Daily Technical Highlights - (WONG, ROHAS)

kiasutrader

Publish date: Tue, 12 Dec 2017, 09:24 AM

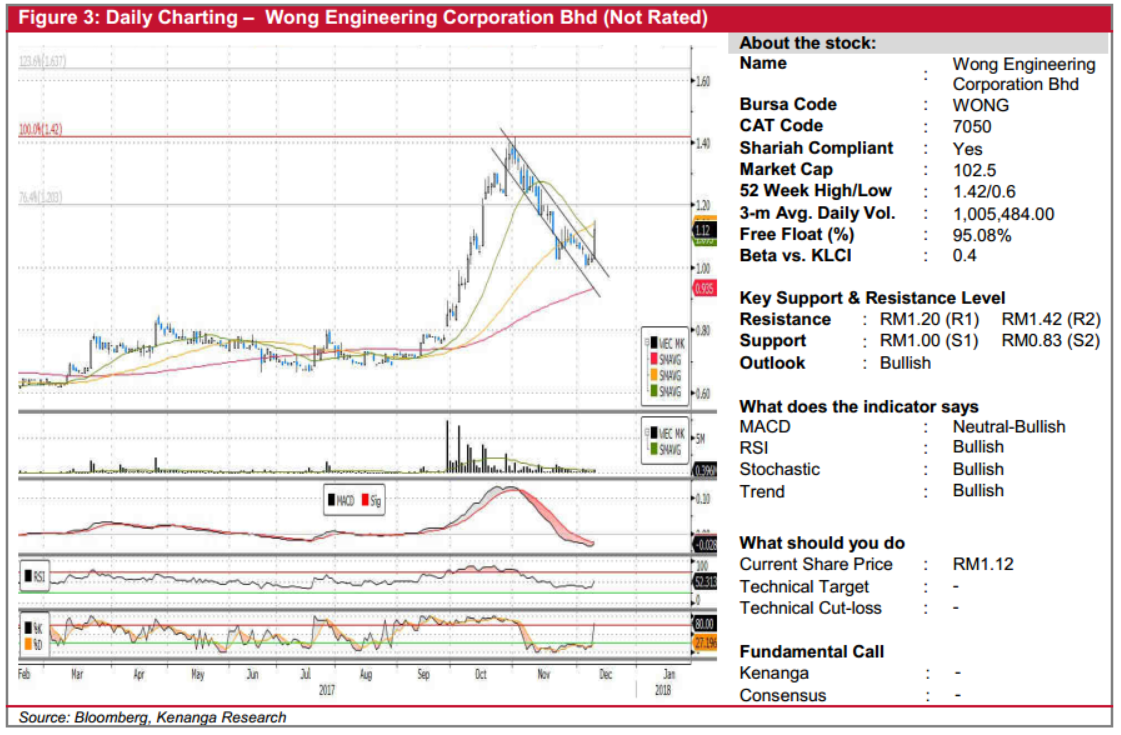

WONG (Not Rated). WONG’s share price rallied 9.0 sen (8.7%) yesterday to finish at RM1.12. For the most part of the year, it had been trading within a sideways band between RM0.68-RM0.80. Nevertheless, the share price kicked off a strong rally in late-September, nearly doubling to a high of RM1.42 before staging a meaningful pullback to the RM1.00 mark. With yesterday’s bullish move, the share price appears to have broken out of a downwards consolidation phase and is now poised for a resumption of its prior uptrend. Similarly, the upticks on the RSI and Stochastic are indicative of the next leg higher. From here, immediate resistance levels to target are RM1.20 (R1) and RM1.42 (R2). Should R2 be taken out next, further gains would then be eyed towards RM1.64. Downside support levels are likely at RM1.00 (S1), failing which RM0.83 (S2) is next.

ROHAS (Not Rated). ROHAS gained 5.0 sen (3.6%) yesterday to close at RM1.44, breaking out above its previous resistance of 10-month closing high of RM1.40, which it retested thrice within the past 3 months of consolidation. Notably, the movement was also accompanied by exceptionally high volume, with 1.3m shares traded, more than 4-fold its average volume of 308.3k shares. Additionally, yesterday’s move was followed with positive upticks in all key indicators, with the MACD crossing above its Signal and Zero lines, signalling a shift in near term momentum. From here, the price is on a clear path to trend towards key psychological levels of RM1.60 (R1) and RM1.70 (R2). An immediate resistance-turned-support can be found at the aforementioned RM1.40 (S1), with another support further lower at RM1.30 (S2).

Source: Kenanga Research - 12 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|