Kenanga Research & Investment

Daily Technical Highlights – (GHLSYS, CCK)

kiasutrader

Publish date: Fri, 22 Jun 2018, 08:56 AM

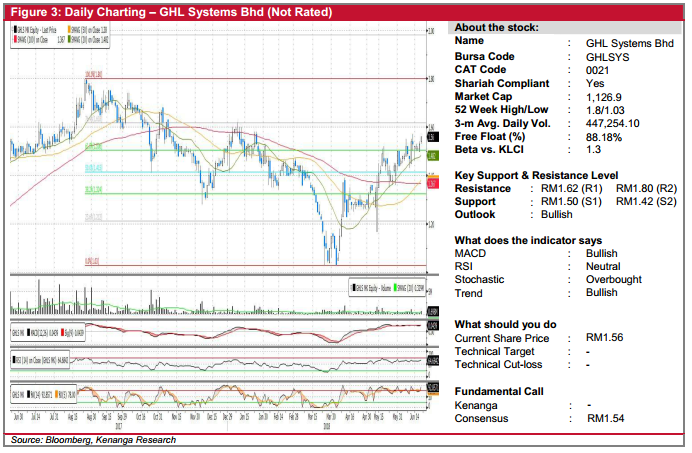

GHLSYS (Not Rated)

- Yesterday, GHLSYS gained 3.0 sen (2.0%), closing at RM1.56 on stronger-than-average trading volume.

- Trend has been positive with subsequent formation of higher highs and higher lows after the share bottomed-out in early-Apr.

- Technical indicators are seemingly supportive for a bullish outlook, backed by continuous upwards movements in the MACD while key SMAs currently in “Golden Cross” state.

- Follow-through buying could see the share continue trending towards resistances at RM1.62 (R1) and RM1.80 (R2).

- Conversely, support levels can be found at RM1.50 (S1) and RM1.42 (S2).

CCK (Not Rated)

- CCK gained 2.0 sen (2.17%) to end at RM0.940, on above-average volume.

- Yesterday’s intraday movement displayed CCK’s ability to the run against the broader weak market sentiment, which may be deemed to be a signal of strength.

- Technical outlook remains mildly positive with the stock leading key SMAs higher, while indicators are still decent albeit with some pullback of late.

- Support levels are identified at RM0.890 (S1) and RM0.810 (S2), where keen investors may time their entry.

- Conversely, foresee resistances at RM1.03 (R1) and RM1.16 (R2).

Source: Kenanga Research - 22 Jun 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments