Kenanga Research & Investment

Daily Technical Highlights – (HEIM, STAR)

kiasutrader

Publish date: Wed, 07 Nov 2018, 11:50 AM

HEIM (Not Rated)

- HEIM gained 72.0 sen (+3.77%) to close at RM19.82 yesterday, as investors reacted positively towards lack of development in excise duties during the Budget 2019

- Overall technical outlook appears positive and has broken above the 20-day SMA. Moreover, it appears to be testing the 50- day SMA.

- Should it be able to break above RM20.00 (R1) where the 50-day SMA is hovering at, next resistance level to watch for is RM20.70 (R2).

- Conversely, downside supports can be identified at RM19.00 (S1) and RM17.50 (S2).

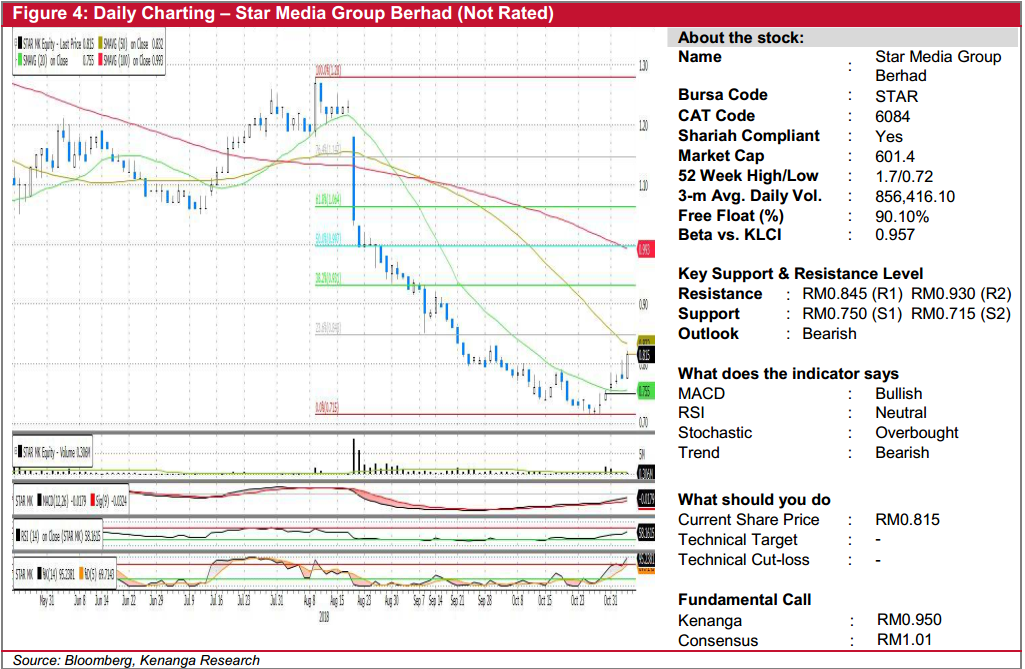

STAR (Not Rated)

- STAR grew by 4.0 sen (+5.16%) to end at RM0.815

- Notably, this rally saw STAR closing above the 20-day SMA, a first since it began trending downwards in late-August.

- Yesterday’s candlestick represented a close above its previous high of RM0.805, signifying a potential continuation of October’s rally.

- Should buying momentum continue, we expect the share to head towards resistances of RM0.845 (R1) and RM0.930 (R2) while downward bias should see supports at RM0.750 (S1) and RM0.715 (S2).

Source: Kenanga Research - 7 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments