Daily Technical Highlights - (JAKS, HAPSENG)

kiasutrader

Publish date: Fri, 15 Dec 2017, 11:11 AM

JAKS (Not Rated). Yesterday, JAKS saw its share price climbing 3.0 sen (2.0%) to finish at the highest level since July at RM1.52. Overall, its technical picture has been improving over the past few months with all three key SMAs in “Golden Crossover” and momentum indicators on a steady climb. As a result of yesterday’s bullish move, the share price has finally confirmed that a new uptrend is developing following the April-September downwards grind. From here, we reckon that JAKS has the potential to move higher towards immediate resistance levels at RM1.60 (R1) before staging a retest of April’s high of RM1.79 (R2). Once broken through, further gains would then be eyed towards RM2.00 further up. Immediate downside support is located at RM1.40 (S1), although a break below would be highly negative with next support only present at RM1.25 (S2).

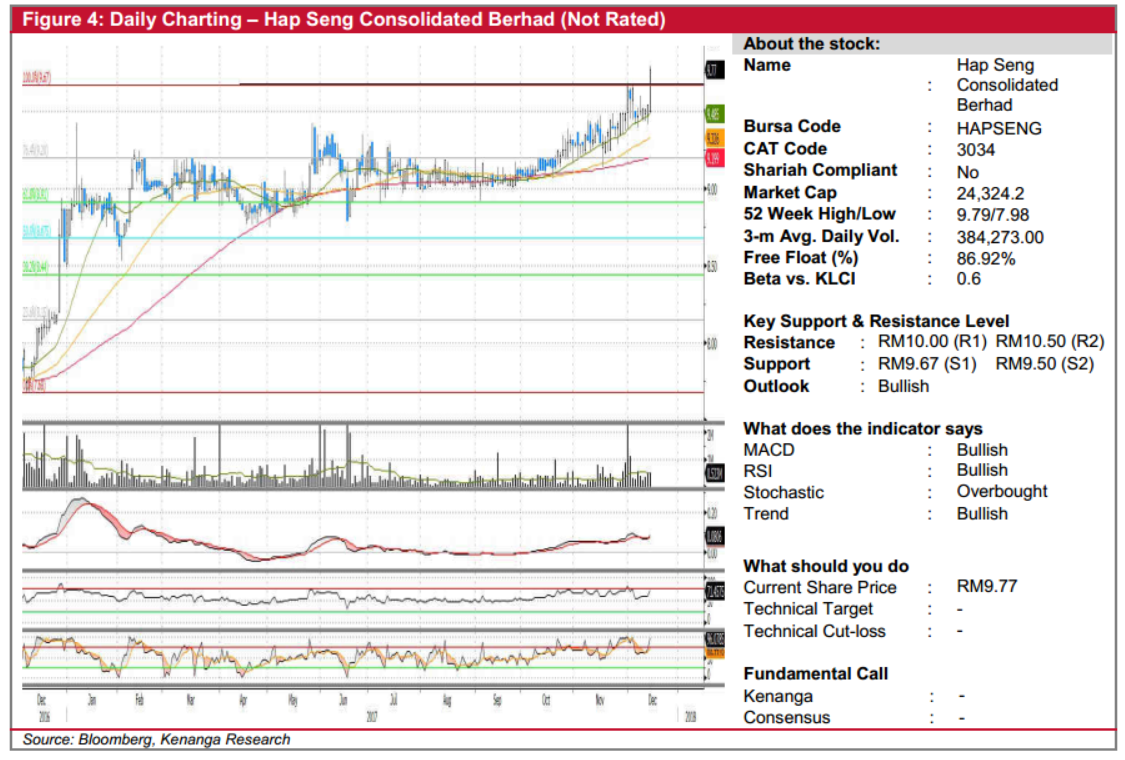

HAPSENG (Not Rated). HAPSENG gained 23.0 sen (2.4%) yesterday to close at an all-time high at RM9.77 on the back of decent trading volume of 0.5m shares exchanging hands. Yesterday’s breakout took out the key resistance level of RM9.67 in which was previously retested thrice over the past 2 weeks and we believe that this could signal a continuation of a prior uptrend which keeps the technical picture intact. In addition, with the share price above key SMAs and an uptick on the MACD line which is above the zero line, we think that the share price will have a positive outlook in the immediate term. All in, we expect the share price to trend higher towards key psychological resistance level of RM10.00 (R1) or further up, at the resistance level of RM10.50 (R2). Meanwhile, immediate support can be found at resistance-turned support at RM9.67 (S1), with a lower key support level at RM9.50 (S2).

Source: Kenanga Research - 15 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|