Kenanga Research & Investment

Daily Technical Highlights – (N2N, TMCLIFE)

kiasutrader

Publish date: Wed, 18 Jul 2018, 09:15 AM

N2N (Not Rated)

- N2N declined 2.0 sen (-1.55%) yesterday to close at RM1.27.

- Technically, we are expecting some retracement in the short-term.

- Yesterday, the share closed below its 20-day SMA for the first time since the start of its rally in April. This, coupled with tepid volumes and declining MACD could indicate diminishing momentum from the rally.

- Supports can be identified at RM1.21 (S1) and RM1.10 (S2) based on Fibonacci. Conversely, Fibonacci projects resistances at RM1.37 (R1) and RM1.54 (R2).

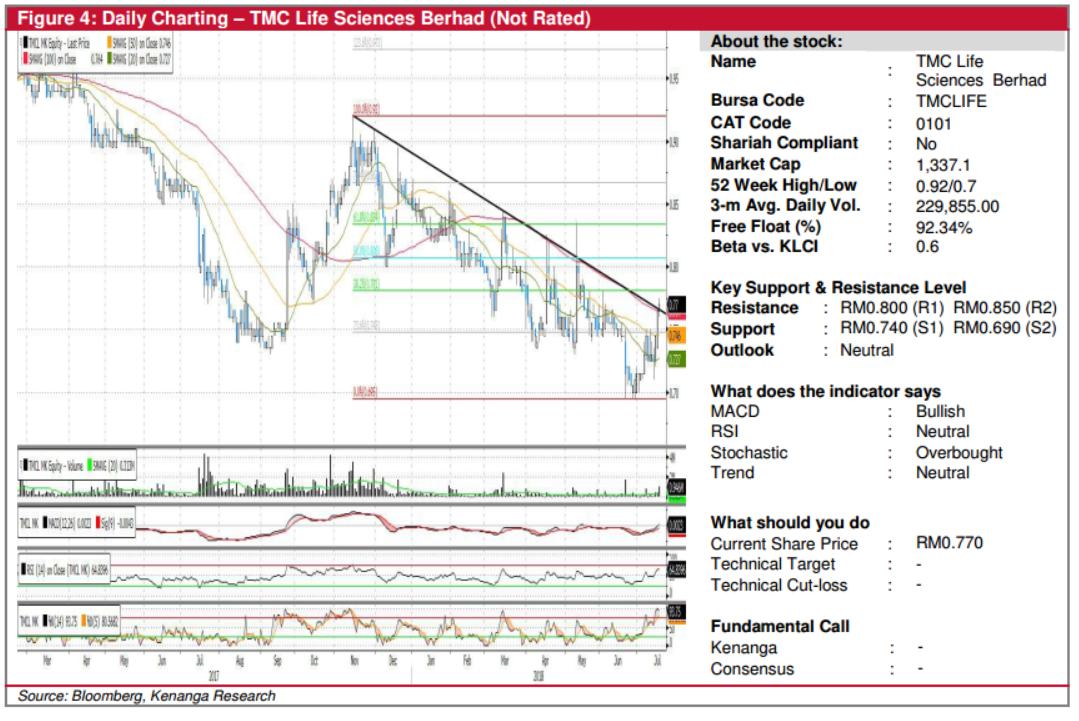

TMCLIFE (Not Rated)

- TMCLIFE gained 0.5 sen (+0.65%) to close at RM0.770, backed by higher than average trading volume.

- Chart-wise, the share was on a downtrend since November 2017. However, recent upward movement may be a sign of bottoming up as the share has now closed above the 100-day SMA.

- Should this be a valid breakout, we may see the share head higher towards RM0.800 (R1) and RM0.850 (R2).

- Conversely, supports can be identified at RM0.740 (S1) and RM0.690 (S2).

Source: Kenanga Research - 18 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments