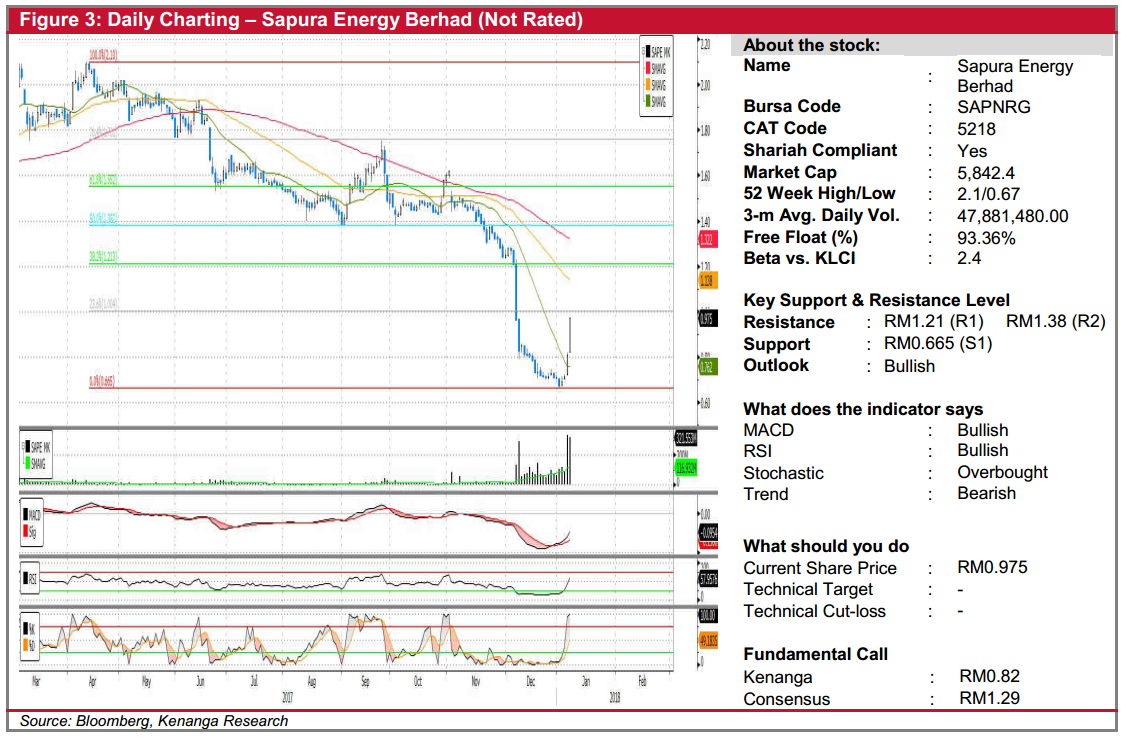

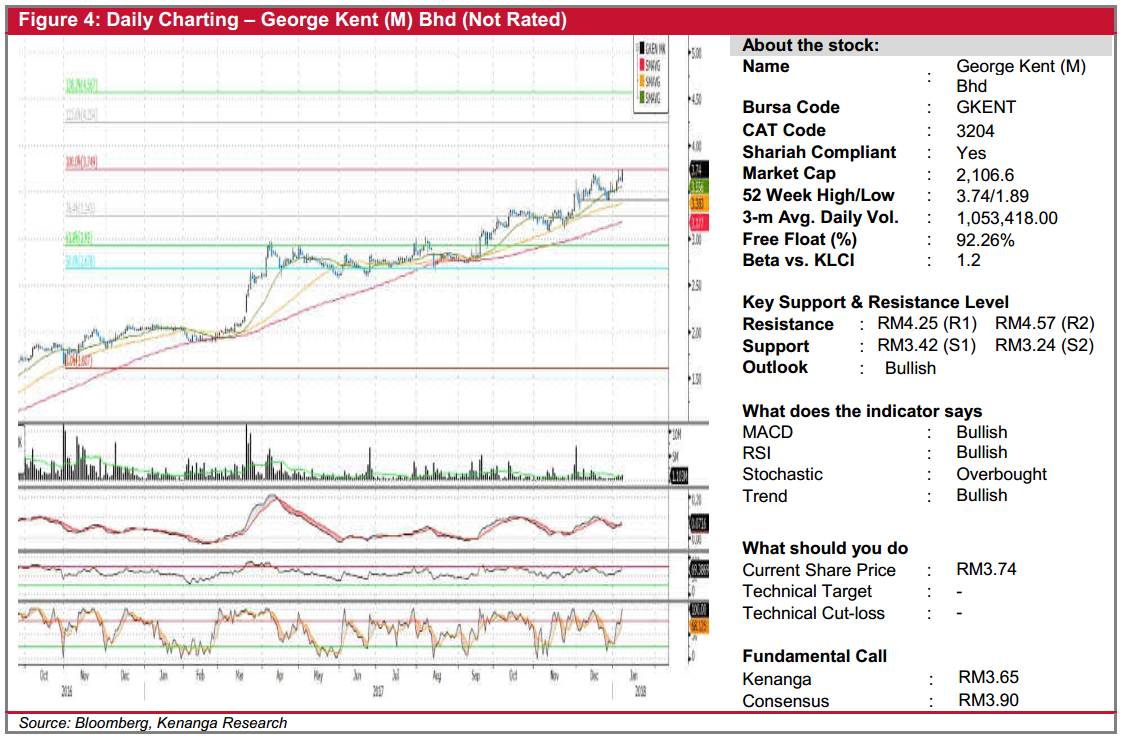

Daily Technical Highlights - (SAPNRG, GKENT)

kiasutrader

Publish date: Tue, 09 Jan 2018, 10:09 AM

SAPNRG (Not Rated). SAPNRG rallied a whopping 16.5 sen (20.4%) yesterday, closing at intraday high of RM0.975 with a white Marubozu candlestick. Importantly, yesterday’s move marks a second consecutive day of a remarkable run, both of which are accompanied by healthy trading volumes of more than double its daily average. We believe the share is showing signs of bottoming-out after hitting a low of RM0.665 on the first trading day of the year. Indicators have now turned positive, with the MACD crossing above its Signal line, while the RSI had punched out of the oversold zone, thus tipping the biasness of the share towards a continued bullish move. From here, follow-through momentum could see the share trending towards resistances at RM1.21 (R1) and RM1.38 (R2), while downside support can be found at its aforementioned low of RM0.665 (S1).

GKENT (Not Rated). GKENT rallied 10.0 sen (2.7%) yesterday, finishing at the day’s high of RM3.74. From a technical perspective, the share price has formed a white “Marubozu” candlestick, indicating that bulls dominated the entire trading day. Similarly, GKENT’s technical outlook is bullish with the share price firmly above key SMAs. The MACD has also crossed above its Signal-line suggesting upside bias at this juncture. GKENT is now in the midst of testing its RM3.74 resistance level. Though, we expect follow-through buying to continue and see the potential for a run-up towards next resistance levels of RM4.25 (R1) and RM4.57 (R2) next. Conversely, downside support levels are RM3.42 (S1) and RM3.24 (S2) below.

Source: Kenanga Research - 9 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)