Kenanga Research & Investment

Daily technical highlights – (QES, KHEESAN)

kiasutrader

Publish date: Thu, 11 Oct 2018, 09:07 AM

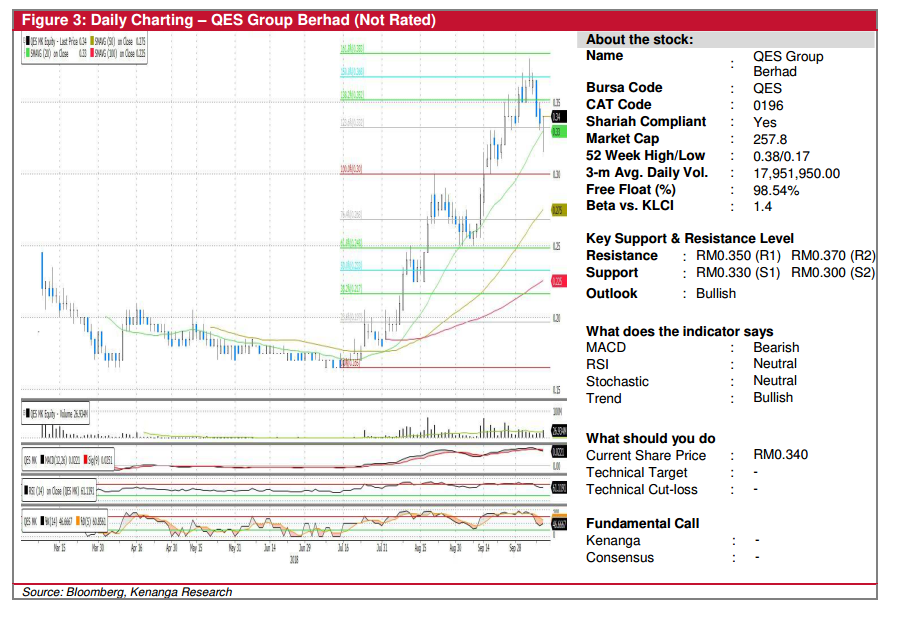

QES (Not Rated)

- QES gained 0.5 sen (+1.49%) to close at RM0.340, on the back of above-average trading volume.

- This week has seen QES under-go a retracement after an exceptional rally since mid-July. Yesterday’s candlestick formed a “dragonfly doji” which signifies buying interest. Notably, this bullish reversal candlestick pattern appeared on its 20-day SMA, which acts in confluence to signify buying interest. We also note that QES managed to close positive amidst the sell-down in the market.

- We expect buying interest to continue to bring the share towards RM0.350 (R1) and RM0.370 (R2). Conversely, immediate support can be identified at RM0.330 (S1), near its 20-day SMA and RM0.300 (S2), its previous resistance turned support.

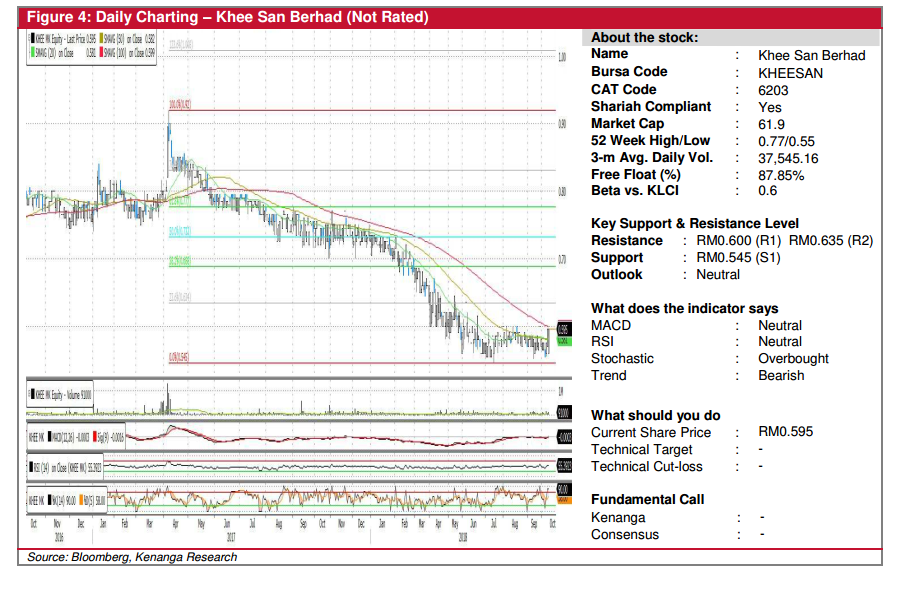

KHEESAN (Not Rated)

- KHEESAN closed at RM0.595 yesterday, with a bullish “Marubozu” candlestick formed.

- Technical chart indicates a downtrend breakout, potentially to signal the share price has bottomed out and now poised for a recovery.

- From here, expect KHEESAN to punch through its 100-day SMA at RM0.600 (R1).Should this level be taken out, next resistance level to target is RM0.635 (R2).

- Immediate downside support can be found at RM0.545 (S1), where a break below is deemed highly negative.

Source: Kenanga Research - 11 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments