Daily Technical Highlights - (SERBADK, INARI)

kiasutrader

Publish date: Fri, 24 Nov 2017, 09:33 AM

SERBADK (Not Rated). SERBADK posted a strong rally yesterday, gaining 22.0 sen (7.9%) to close at its all-time high of RM3.00. This comes after the company announced its 3Q17 quarterly results two days prior, which saw its core net profit growing 52%. Chart-wise, yesterday’s move formed a white “Marubozu” candlestick, and was accompanied by improved trading volume - tell-tale signs of the share gaining investors’ interest. Moreover, yesterday’s move decisively broke above previous high cum resistance of RM2.84, with key indicators following-suit with positive upticks. On the bigger picture, the share price is in a continuation of its underlying uptrend, leading key SMAs upwards in a “golden-cross” state. From here, expect the share to continue trending towards resistances at RM3.16 (R1) and RM3.35 (R2). Conversely, downside supports can be identified at RM2.58 (S1) and RM2.34 (S2).

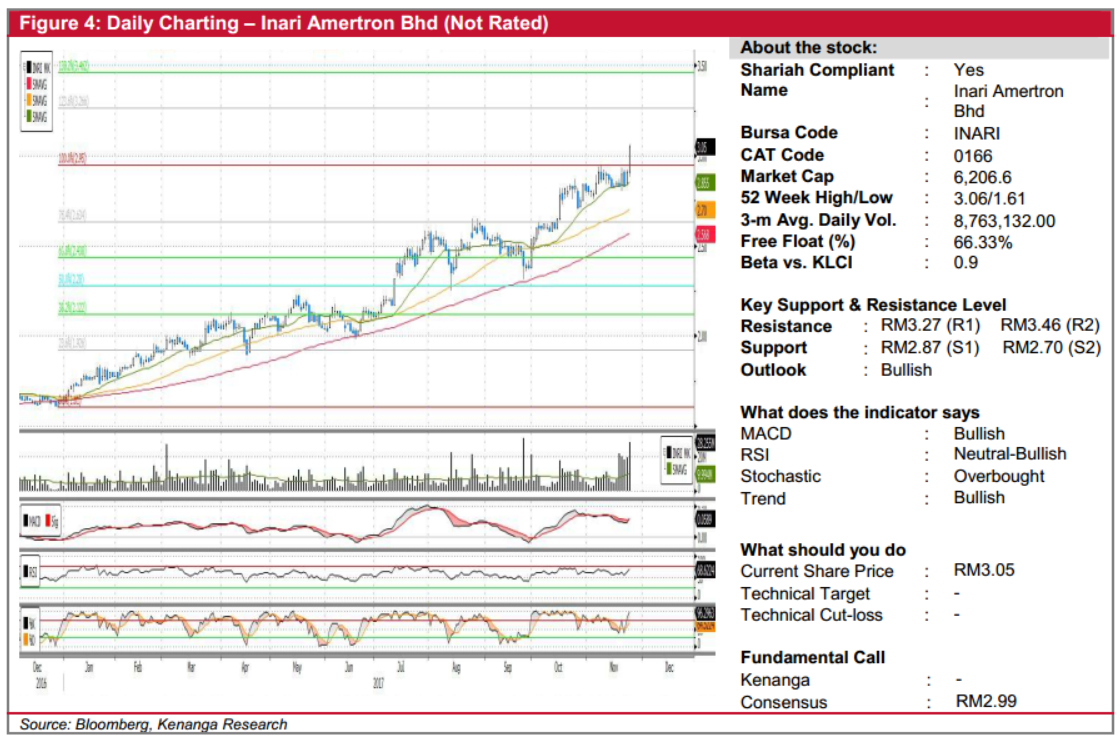

INARI (Not Rated). INARI saw its share price surging 14.0 sen (4.8%) yesterday to close at record high of RM3.05. The move was supported by strong trading volumes, with 28.3m shares traded – representing almost triple its 20-day average of 9.9m shares. Following yesterday’s gain, the share price broke out from its previous high of RM2.95 after multiple retests in the past month, marking a continuation of its 11-months bullish run. Having already gained 85% YTD, we believe the bulls are in favour to continue its run, with the share firmly leading all key SMAs upwards while trading volumes continued to remain strong. Simultaneously, key indicators are also starting to show early signs of bullish continuation, as seen in the MACD’s crossover above its Signal-line coupled with minor upticks from the RSI and Stochastic indicators. From here, next resistance levels are located at RM3.27 (R1) and RM3.46 (R2) further up. Conversely, support levels can be found at RM2.87 (S1) and RM2.70 (S2).

Source: Kenanga Research - 24 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-08-29

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-27

INARI2024-08-27

INARI2024-08-27

INARI2024-08-27

INARI2024-08-27

INARI2024-08-26

INARI2024-08-26

INARI2024-08-23

INARI2024-08-23

INARI2024-08-23

INARI2024-08-21

INARI2024-08-21

INARI2024-08-20

INARI2024-08-20

INARI2024-08-20

INARI

.png)