Daily Technical Highlights - (TUNEPRO, JAKS)

kiasutrader

Publish date: Thu, 19 Oct 2017, 10:38 AM

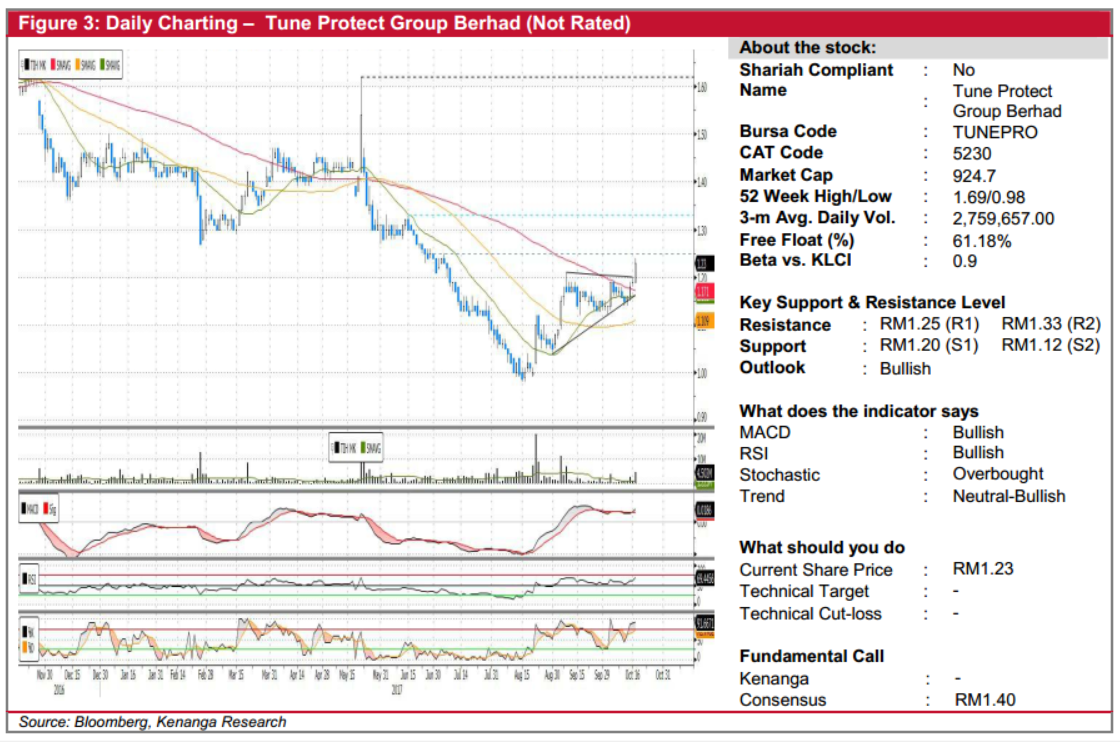

TUNEPRO (Not Rated). TUNEPRO’s share price rose 4.0 sen (3.4%) last Tuesday to RM1.23 on increased volume with 4.5m shares traded. Notably, the share price has broken out of a “Ascending Triangle” pattern. This potentially signals a resumption of its prior near-term bullish trend. With most key indicators in bullish state, we expect further gains ahead with the price to trend towards overhead resistance level of RM1.25 (R1). Pending a decisive breakout from R1, next resistance levels are RM1.33 (R2) and further up, RM1.62 (R3), its YTD high. Conversely, downside support levels are RM1.20 (S1) and RM1.12 (S2).

JAKS (Not Rated). We saw JAKS climbing 8.0 sen (6.2%) to RM1.38 last Tuesday. For the past 7 months, JAKS had endured a downtrend that saw the share price retreating from a high of RM1.72 to as low as RM1.20 before bottoming out. Last Tuesday’s move could mark as a breakout from the downtrend supported with strong trading volume of 5.0m shares. Indicator-wise, despite the MACD still signalling negative momentum, the move has caused an uptick in the MACD, indicating gain in momentum. From here, we expect the share price to likely punch through its overhead resistance of RM1.40 (R1) and, if given enough momentum, may climb higher towards RM1.49 (R2). The former RM1.30 resistance has now turned into support (S1), with an additional support level below at RM1.20 (S2).

Source: Kenanga Research - 19 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|