Daily Technical Highlights - (AIRASIA, M3TECH)

kiasutrader

Publish date: Wed, 10 Jan 2018, 09:40 AM

AIRASIA (Not Rated). AIRASIA's share price rallied 15 sen (4.2%) before finishing at an all-time high of RM3.74. Yesterday's breakout was supported by exceptionally high trading volume of 26.4m shares - more than thrice its 20-day average volume. We believe yesterday's move signals a continuation of a prior uptrend since the start of January 2017, after retesting the RM3.59 resistance level twice over the past year. Chart-wise, the share price is currently leading key SMAs and is still in the “Golden Crossover” state. In addition, the MACD indicator showed a positive uptick, with both MACD line and signal line healthily above the zero-line. With that, we expect follow-through buying momentum towards RM3.93 (R1) with a further psychological hurdle at RM4.00 (R2). On the other hand, key support levels can be found at RM3.59 (S1) where investors may consider buying on pullbacks and a lower support at RM3.25 (S2).

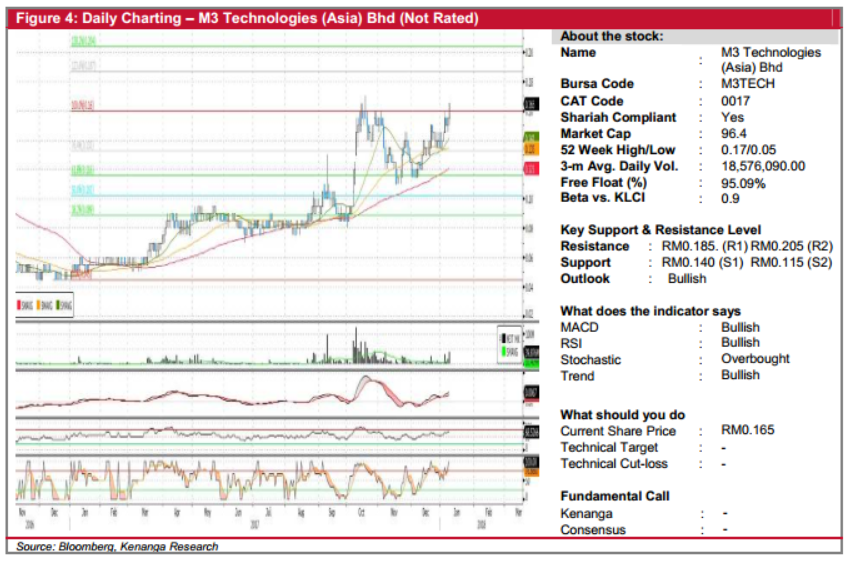

M3TECH (Not Rated). M3TECH’s rose 1.0 sen (6.5%) yesterday and closed at RM0.165, being its highest closing within the 52-weeks period. The move represents a breakout from its Oct 2017 level, potentially signal a continuation of its uptrend. SMAs are currently in a “golden-crossover” state staging a bullish technical outlook. Indicators are also in a bullish stance with MACD continues in leading its Signal line upward and other oscillators showing uptick. From here, we expect the share price to climb towards RM0.185 (R1) and possibly RM0.205 (R2). Conversely, the downside supports levels are RM0.140 (S1) and RM0.115 (S2).

Source: Kenanga Research - 10 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|