Daily Technical Highlights - (MMSV, VITROX)

kiasutrader

Publish date: Thu, 14 Dec 2017, 11:12 AM

MMSV (Not Rated). MMSV’s share price gained 13.0 sen (8.2%) yesterday to finish at RM1.71 on increased volume of 1.5m shares, higher than the average volume of 0.8m shares. Throughout 2017, the share price has been trading within an uptrend channel since March before it consolidates downward starting September to year to date. Nonetheless, its recent movements are starting to form a “Double Bottom” pattern awaits for a confirmation move, which signals the price has potentially been bottoming out. Key indicators are also supportive of a move higher, with the RSI now above the 50-point mark while the MACD has hooked upwards above Signal line. As such, a strong breakout from neckline resistance level of RM1.78 (R1) will lead the share price trend higher towards RM2.02-RM2.05 (R2) where the measurement objective and its record high coincide. Downside support levels are RM1.69 (S1) and RM1.60 (S2) below.

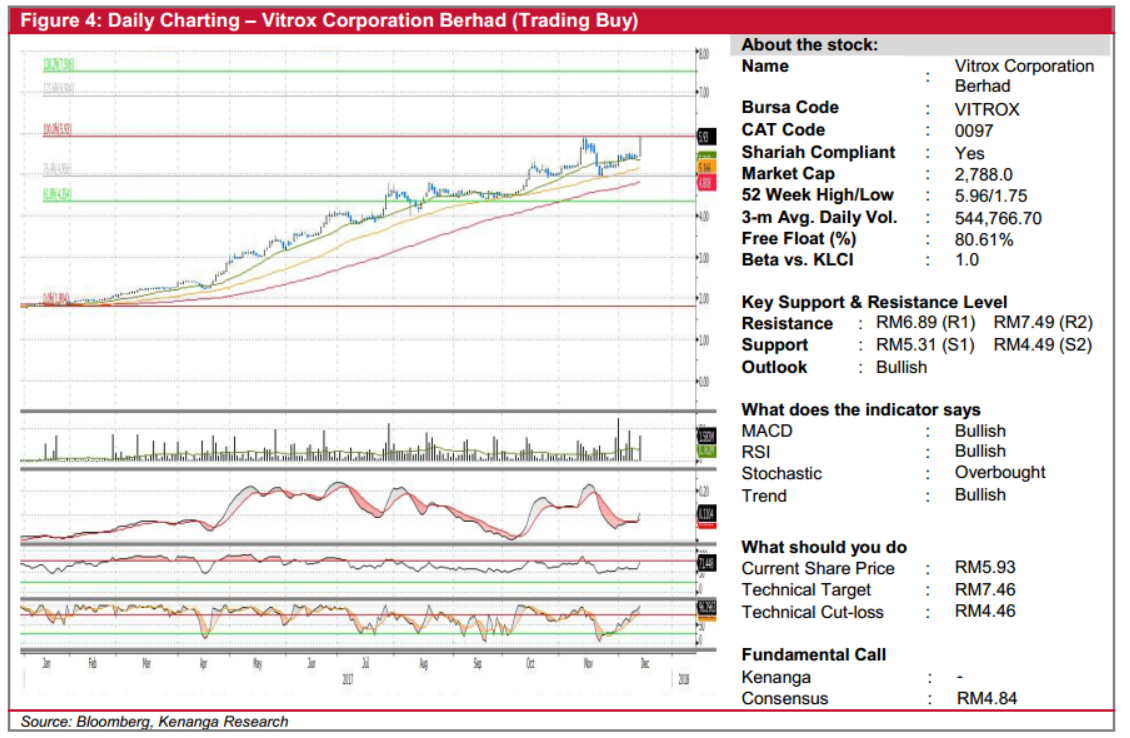

VITROX (Trading Buy, TP: RM7.46 , SL: RM4.46 ). Recall that we have a Trading Buy recommendation on VITROX (13- Oct@RM4.86). Since then, the share price has performed to our expectations, with yesterday’s single-day 50.0 sen (9.2%) surge propelling the share price to our RM5.93 technical target price. Chart-wise, VITROX has been on healthy uptrend since early of the year, having tripled from a low of RM1.82 in January. Likewise, yesterday’s bullish move has triggered a resistance breakout to signal a continuation of its prior uptrend. Notably, positive indicators such the MACD Signal line and uptick in RSI close to the bullish zone indicates improved buying interest. Given that the share price is trending above all three key SMAs and still bullish technical readings, we see the potential for VITROX to gear upwards to RM6.89 (R1) and possibly RM7.49 (R2). Look to take profit 3 bids below R2. Key support thresholds are seen at RM5.31 (S1) and RM4.49 (S2) further down, while our stop-loss is placed at RM4.46 (3 bids below (S2)).

Source: Kenanga Research - 14 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|