Kenanga Research & Investment

Daily Technical Highlights – (PUC, NGGB)

kiasutrader

Publish date: Tue, 13 Nov 2018, 09:21 AM

PUC (Trading Buy, TP: RM0.205; SL: RM0.135)

- Yesterday, PUC gained 1.5 sen (+10.35%) to close at RM0.160, backed by above-average trading volume.

- Chart-wise, the share has been on a downtrend before starting its rally in early-November. Yesterday’s move represented a close marginally above its 100-day SMA which potentially could signal a reversal. We note that this is the first-time PUC closed above its 100-day SMA since late-May this year.

- Key momentum indicators are also steadily inching upwards providing positive signals. We also find comfort in the fact that its 50-day SMA has provided strong support and some form of consolidation last week before yesterday’s move.

- From here, we reckon further downside to be limited with support levels identified at RM0.140 (S1) and RM0.120 (S2). Conversely, should buying momentum continue, we expect PUC to test resistances at RM0.170 (R1) and RM0.220 (R2).

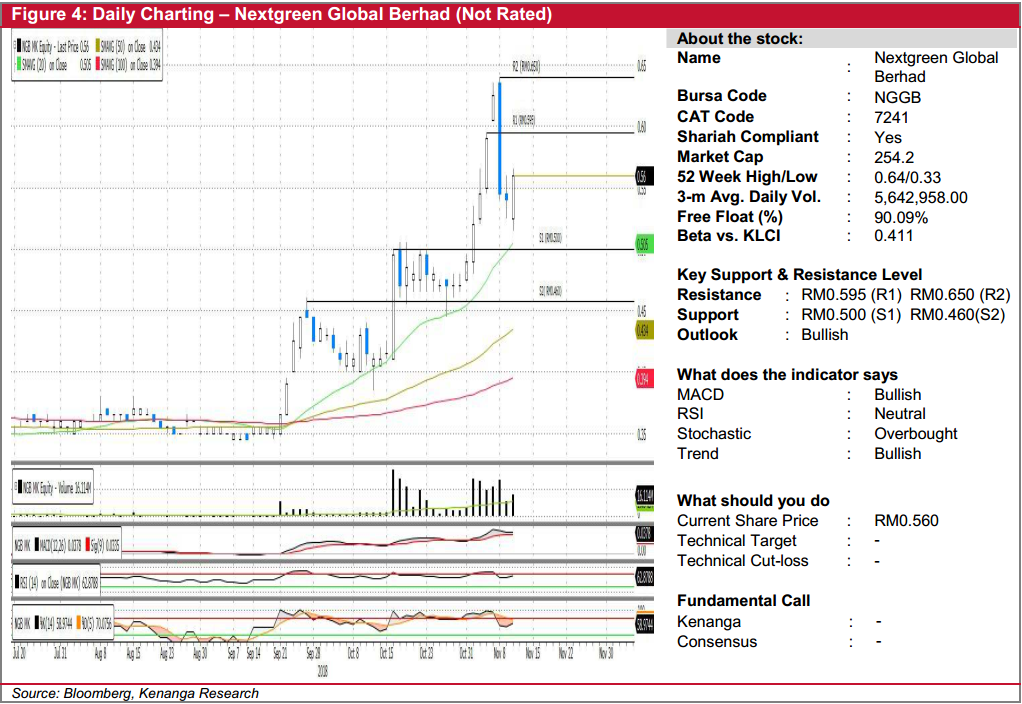

NGGB (Not Rated)

- Yesterday, NGGB rose 2.0 sen (+3.70%) to close at RM0.560.

- Chart-wise, the share has been on a brief uptrend since mid-Oct after it found support near its 20-day SMA. Notably, the share experienced a retracement a few days ago after reaching a record high of RM0.650.

- We believe that the retracement could potentially be over and there may be further possibility of a continuation of the uptrend as the share is currently trading above key SMAs with key indicators continuing their positive displays.

- Furthermore, we see RM0.500 (S1) as a sturdy support level which may serve as a good entry point. Should (S1) be taken out, we look towards RM0.460 (S2) as the next support.

- Any positive bias should find resistances at RM0.595 (R1) and RM0.650 (R2).

Source: Kenanga Research - 13 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments