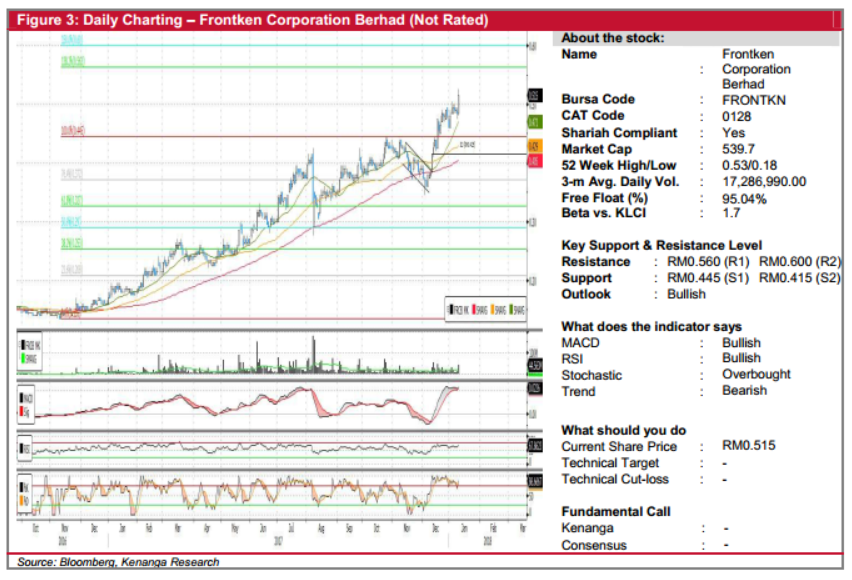

Daily Technical Highlights - (FRONTKN, SAMCHEM)

kiasutrader

Publish date: Thu, 11 Jan 2018, 10:44 AM

FRONTKN (Not Rated). FRONTKN's share price rallied 3 sen (6.2%) before finishing at an all-time high of RM0.515. Yesterday's move was supported by good trading volume of 44.6m shares exchanging hands - more than twice its 20-day average volume. We believe yesterday's move signals a continuation of a prior uptrend since the start of November 2016. Chart-wise, the share price is currently leading key SMAs with the MACD indicator showed a positive uptick. Both MACD line and signal line are also trading healthily above the zero-line. With that, we expect follow-through buying momentum towards RM0.560 (R1) with a further hurdle at RM0.600 (R2). On the other hand, key support levels can be found at RM0.445 (S1) with a lower support at RM0.415 (S2).

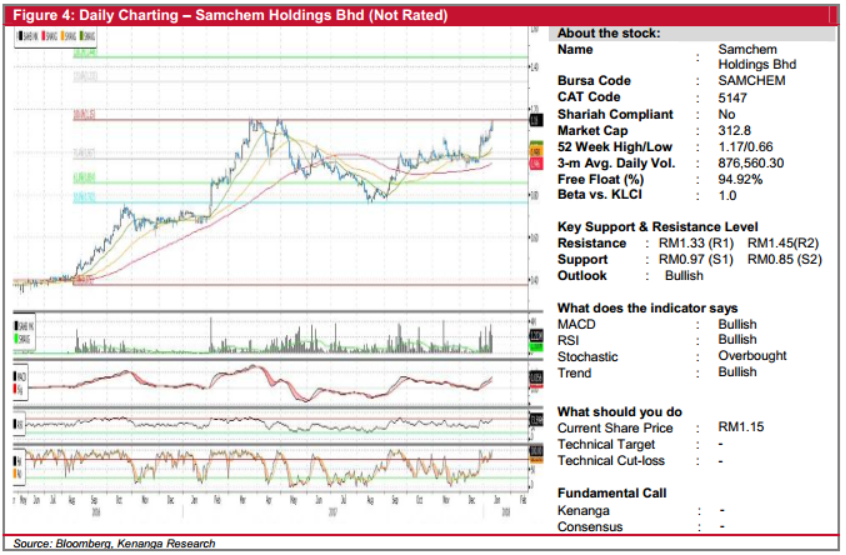

SAMCHEM (Not Rated). SAMCHEM advanced 5.0 sen (4.5%) yesterday, finishing at RM1.15. This was accompanied by strong trading volume, with 2.2m shares exchanging hands – double its 20-days average of 1.1m. Chart wise, SAMCHEM has resumed into an uptrend post 3-months of sideways consolidation. Moreover, technical outlook is bullish with SMAs currently in a “golden-crossover” state and MACD leading its Signal line. SAMCHEM is in the midst of testing its overhead resistance of RM1.15. However, we expect a follow-through buying to continue and see potential for a climb towards next resistance level of RM1.33 (R1) and possibly RM1.45 (R2) further up. Conversely, near term dips may be taken as buying opportunities with support levels identified at RM0.97 (S1) and RM0.85 (S2).

Source: Kenanga Research - 11 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)