Daily Technical Highlights - (DGSB, TOPGLOV)

kiasutrader

Publish date: Wed, 20 Dec 2017, 08:47 AM

DGSB (Not Rated). Yesterday, DGSB’s share price rallied a good 3.5 sen (41.2%) to finish at a fresh all-time high of RM0.12. The breakout took out key resistance level of RM0.10 in which was previously retested twice over the past 2 months. The move yesterday was backed by exceptional trading volume of 313.7m shares exchanging hands, which was more than 10-fold the daily average volume traded for DGSB. In addition, there was an uptick in the MACD line, crossing the signal line from the bottom and above the zero line. We believe this signifies positive momentum into the immediate term. With that, we expect potential follow-through buying momentum towards RM0.13 (R1) with a further ceiling at RM0.14 (R2). Meanwhile, key support levels can be found at RM0.08 (S1), with a lower support level at RM0.07 (S2).

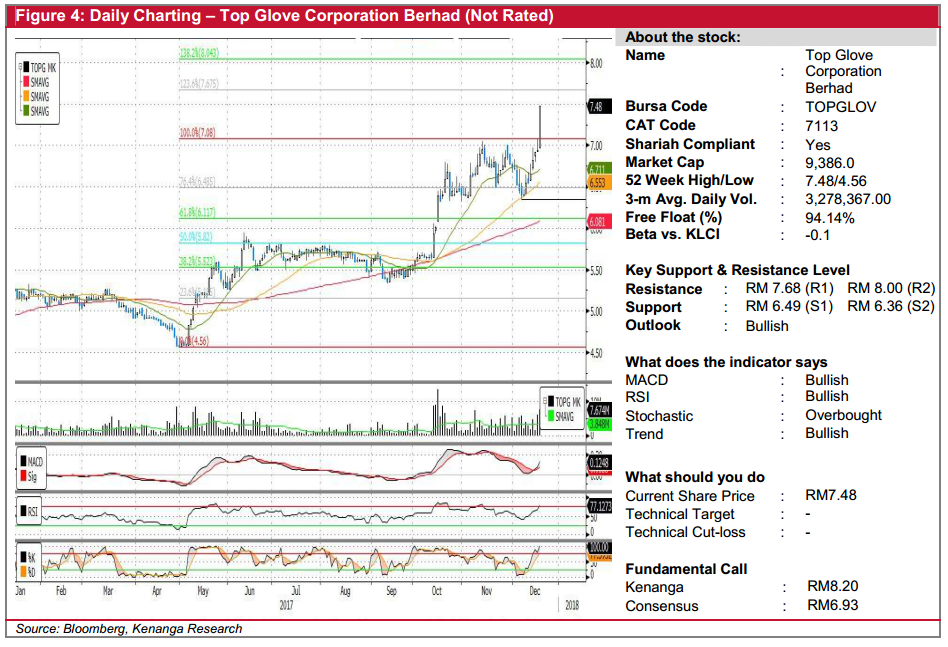

TOPGLOV (Not Rated). TOPGLOV saw its share price surged 54.0 sen (7.8%) to close at record high of RM7.48 yesterday amid the release of its 1Q18 headlines earnings that showed a 43.8% YoY increase. Chart-wise, over the past three months, TOPGLOV has been consolidating sideways. However, the share price is now poised for an uptrend resumption following yesterday’s move– which resulted in a consolidation breakout at RM7.08. This was accompanied by strong trading volume with 7.8m shares exchanging hand, double of its 20-day average of 3.8m shares. Similarly, the key momentum indicators such as the MACD and RSI have both hooked up, suggesting gains in momentum, which supports the overall positive technical picture. From here, the share price is on a clear path to test RM7.68 (R1) resistance level, before a possible move higher towards key psychological resistance level at RM8.00 (R2). Downside support levels are RM6.49 (S1) and RM6.36 (S2) below.

Source: Kenanga Research - 20 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|