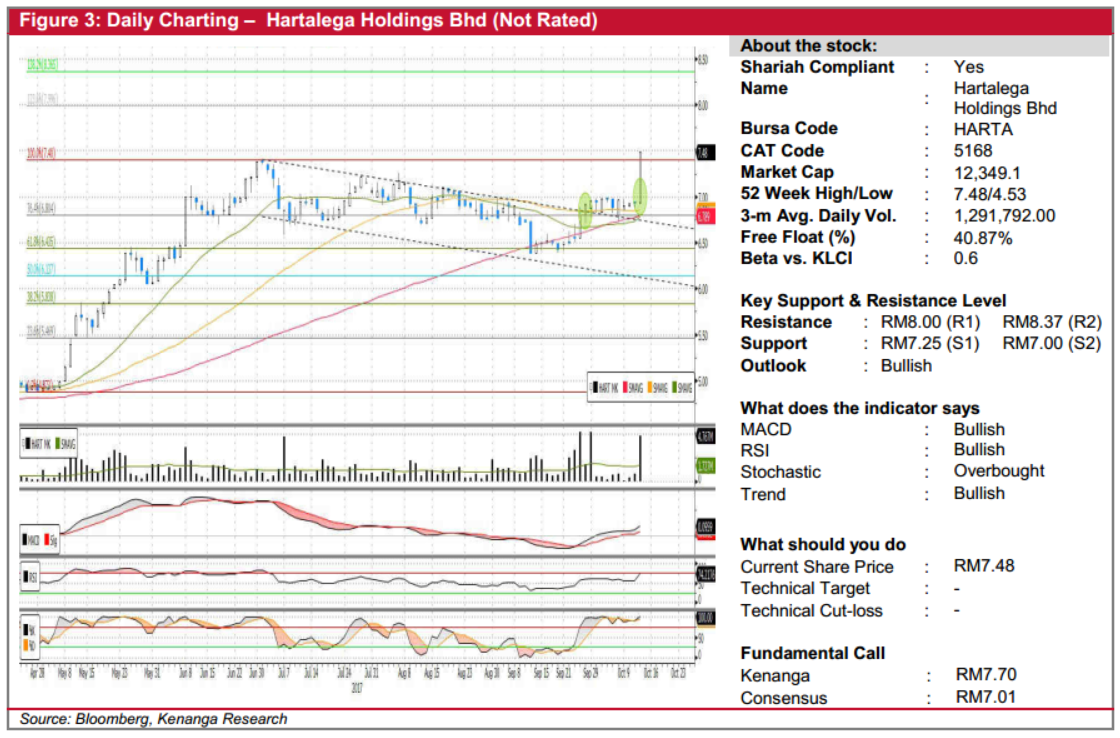

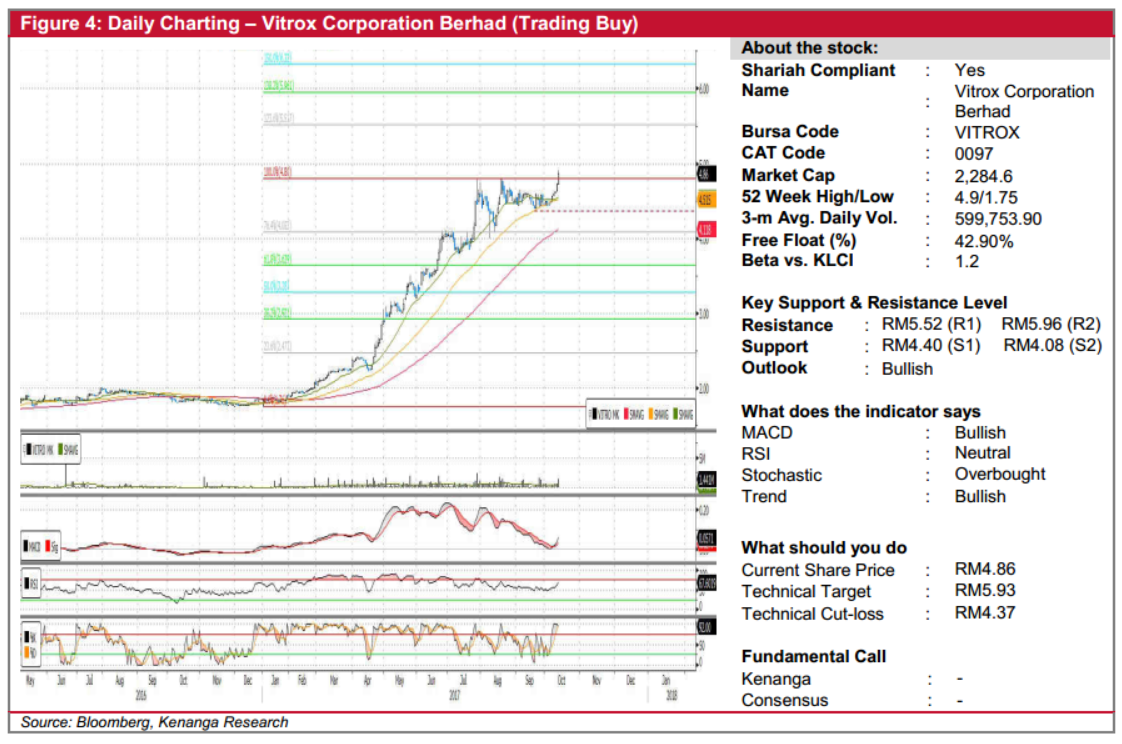

Daily Technical Highlights - (HARTA, VITROX)

kiasutrader

Publish date: Fri, 13 Oct 2017, 09:32 AM

HARTA (Not Rated). HARTA surged 54.0sen (7.8%) to a fresh record yesterday to close at RM7.48. Yesterday’s move was the second breakout since September, which further confirms the bullish trend reversal. The first breakout in September marked the end of its previous mild downtrend since July to trend sideways later. Indicator-wise, the MACD just turned positive, indicating increasing upward momentum. Supported by strong volume of 4.8m shares compared to SMA (20) of 1.7m shares, the overall technical picture looks promising for it to trend higher. From here, the share price has a clear path towards RM8.00 (R1) and possibly RM8.37 (R2) further up. Meanwhile, the support level is resistance turned support of RM7.25 (S1), with an additional support level below at RM7.00 (S2).

VITROX (Trading Buy, TP: RM5.93, SL: RM4.37). Yesterday, VITROX’s share price rallied a good 14.0 sen (2.9%) to close at all-time high of RM4.86. This was accompanied by high volumes of 1.8m shares traded - more than triple its 20- day average of 0.5m shares. More importantly, it took out the key resistance level of RM4.80 which it had previously retested twice over the past 3 months. We believe this could signal a continuation of its prior uptrend, which lasted from beginning of the year until July. Likewise, with the share price now above key SMAs, and with a bullish uptick from its MACD to crossover its Signal line, we believe the balance of evidence favours the upside in the immediate term. From here, we place our technical target 3 sen below our higher resistance of RM5.96 (R2), with an intermediate resistance at RM5.52 (R1). Likewise, our stop-loss level is placed 3.0 sen below immediate support at RM4.40 (S1), with a lower support at RM4.08 (S2).

Source: Kenanga Research - 13 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|