Daily Technical Highlights - (INARI, MBL)

kiasutrader

Publish date: Tue, 17 Oct 2017, 12:34 PM

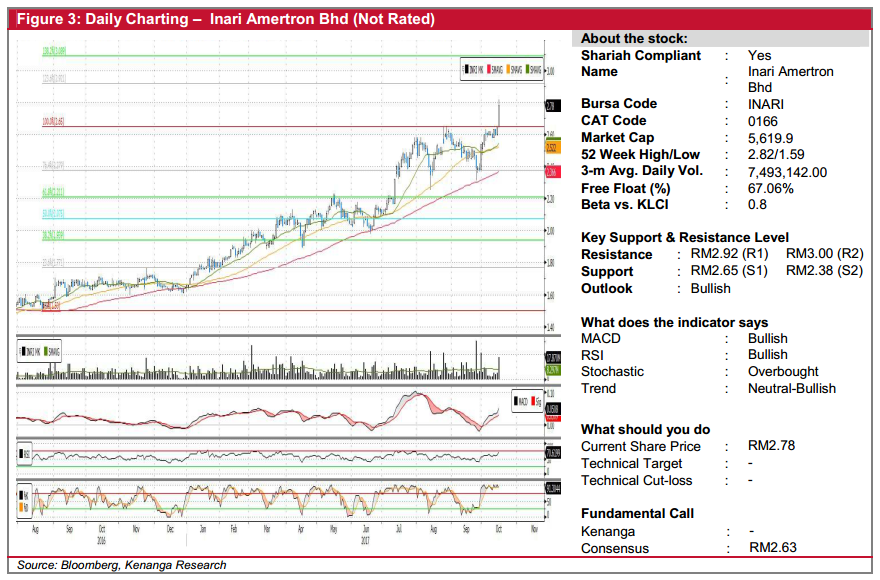

INARI (Not Rated). INARI’s share price surged 13.0 sen (4.9%) before finishing at an all-time high of RM2.78. Chart-wise, yesterday’s break out signalled the continuation of its prior uptrend after several failed breakouts in the past two months. Additionally, the “Golden Crossover” between the 20-day and 50-day SMAs, confirms the resumption of this bullish trend. The move is also supported by positive signal in most key indicators and strong trading volume of 17.9m shares. From here, we expect INARI’s share price to move towards RM2.92 (R1) resistance level, before a possible climb further up to psychological level of RM3.00 (R2). With overall bias to the upside, any weakness towards the RM2.65 (S1) resistanceturned-support should be viewed as a buying opportunity while a break below RM2.38 (S2) would be highly negative for the stock.

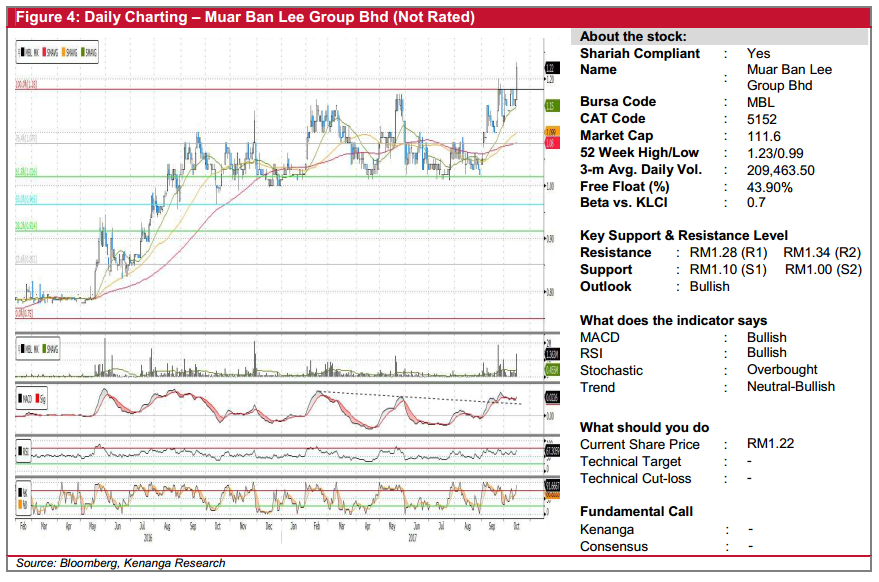

MBL (Not Rated). MBL’s share price closed at a 4-year high yesterday after the share price rose 6.0 sen (5.2%) to RM1.22. Yesterday’s move marked MBL’s breakout from its more-than-a-year range-bound trading with relatively strong trading volume of 1.4m shares vs. its 20-day average of 0.5m shares. It was also supported by uptick in the MACD, which just crossed above both Signal and Zero lines, indicating a gain in momentum. From here, immediate resistance levels to target are RM1.28 (R1) while a decisive breakthrough will bring the price further up towards RM1.34 (R2). Downside support levels are present at RM1.10 (S1) and RM1.00 (S2) below

Source: Kenanga Research - 17 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-08-29

INARI2024-08-29

INARI2024-08-29

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-27

INARI2024-08-27

INARI2024-08-27

INARI2024-08-27

INARI2024-08-27

INARI2024-08-27

MBL2024-08-26

INARI2024-08-26

INARI2024-08-23

INARI2024-08-23

INARI2024-08-23

INARI2024-08-21

INARI2024-08-21

INARI2024-08-20

INARI2024-08-20

INARI2024-08-20

INARI

.png)