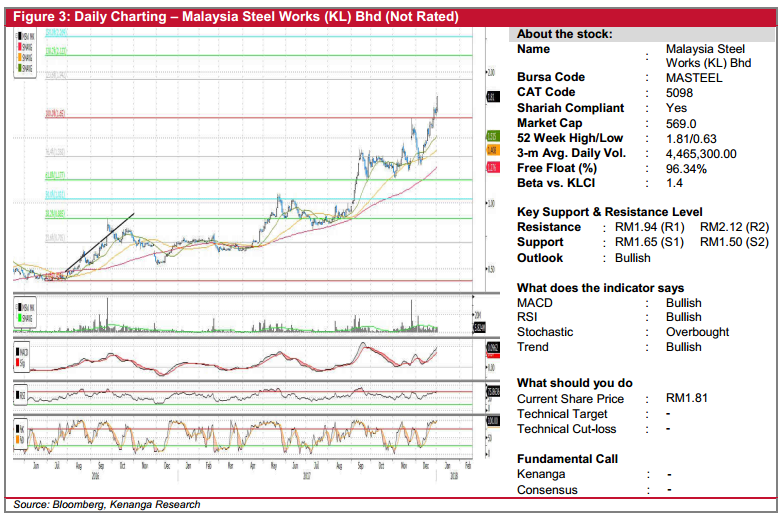

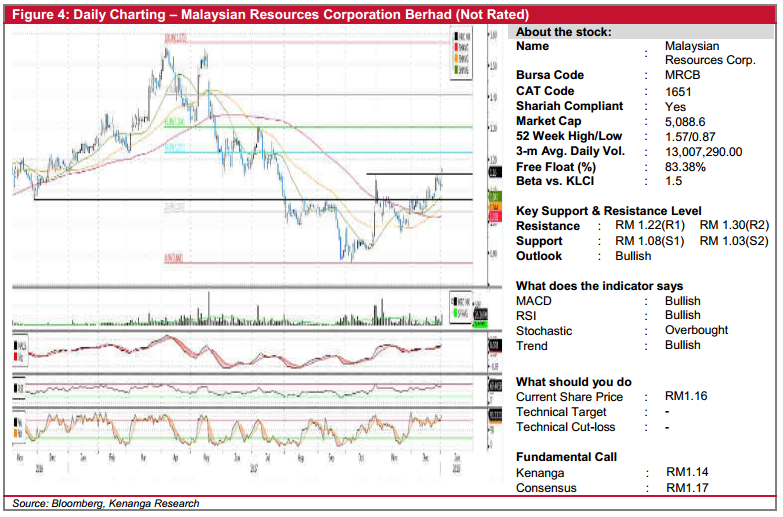

Daily Technical Highlights - (MASTEEL, MRCB)

kiasutrader

Publish date: Wed, 03 Jan 2018, 03:37 PM

MASTEEL (Not Rated). Yesterday, MASTEEL’s share price rallied 10 sen (5.8%) to finish at an all-time high of RM1.81. The breakout took out key resistance level of RM1.71 supported by trading volume of 5.8m shares exchanging hands. Furthermore, the MACD indicator shows a bullish convergence, with the MACD line also healthily above both the signal line and zero line. Despite the Stochastic being deeply overbought, we believe that the balance of evidence supports a move to the upside in the weeks ahead. Near term, dips may be taken as buying opportunities, before an eventual climb to RM1.94 (R1) with a further ceiling at RM2.12 (R2). Meanwhile, key support levels can be found at RM1.65 (S1), with a lower support level at RM1.50 (S2).

MRCB (Not Rated). Yesterday, MRCB gained an impressive 4.0 sen (3.6%), closing at RM1.16. This was accompanied by exceptional trading volume, with 26.4m shares exchanging hands – triple its 20-day average volume of 8.4m. Chart-wise, yesterday’s move is seen to have broken through the resistance which it tested early last week, forming a breakout from October’s high. Moreover, with the share price leading all key SMAs upward and MACD crossing above the Signal line recently, the technical outlook is increasing bullish. As such, we reckon the balance of evidence could favour a move higher at this juncture. Hence, we expect follow through buying to continue and foresee a climb toward resistance placed at RM1.22 (R1) and RM1.30 (R2) further up. Conversely, downside support levels can be identified at RM1.08 (S1) and RM1.03 (S2). (R2) further up. Conversely, downside support levels can be identified at RM1.08 (S1) and RM1.03 (S2).

Source: Kenanga Research - 3 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|