Kenanga Research & Investment

Daily Technical Highlights – (ANNJOO, LEESK)

kiasutrader

Publish date: Thu, 09 Aug 2018, 09:14 AM

ANNJOO (Not Rated)

- Yesterday, ANNJOO gained 14.0 sen (+7.07%) to close at RM2.12.

- Technically, ANNJOO seems to have displayed signs of bottoming out in July. Notably, yesterday’s candlestick closed above the 50-day SMA for the first time since its decline in March 2018, which could indicate a continuation of its July's rally. This, accompanied by exceptional trading volume, indicates strong buying interest. Key momentum indicators continue to show positive signals as well.

- Expect ANNJOO to test its resistance at RM2.20 (R1) and RM2.39 (R2) should the first resistance be taken out.

- Conversely, downside bias should find supports at RM2.00 (S1) and RM1.88 (S2).

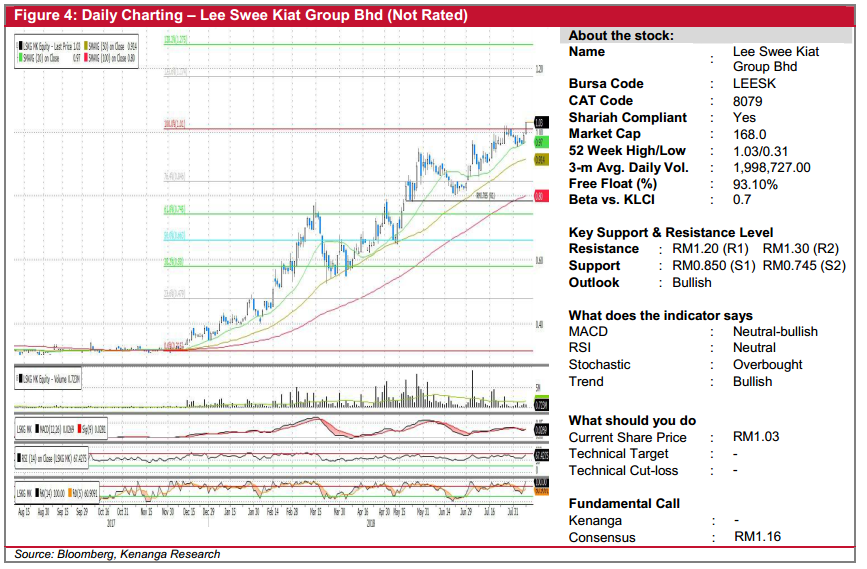

LEESK (Not Rated)

- Yesterday, LEESK gained 4.0 sen (+4.04%), to close at RM1.03 with a bullish “Marubozu” candlestick formed.

- Trend has been positive with subsequent formation of higher highs and higher lows after the share bottomed-out in early-Dec last year.

- Technical indicators seem supportive and suggest for an attempt to test the next higher high with the MACD inflecting upwards to crossover Signal-line while key SMAs remain in “Golden Cross” state.

- From here, follow-through buying may bring the share to meet resistance at RM1.20 (R1) with a decisive take down will see the index on a higher note at RM1.30 (R2)

- However, failure to do so, the share may retreat back to immediate support level RM0.850 (S1) and RM0.745 (S2) further down.

Source: Kenanga Research - 9 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments