Kenanga Research & Investment

Daily Technical Highlights – (HSSEB, REDTONE)

kiasutrader

Publish date: Tue, 14 Aug 2018, 09:39 AM

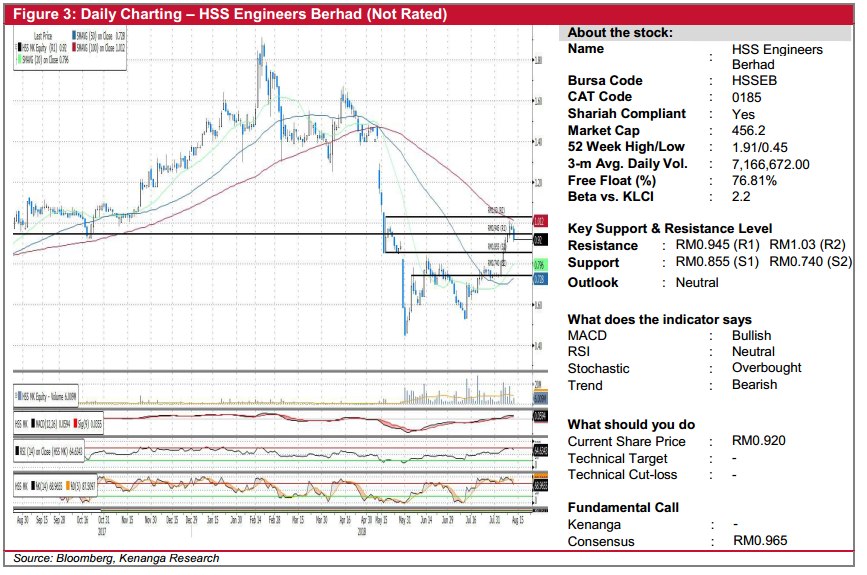

HSSEB (Not Rated)

- Yesterday, HSSEB fell 5.0 sen (-5.16%) to close at RM0.920.

- Technical-wise, the share has retraced after staging a rebound rally since June 2018. We think that the retracement is not over yet given that HSSEB failed to break above the key 100-day SMA. Key momentum indicators are also showing signs of retracement as well.

- From here, expect HSSEB to test support levels of RM0.855 (S1) and further down to RM0.740 (S2) if the first support level is failed to hold.

- Conversely, should the rally continue, resistance levels can be identified at RM0.945 (R1) and RM1.03 (R2).

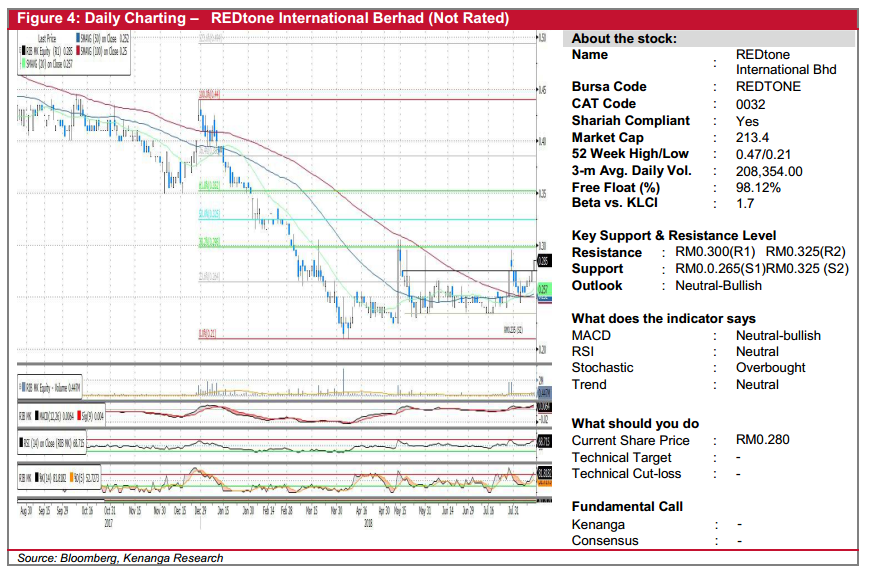

REDTONE (Not Rated)

- REDTONE gained 1.0 sen (+3.64%) yesterday to close at RM0.280.

- Recent few white “Marubozu” candlesticks represent a pick-up in investors’ interest, bringing the share to decisively breakout from months of sideways trading.

- Likewise, indicators are also mostly in positive given gradually improving volumes and upwards movements in MACD.

- Key resistance level to look-out for is RM0.300 (R1). Once taken out, the share price is on a clear path for the next leg higher towards resistance level RM0.325 (R2).

- Conversely, downside support can be found at resistance-turned-support RM0.265 (S1) and RM0.235 (S2) further down.

Source: Kenanga Research - 14 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments