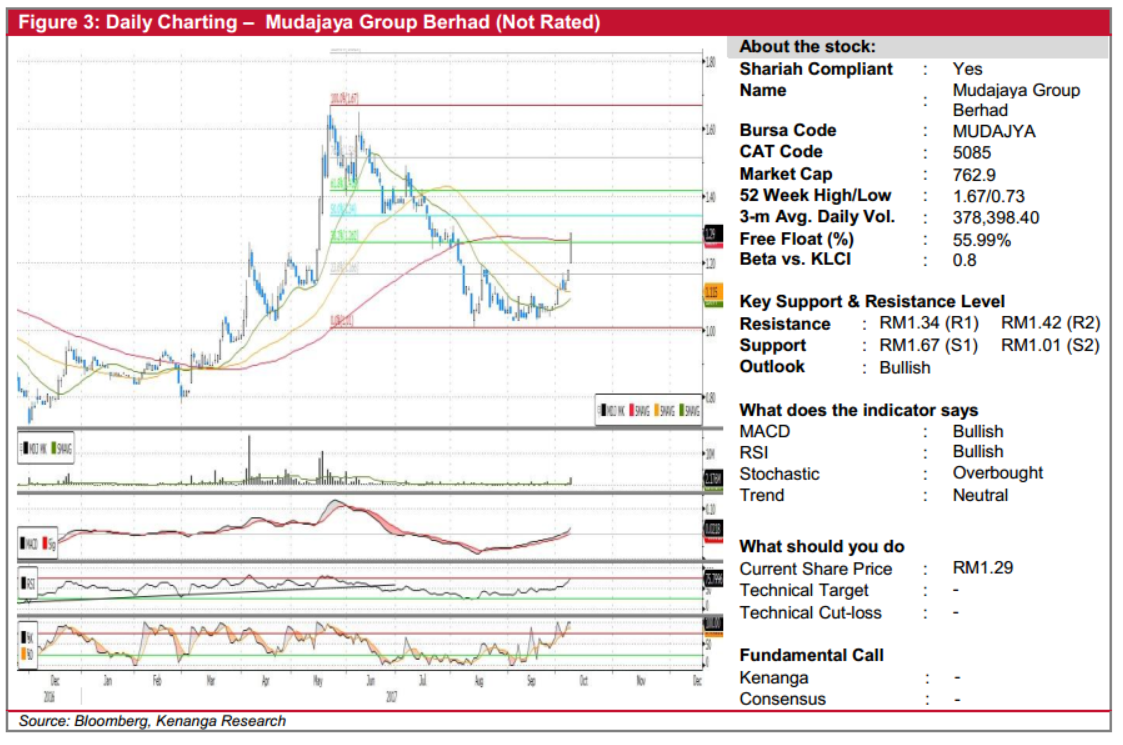

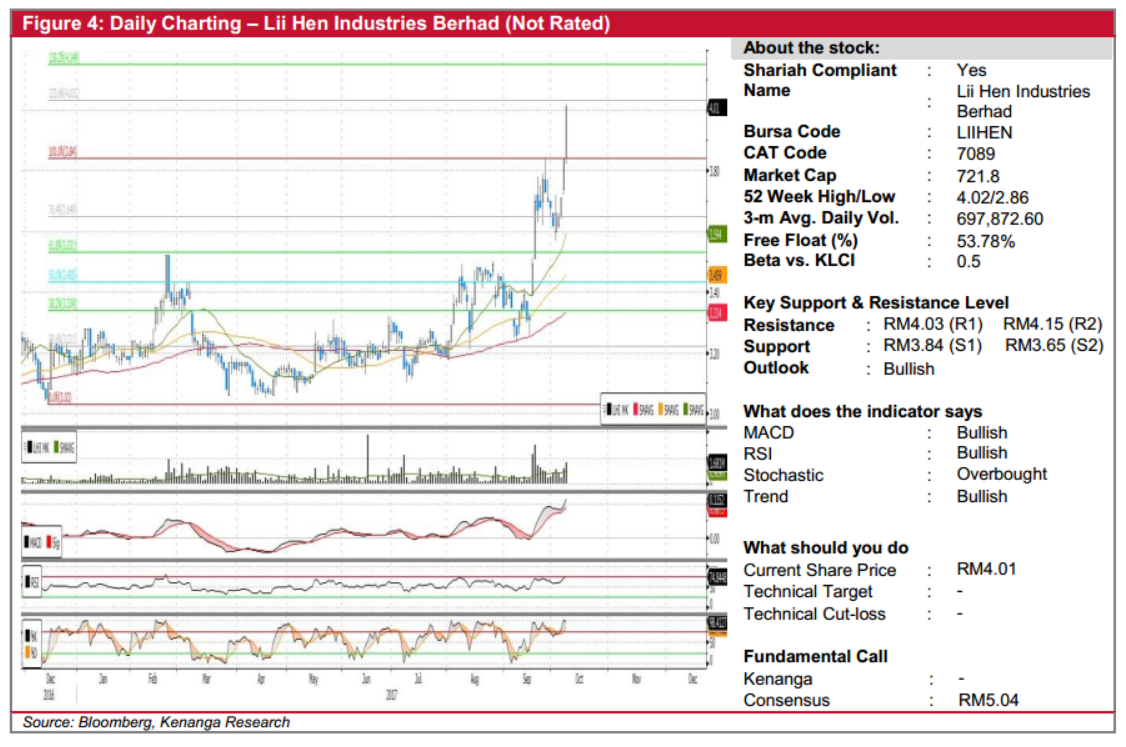

Daily technical highlights - (MUDAJYA, LIIHEN)

kiasutrader

Publish date: Tue, 10 Oct 2017, 09:34 AM

MUDAJYA (Not Rated). Yesterday, MUDAJYA rose 11.0 sen (9.3%) to close at RM1.29. This was backed by exceptionally high trading volume, with 2.2m shares exchanging hands – nearly 5-fold its 20-day average. More importantly, yesterday’s decisive move further confirms a reversal from its prior downtrend since late-May. Likewise, positive displays from key indicators also further suggest a move higher. From here, sustained momentum should see the share trend towards resistances at RM1.34 (R1) and RM1.42 (R2). Conversely, support levels can be identified at RM1.67 (S1) and RM1.01 (S2).

LIIHEN (Not Rated). LIIHEN rose an impressive 17.0 sen (4.4%) yesterday, closing at fresh high of RM4.01. Trading volume was above average, with 1.7m shares exchanging hands. More importantly, yesterday’s move marked a decisive breakout above its previous resistance of RM3.84, which the share retested twice in the past two weeks to no avail. Additionally, with key SMAs continuing to be in an upward fanning state, and indicators retaining its bullish displays, we believe the balance of evidence continues to favour a further move upwards. From here, utilising a Fibonacci projection, we expect some overhead resistances at RM4.03 (R1) and RM4.15 (R2). Conversely, downside support includes the aforementioned resistance-turned-support at RM3.84 (S1) with another support further lower at RM3.65 (S2).

Source: Kenanga Research - 10 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|