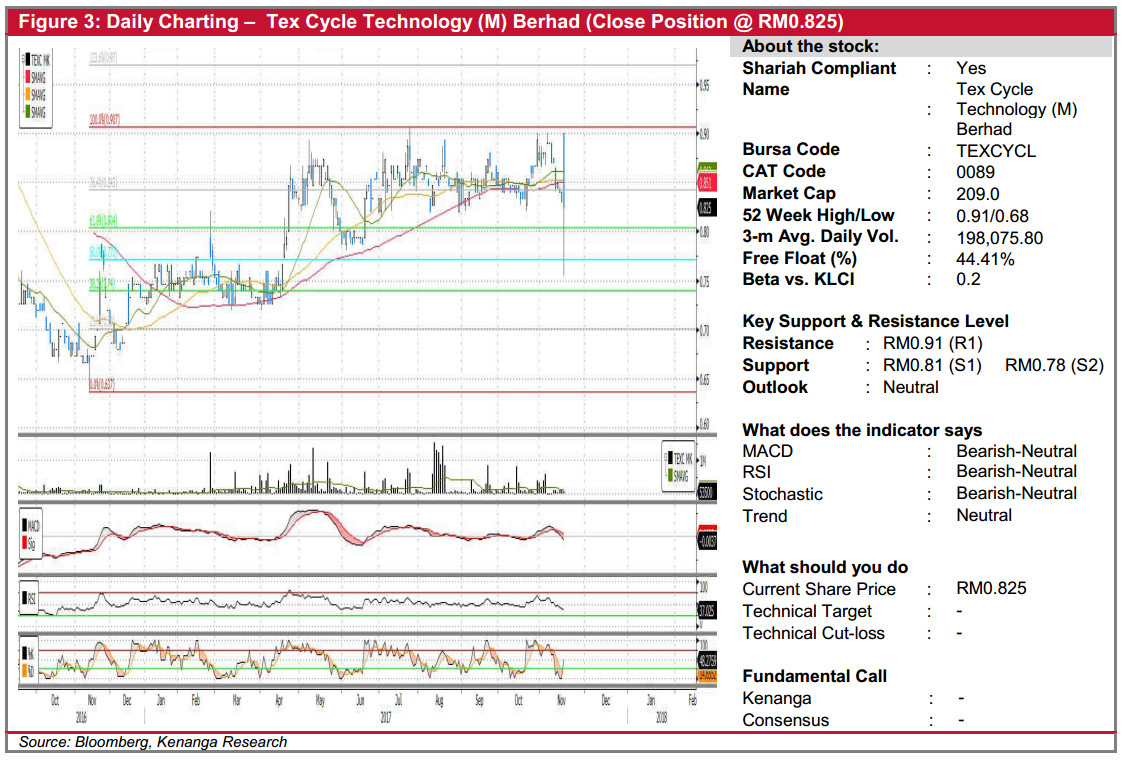

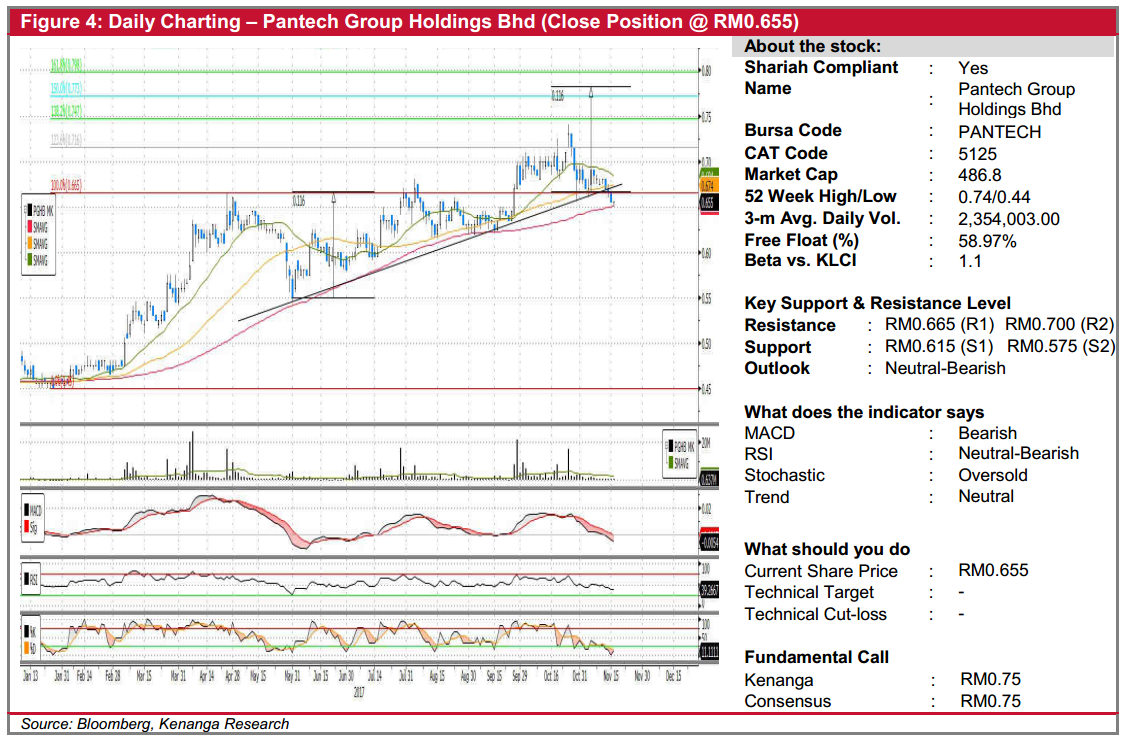

Daily Technical Highlights - (TEXCYCL, PANTECH)

kiasutrader

Publish date: Fri, 17 Nov 2017, 12:26 PM

TEXCYCL (Close Position @ RM0.825). We continue our efforts to further trim our technical portfolio, after taking profits in PETRONM (total gains: 15%) and PTRANS (total gains: 46%) yesterday, amid the weak market breadth in recent days. Our closed position on TEXCYCL at this level implies a total loss of 1.7% since our initial recommendation dated 21-Apr- 2017. Chart-wise, the share price has been hovering through since recommendation. Likewise, tapering volumes of late, coupled with negative showings from key indicators could suggest a continuation of directionless movement. From here, look out for key resistance at RM0.91 (R1) and key supports at RM0.81 (S1) and RM0.78 (S2).

PANTECH (Close Position @ RM0.655). We are also closing our position on PANTECH in continued streamlining of our technical portfolio. Recall that we first issued a technical ‘Trading Buy’ recommendation on the stock on 29-Sept-2017, with our current closing position implying a 2.2% loss since then. Chart-wise, besides the tapering off of trading volumes, the stock has now broken below its previous uptrend, reflecting a potential trend-reversal. The bearish technical picture is also supported by the negative state of key indicators. Notably, the MACD is now in negative territory with the Signal-line above the MACD line, and hitting a lower trough. Conclusively, we believe the technical outlook has deteriorated, with the riskreward ratio no longer deemed favourable to keep an open position. Moving forward, the stock’s support levels are located at RM0.615 (S1) and RM0.575 (S2), while resistance levels are at RM0.665 (R1) and RM0.700 (R2).

Source: Kenanga Research - 17 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|