Daily technical highlights – (LIONIND, FRONTKN)

kiasutrader

Publish date: Fri, 19 Oct 2018, 08:39 AM

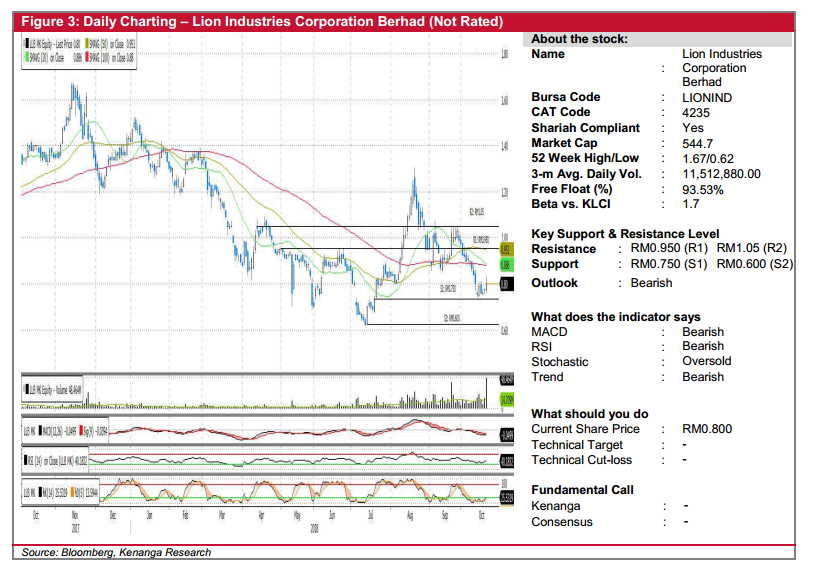

LIONIND (Not Rated)

• LIONIND climbed 2.5 sen to close at RM0.800 yesterday.

• Notably, yesterday’s move was supported by high trading volume. However, we find this rather unconvincing given the share’s strong primary downtrend.

• Moreover, the 20-day SMA is close to crossing below the 100-day SMA while other momentum indicators had not shown any meaningful signs of a reversal.

• Nevertheless, should strong buying momentum follow-through and break above RM0.950 (R1), expect next resistance at RM1.05 (R2).

• Conversely, downside support is identified at RM0.750 (S1) and RM0.600 (S2).

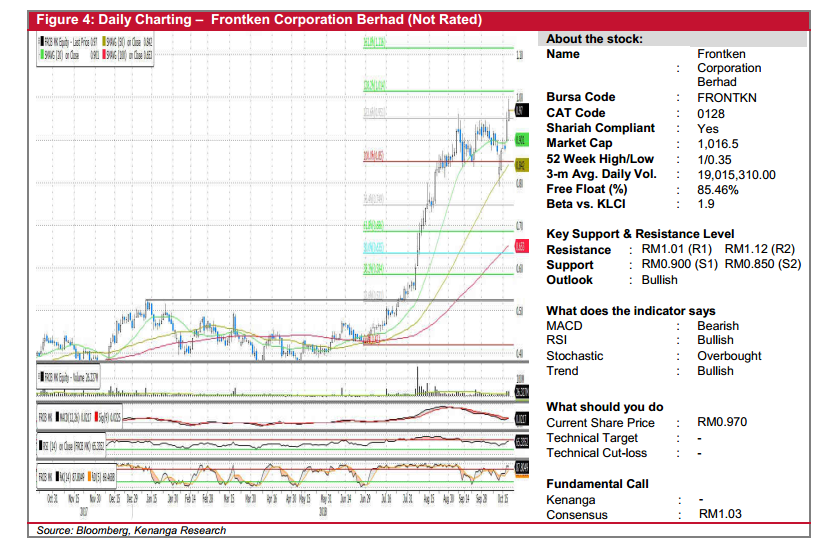

FRONTKN (Not Rated)

• FRONTKN gained 2.5 sen (+2.65%) to end at RM0.970 yesterday on stronger-than-average trading volume.

• Technically, the share has been enjoying a steady uptrend since end-June, with yesterday’s close resulting in a decisive breakout above its prior RM0.951 resistance level.

• Resurgence of buying interest on the stock is also reflected by upward trending on RSI and Stochastic from their respective oversold position.

• Should follow-through buying interest carry on over the next few days, the stock could set sights towards RM1.01 (R1) and should this be taken out, next resistance level is identified at RM1.12 (R2).

• Meanwhile, support levels are located at RM0.900 (S1) with a break below RM0.850 (S2) is deemed highly negative.

Source: Kenanga Research - 19 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|