Kenanga Research & Investment

Daily Technical Highlights – (PIE, WCT)

kiasutrader

Publish date: Wed, 19 Sep 2018, 09:33 AM

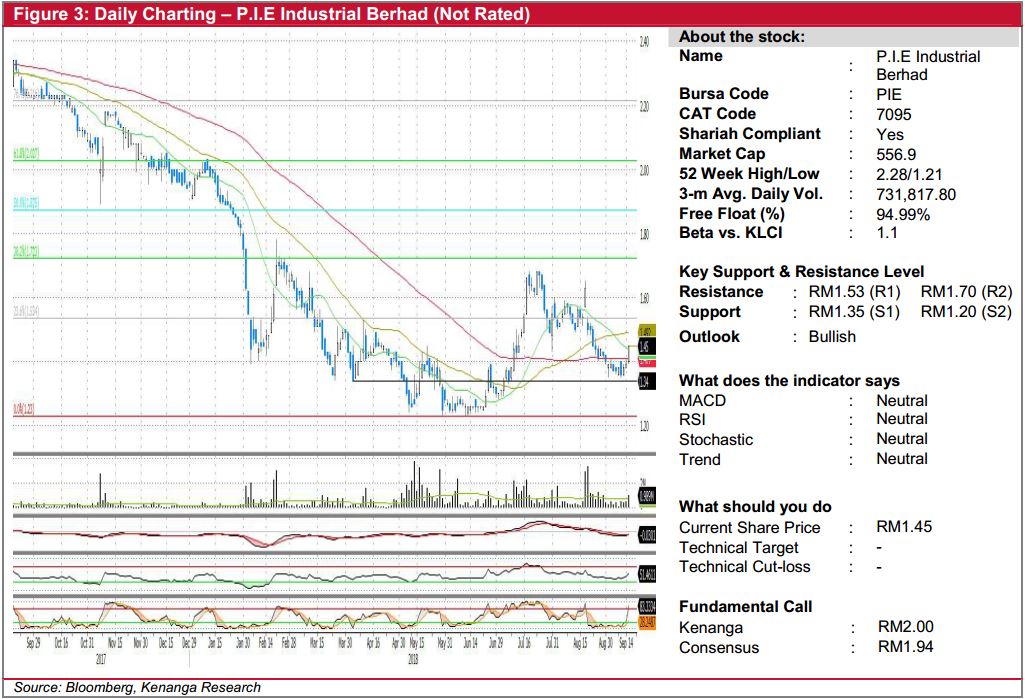

PIE (Not Rated)

- PIE climbed 6.0 sen (+4.32%) to end at RM1.45 last night, backed by strong trading volume.

- More notably, yesterday’s candlestick saw the share closed above both its 20 and 100-day SMAs.

- Momentum indicators are also showing meaningful upticks, possibly indicating that the share is bottoming-out from its shortterm downtrend.

- A possible short-term rally towards RM1.53 (R1) may be seen while a break above R1 will suggest a further test of the next resistance level at RM1.70 (R2).

- Conversely, downside supports can be identified at RM1.35 (S1) and RM1.20 (S2)

WCT (Not Rated)

- WCT gained 7.0 sen (+8.14%) to close at RM0.930 following an announcement that the company had accepted a letter of award.

- Chart-wise, the share had been moving downwards since mid of July 2018, as shown by the string of black-bodied candlesticks formed.

- However, yesterday’s move saw the share broke above key SMAs as it gapped up upon its opening bell, possibly indicating a change in sentiment towards the stock.

- Expect continuous buying momentum from here that may see it rally towards RM 1.00 (R1) and possibly RM1.20 (R2).

- Conversely, retracement towards RM0.800 (S1) and RM0.700 (S2) would serve as a good entry point for interested

Source: Kenanga Research - 19 Sept 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments