Daily Technical Highlights - (PMETAL, SCOMNET)

kiasutrader

Publish date: Fri, 29 Dec 2017, 10:58 AM

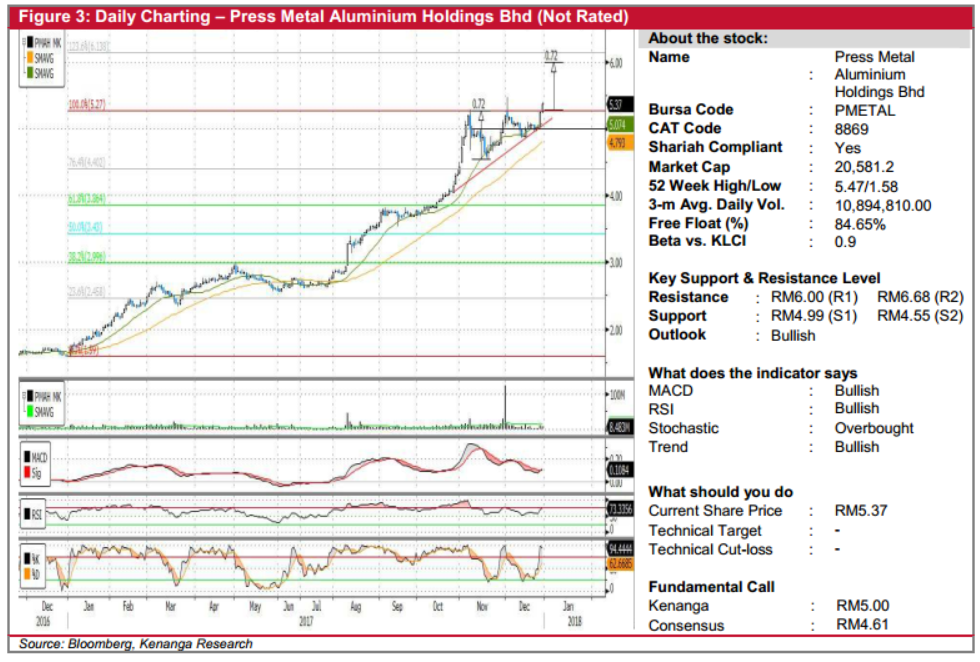

PMETAL (Not Rated). PMETAL’s share price rose for a second-straight day to RM5.37, up by 13.0 sen (2.5%) on decent trading volume of 8.5m shares. Chart-wise, PMETAL’s share price had been consolidating since end- Oct17. However, yesterday saw PMETAL making a decisive breakout in which it took out the resistance level of RM5.27, which was retested thrice previously. Likewise, this also resulted in an “Ascending triangle” breakout and suggests that PMETAL is on track to trending higher. We observe both MACD and RSI indicators have inflected upwards to reflect a steady momentum supportive of a bullish move. Overall, we expect further gains towards the “Ascending Triangle” measurement objective of RM6.00 (R1) which coincides with key psychological level or possibly higher at RM6.68 (R2) level. Downside risks could be limited to RM4.99 (S1) resistance-turnedsupport and further down at RM4.55 (S1).

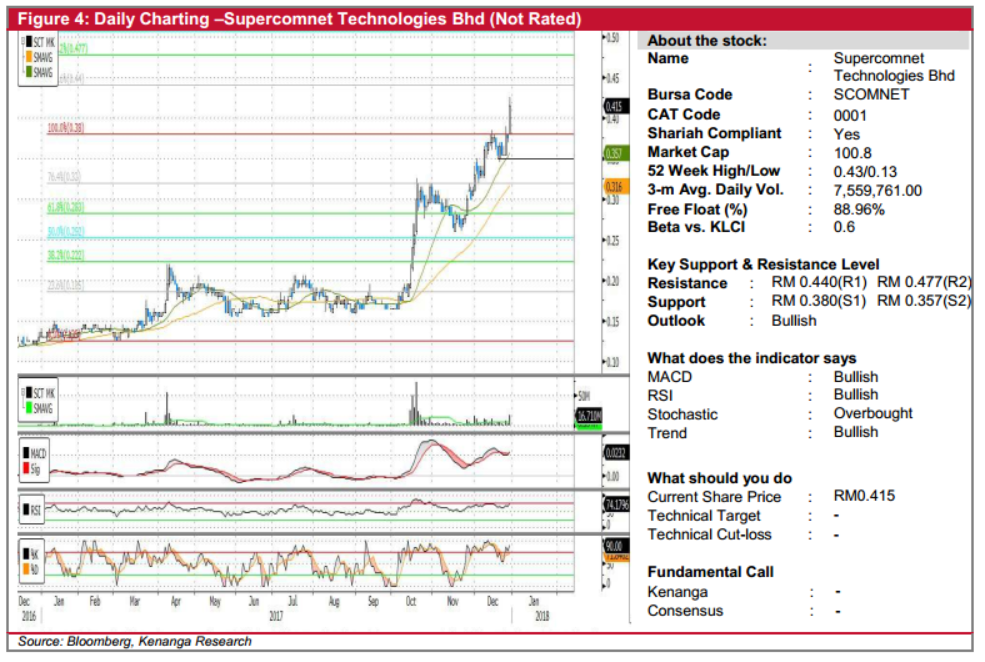

SCOMNET (Not Rated). Yesterday, SCOMNET’s share price climbed 4.0 sen (10.7%) to close at its all-time high of RM0.415 accompanied by higher trading volume of 16.7m shares, more than doubled its 20-day daily average of 6.3m shares. From a charting perspective, SCOMNET’s share price had been moving sideways for the most part of this year before it kicked off a strong rally in which it broke out its consolidation phase at RM0.185 level in October. The share price then rallied upwards to as high as RM0.380 last week before making another high yesterday at RM0.415. Notably, yesterday’s close also took out the resistance level of RM0.380, to signal continuation of its prior uptrend. Given momentum indicators that are all in positive state such as uptick in both MACD and RSI, we expect SCOMNET to trend higher towards resistance level of RM0.440 (R1) and RM0.477 (R2) for further gains. Meanwhile, weaknesses, if any, are capped at the resistance-turned-support level of RM0.380 (S1) or RM0.357 (S2) further down.

Source: Kenanga Research - 29 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)