Daily Technical Highlights - (KEYASIC, FRONTKN)

kiasutrader

Publish date: Wed, 13 Dec 2017, 11:09 AM

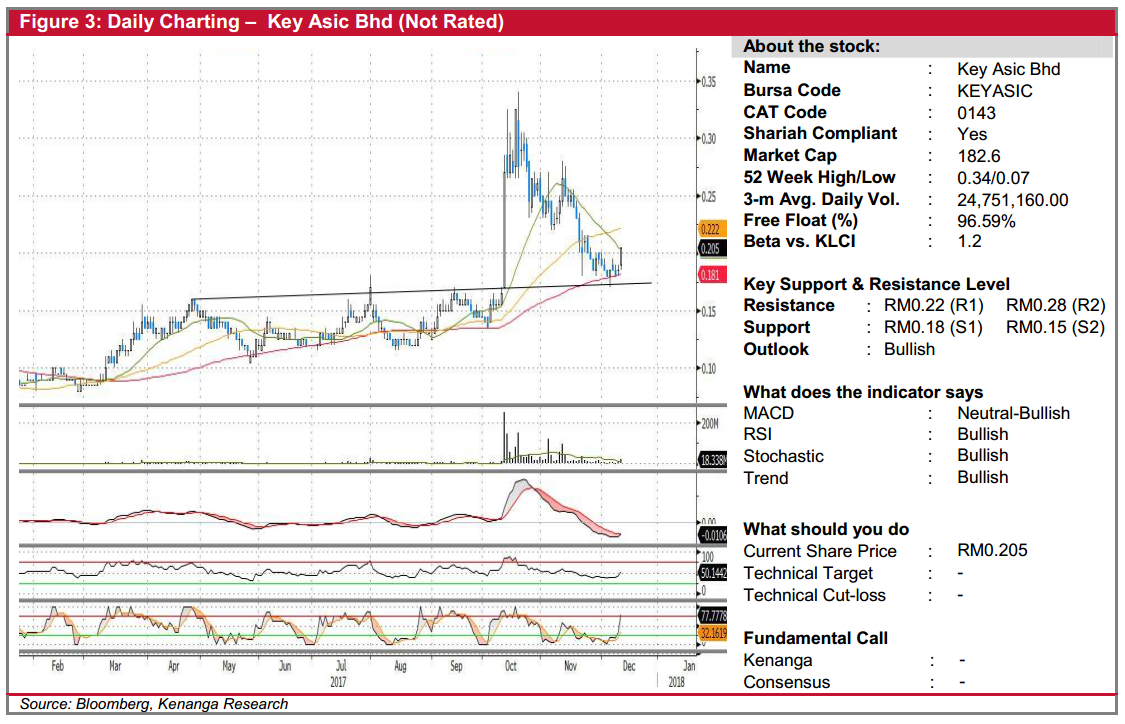

KEYASIC (Not Rated). KEYASIC saw its share price gaining 2.0 sen (10.8%) yesterday to finish at its day’s high of RM0.205. From a charting perspective, yesterday’s bullish move signalled that the share price has made a bottom after a steep downtrend after a two-month downwards move. In fact, we would not discount the possibility that KEYASIC will rebound from its long-term support-turned-resistance level at RM0.18, as evidenced by the upticks on the RSI and Stochastic as well as the MACD-Signal line crossover yesterday. From here, immediate resistance levels to target are RM0.22 (R1) and RM0.28 (R2) further up. Downside support levels include the aforementioned RM0.18 (S1) and RM0.15 (S1) support levels, although a break below the former would be highly.

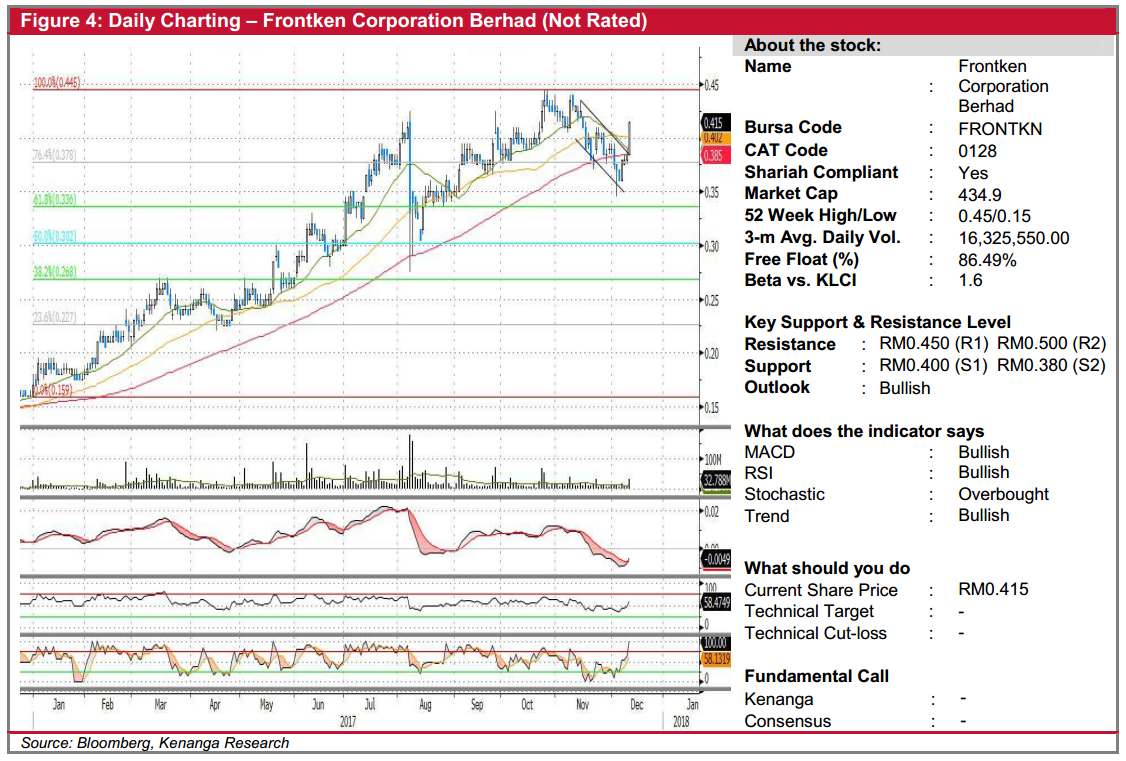

FRONTKN (Not Rated). Yesterday, FRONTKN gained 3.0 sen (7.8%) to close at its intraday high of RM0.415. Buyers maintained control throughout the session, with the share forming a “white-Marubozu” candlestick, accompanied with aboveaverage trading volume of 32.8m shares. Yesterday’s move marked a decisive breakout from a 1-month downward consolidation, marking a potential resumption of its previous uptrend since the beginning of the year. In addition, all key momentum indicators have spiked up, which are indicative of a short-term shift in momentum from bearish to bullish. As such, we foresee the share to carry some upward bias and expect it to trend towards resistances at RM0.450 (R1) and RM0.500 (R2). Downside support can be found at RM0.400 (S1), and at RM0.380 (S2) further lower.

Source: Kenanga Research - 13 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|