Kenanga Research & Investment

Daily Technical Highlights – (EURO, BKOON)

kiasutrader

Publish date: Wed, 14 Mar 2018, 11:21 AM

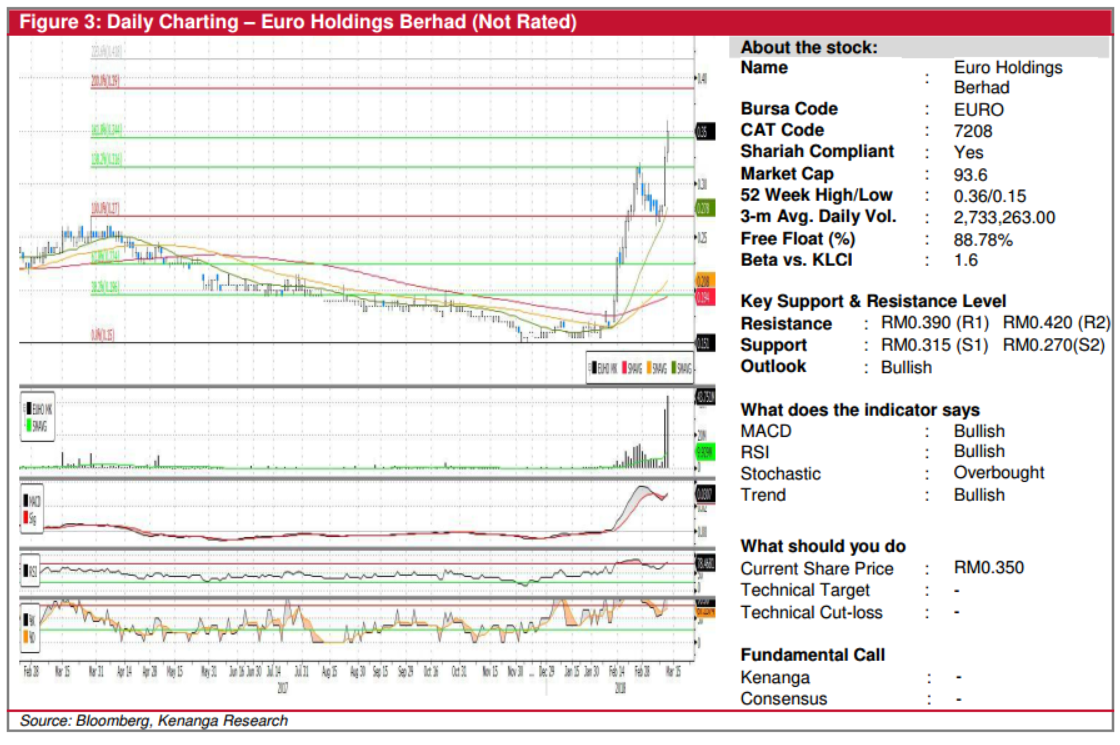

EURO (Not Rated)

- EURO jumped 2.5sen (7.69%) to reach RM0.350.

- The share had been on a bullish run over the past three trading days, backed by stronger than average trading volume.

- Overall technical outlook is positive with the MACD line having just crossed above the Signal Line and the share is currently leading key SMAs upward.

- Expect the bullish run to continue leading the share towards RM0.390 (R1) and even RM0.420 (R2).

- If the bullish momentum tapers off, downside support levels can be identified at RM0.315 (S1) and RM0.270 (S2).

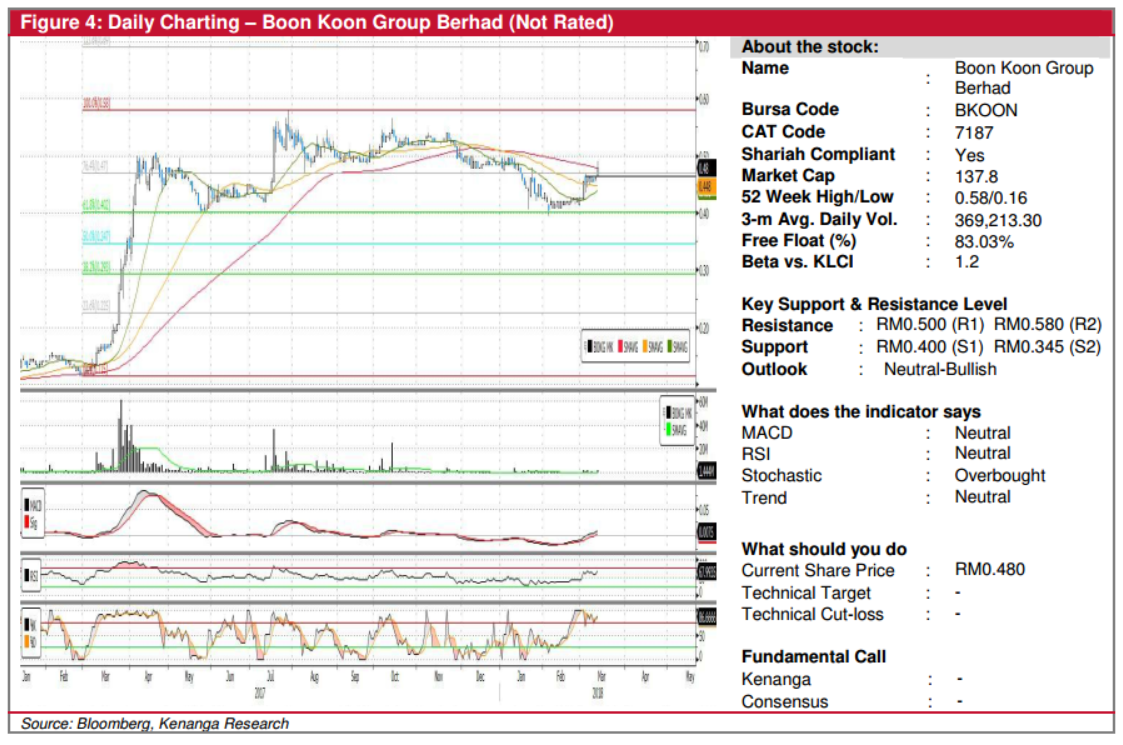

BKOON (Not Rated)

- BKOON gained 2.0 sen (4.35%) to close at RM0.480.

- The share price has been consolidating sideways since mid- January within the range of RM0.402-RM0.470.

- Yesterday’s close marked a breakout from RM0.470 level after consecutive multiple retests in the days prior.

- With MACD showing improvement, expect BKOON to further trend towards psychological resistance level RM0.500 (R1).

- Technical outlook will turn positive once RM0.500 (R1) resistance level is taken out decisively and expects further possible advancement towards RM0.580 (R2) next.

- Conversely, a break below RM0.400 (S1) is deemed highly negative and expects lower support at RM0.345 (S2).

Source: Kenanga Research - 14 Mar 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments