Kenanga Research & Investment

Daily Technical Highlights – (PENTA, BAT)

kiasutrader

Publish date: Tue, 15 May 2018, 09:15 AM

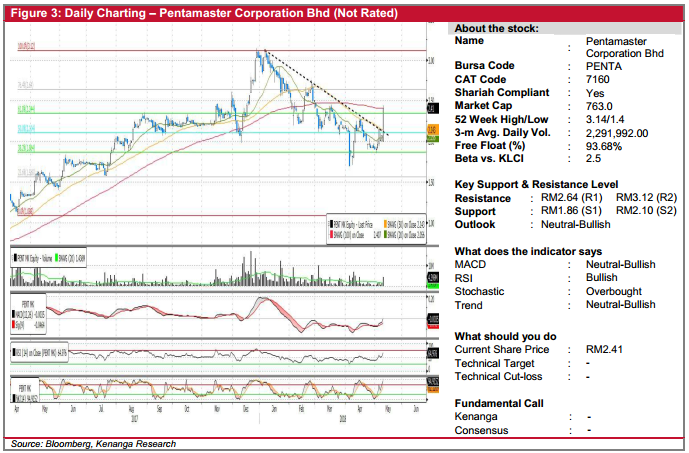

PENTA (Not Rated)

- PENTA surged 34.0 sen (16.4%) to close at RM2.41, backed by higher than average trading volume.

- Importantly, yesterday’s move signals a breakout from its key downtrend line, with price closing above all key SMAs.

- Momentum indicators are turning positive as MACD and RSI tick higher.

- Expect follow-through buying towards RM2.64 (R1). Should R1 is taken out; the next targeted resistance is RM3.12 (R2).

- Conversely, support levels can be found at RM2.10 (S1) and RM1.86 (S2).

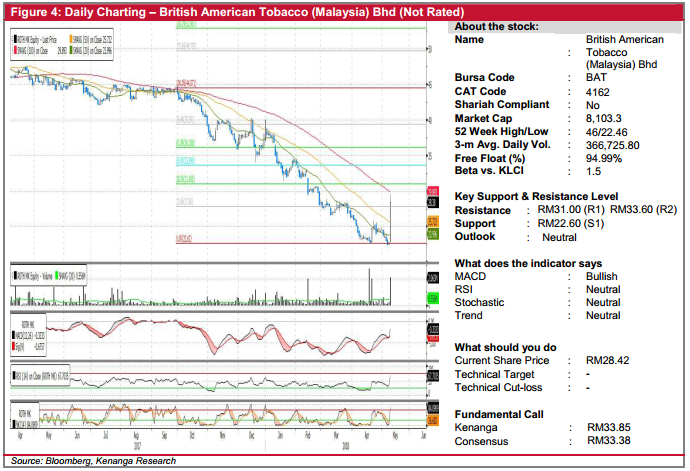

BAT (Not Rated)

- BAT closed at RM28.42 yesterday with strong trading volume of 2.06m.

- Yesterday’s move marked a first-day breakout after a long downtrend, with the share closing above its short and mid-term SMAs of 20 and 50-day, potentially signalling a bottoming-out. Technical outlook is further bolstered by positive upticks in key momentum indicators.

- From here, expect BAT to move towards RM31.00 (R1) and RM33.60 (R2) further up.

- Immediate support is identified at RM22.62 (S1).

Source: Kenanga Research - 15 May 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments