Daily technical highlights - (LIONIND, HENGYUAN)

kiasutrader

Publish date: Tue, 07 Nov 2017, 09:49 AM

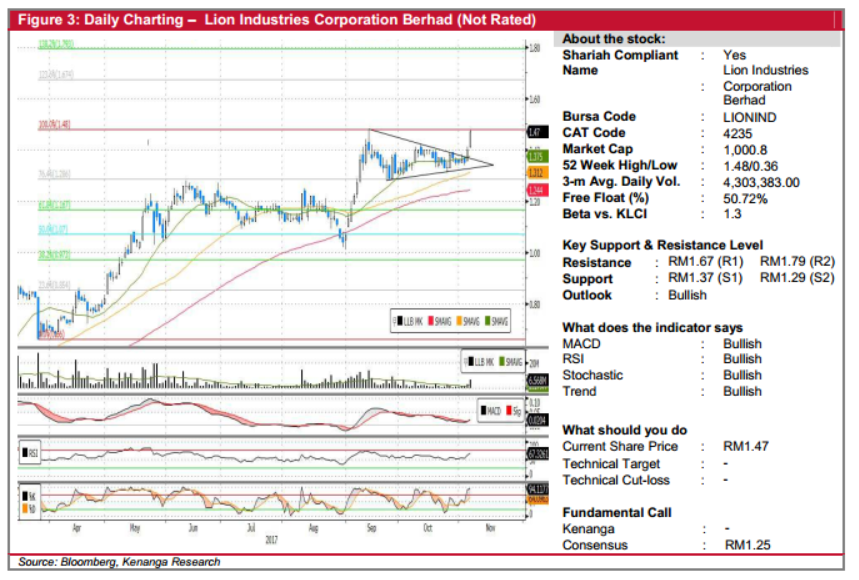

LIONIND (Not Rated). LIONIND saw its share price climbing 7.0 sen (5.0%) to finish at RM1.48. Trading volume surged for a second day, with 6.6m shares changing hands. From a charting perspective, LIONIND’s share price had been prone to sporadic run-ups and subsequent sideways trade over the past year with a recent example being the RM1.01 to RM1.48 rally in September, followed by the subsequent consolidation phase over the next two months. Nevertheless, with yesterday’s bullish move, we believe that the share price is poised to kick off a similar rally. Note that the MACD has just completed a Signal-line crossover while the RSI and Stochastic indicators have hooked upwards. Hence, we see the potential for a follow-through buying towards next resistance levels RM1.67 (R1) and possibly RM1.79 (R2). Any downside is likely to be limited to RM1.37 (S1), failing which the next support is located at RM1.29 (S2).

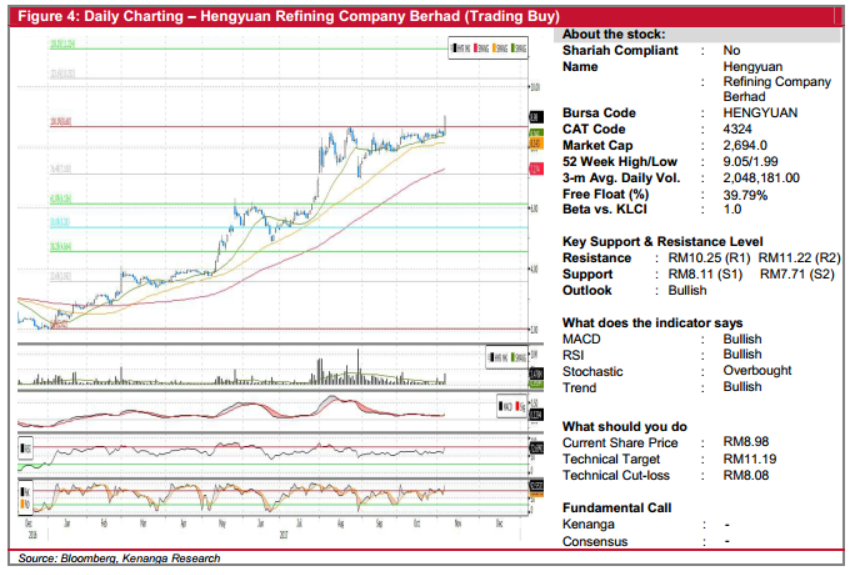

HENGYUAN (Trading Buy, TP: RM11.19; SL: RM8.08). Yesterday, HENGYUAN rallied an impressive 59.0 sen (7.0%), closing at 4-year high of RM8.98. This was accompanied by healthy trading volumes, with 3.5m shares exchanging hands – representing 3.6x its 20-day average. Chart-wise, yesterday’s move marked a breakout above its previous resistance of RM8.68, as well as the 3-month long period of sideways consolidation. Notably, this may possibly mark as a resumption of a prior uptrend seen earlier in the year until August. With the share price still steadily trading above all key SMAs, which in turn still maintaining its “golden crossover” state coupled with positive upticks from key indicators, we believe the balance of evidence could favour a move higher at this juncture. From here, we set our technical target 3.0 sen below its resistance at RM11.22 (R2), with an intermediate resistance at RM10.25 (R1). Conversely, our stop-loss is also placed 3.0 sen below immediate resistance of RM8.11 (S1). A break-below would be deemed as highly negative, potentially capitulating towards lower resistances at RM7.71 (S2) and RM6.95 (S3).

Source: Kenanga Research - 7 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)