Kenanga Research & Investment

Daily Technical Highlights – (KAREX, AEMULUS)

kiasutrader

Publish date: Wed, 04 Jul 2018, 09:12 AM

KAREX (Not Rated)

- KAREX gained 5 sen yesterday (5.88%), closing at RM0.900, backed by above-average trading volume.

- Chart-wise, the stock has been trading in a range between RM0.750 to RM0.850 for the past two weeks after a short rally in early June. Yesterday’s candlestick broke through its previous swing high resistance of RM0.850 which could signify a continuation of June’s rally.

- Momentum indicators continue to show meaningful upticks and the 20-day SMA has just crossed above the 50-day SMA yesterday for the first time since October 2017.

- From here, we expect the stock to face resistances at RM0.925 (R1) and RM0.995 (R2).

- On the other hand, supports can be identified at RM0.850 (S1) and RM0.750 (S2).

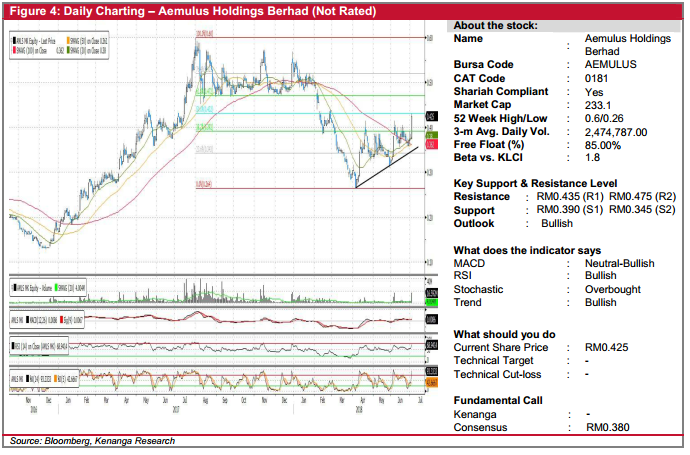

AEMULUS (Not Rated)

- AEMULUS jumped 5.0 sen to end at RM0.425 (+13.3%). This was accompanied by 16.6m shares being traded – quadruple the average volume of 4.0m shares.

- Yesterday’s “Opening Marubozu” candlestick displayed bullishness with the stock successfully closes above earlier resistances level of RM0.400.

- Technically, key SMAs have just completed a “Golden Crossover”, whilst momentum indicators are also showing upside-bias.

- Though the share is approaching a resistance at RM0.435 (R1), we foresee continued buying momentum could result in a R1 breakout, thus paving a further rally towards RM0.475 (R2) and RM0.520 (R3).

- Conversely, downside support can be identified at RM0.390 (S1) and RM0.345 (S2).

Source: Kenanga Research - 4 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments