Daily technical highlights – (INARI, HHGROUP)

kiasutrader

Publish date: Fri, 12 Oct 2018, 08:52 AM

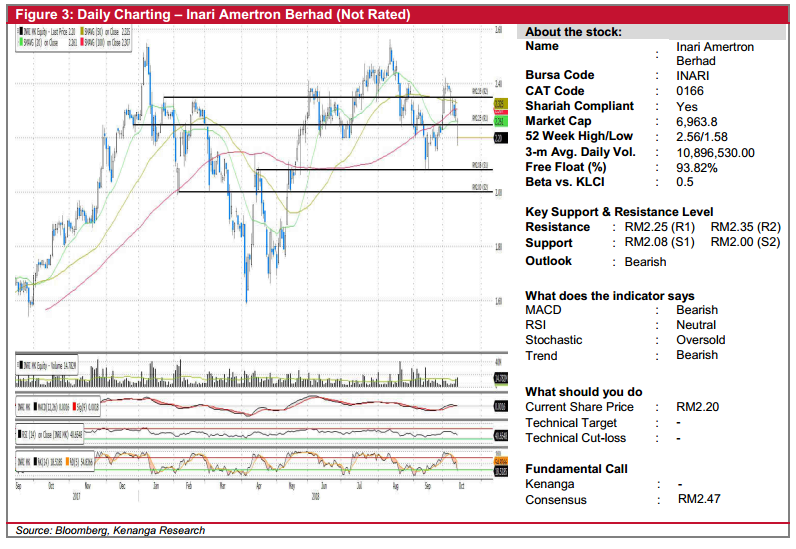

INARI (Not Rated)

• INARI fell 10.0 sen (-4.35%) to close at RM2.20, on the back of above-average trading volume.

• From a technical perspective, the share failed to remain above key SMAs, breaking below its 20-day SMA. Notably, yesterday’s candlestick gapped down and closed to form a bearish pin bar. Moreover, MACD has also displayed a bearish crossover signal which could indicate more downsides.

• Immediate support levels can be identified at RM2.08 (S1) and RM2.00 (S2). Conversely, renewed buying interest should see resistances at RM2.25 (R1) and RM2.35 (R2) should the first level be taken out.

HHGROUP (Not Rated)

• HHGROUP gained 1.5sen (8.33%) to close at RM0.195 yesterday.

• Technically, yesterday’s bullish candlestick could suggest a downtrend reversal as the share appears to have bottomed out.

• Indicators are displaying improvement with MACD to cross over the signal line while other oscillators showing upticks.

• From here, expect HHGROUP to break through its 100-day SMA at RM0.200 (R1). Should this level be taken out, next resistance level to target is RM0.245 (R2).

• Immediate downside support can be found at RM0.170 (S1), where a break below is deemed highly negative.

Source: Kenanga Research - 12 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|