Daily technical highlights – (MISC, BURSA)

kiasutrader

Publish date: Thu, 25 Oct 2018, 08:59 AM

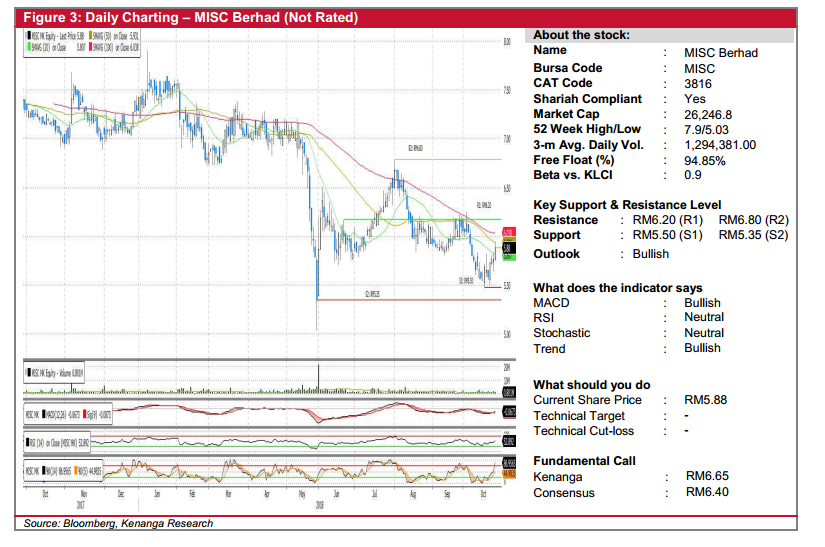

MISC (Not Rated)

• MISC climbed 12.0 sen (+2.08%) to end at RM5.88.

• Chart-wise, the share was on a downtrend since August 2018. However, yesterday’s move saw the share crossed above the 20-day SMA.

• Coupled with the crossing of the MACD line above the signal line, we think that the share may be staging a short-term rebound.

• Continuous positive momentum will see resistance at RM6.20 (R1) and RM6.80 (R2).

• Should momentum taper-off, downside support can be identified at RM5.50 (S1) and RM5.35 (S2)

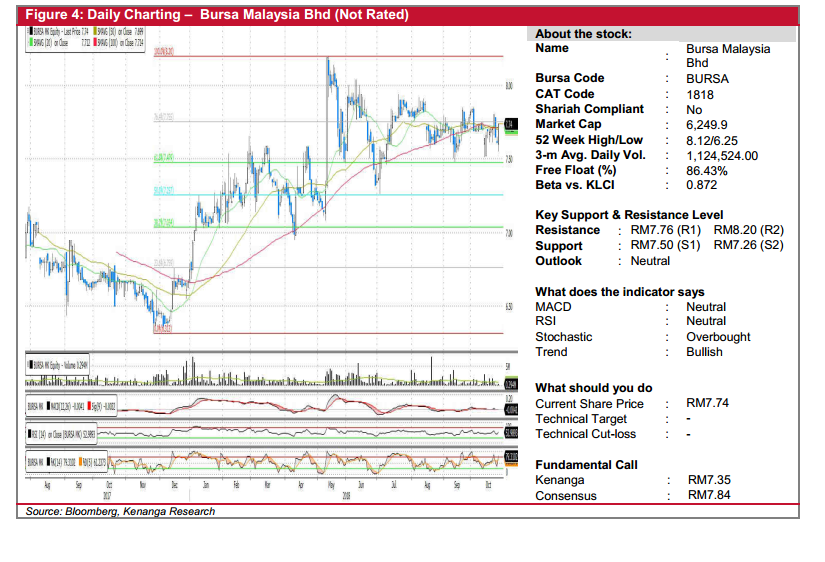

BURSA (Not Rated)

• BURSA gained 13.0 sen (+1.71%) to close at RM7.74 yesterday.

• Yesterday’s bullish candlestick saw it broke past key SMAs, possibly indicating a continued bullish move ahead.

• Moreover, encouraging momentum readings are indicated by meaningful upticks in the RSI and stochastic

• We look towards RM7.76 (R1) as immediate resistance with a decisive breakout will see the share advancing towards RM8.20 (R2).

• Conversely, immediate support can be at RM7.50 (S1), and further down at RM7.26 (S2).

Source: Kenanga Research - 25 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

MISC2024-11-26

MISC2024-11-26

MISC2024-11-25

MISC2024-11-25

MISC2024-11-25

MISC2024-11-25

MISC2024-11-22

BURSA2024-11-22

BURSA2024-11-22

MISC2024-11-22

MISC2024-11-22

MISC2024-11-21

BURSA2024-11-21

BURSA2024-11-21

MISC2024-11-21

MISC2024-11-21

MISC2024-11-20

BURSA2024-11-20

MISC2024-11-20

MISC2024-11-20

MISC2024-11-20

MISC2024-11-19

BURSA2024-11-19

MISC2024-11-19

MISC2024-11-18

BURSA2024-11-18

MISC2024-11-18

MISC