Kenanga Research & Investment

Daily Technical Highlights – (DIALOG, F&N)

kiasutrader

Publish date: Thu, 26 Apr 2018, 09:28 AM

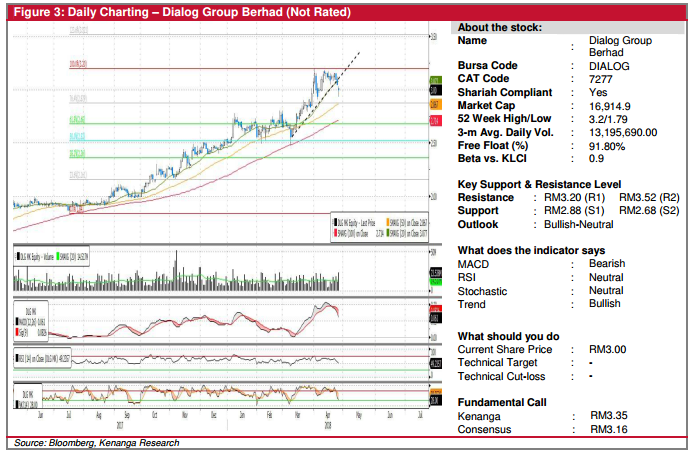

DIALOG (Not Rated)

- DIALOG was one of the most traded stocks yesterday, with 23.5m shares being done. It ended the day 5 sen (1.6%) lower at RM3.00 after gapping down upon its opening bell.

- Chart-wise, price movements over the past two days have resulted in the share breaking below its short-term uptrend since March, closing below its 20-day SMA. However, the longer-term uptrend line since February last year remains intact.

- From here, the recently formed bearish MACD crossover could suggest that a pullback is underway, at least for the shortterm, although this may not necessarily be a firm sell-signal as it continues to hover well above the zero line. Nonetheless, key SMAs are currently still in a state of “Golden Cross”.

- Technical picture would turn definitively bearish should support levels of RM2.88 (S1) and RM2.68 (S2) be decisively taken out. Conversely, breaking above immediate resistance at RM3.20 (R1) is needed before the technical picture can turn affirmatively bullish again, with a higher resistance at RM3.52 (R2).

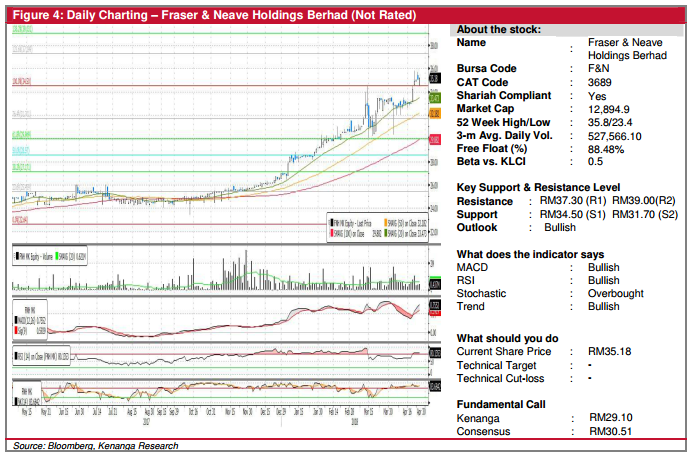

F&N (Not Rated)

- Yesterday, F&N gained 12.0 sen (0.34%) to close at RM35.18.

- Overall technical outlook appears seemingly bullish with the underlying uptrend is still firmly intact, while the share price continues still leading key SMAs upward in the chart.

- Of late, we noticed F&N had shown signs of resilience against the bearish broader market. The share had continued making gains over the past four days despite sell-down in the benchmark index.

- From here, expect the share to continue trending higher towards RM37.30 (R1) and possibly RM39.00 (R2)

- Conversely, any short-term weakness will likely see supports at RM34.50 (S1) and RM31.70 (S2).

Source: Kenanga Research - 26 Apr 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

DIALOG2024-11-26

DIALOG2024-11-25

F&N2024-11-25

F&N2024-11-22

DIALOG2024-11-22

DIALOG2024-11-21

DIALOG2024-11-21

DIALOG2024-11-21

F&N2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

F&N2024-11-19

DIALOG2024-11-19

F&N2024-11-18

DIALOG2024-11-18

F&N2024-11-18

F&N2024-11-18

F&N2024-11-18

F&N2024-11-18

F&N2024-11-18

F&N2024-11-18

F&NMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments