Kenanga Research & Investment

Daily Technical Highlights – (BAT, UNISEM)

kiasutrader

Publish date: Wed, 14 Nov 2018, 08:59 AM

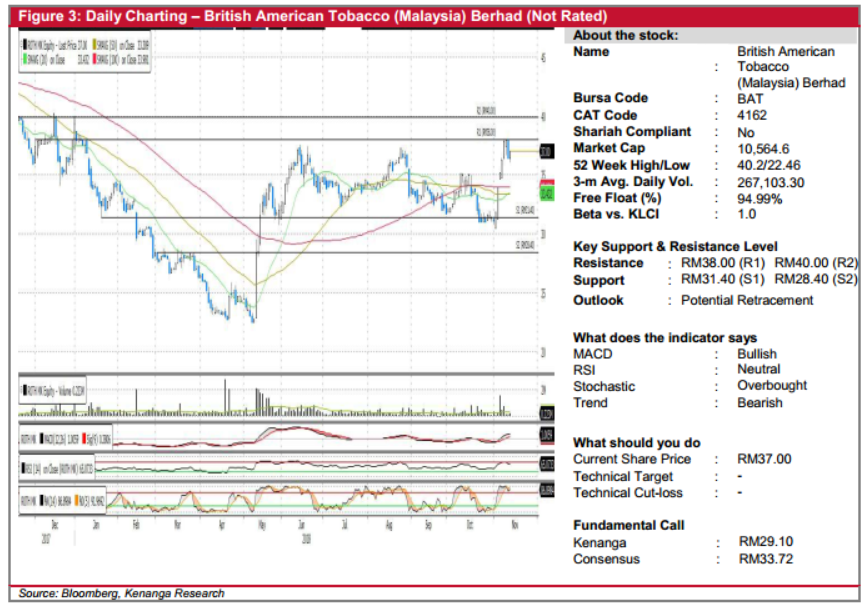

BAT (Not Rated)

- BAT gained 58.0 sen (+1.59%) to close at RM37.00 yesterday.

- Despite yesterday’s gain, we believe its technical picture to be toppish at the current juncture. Its mini rally since start of the month has failed to break past crucial resistance of RM38.00 despite testing it trice, coupled with tepid trading volumes and stochastic indicators hovering in overbought position.

- That said, further retracement towards RM31.40 (S1) may provide as an attractive entry for keen investors, while a break below RM28.40 (S2) will be deemed highly negative.

- Conversely, any positive bias should see resistances at aforementioned RM38.00 (R1) and RM40.00 (R2).

UNISEM (Not Rated)

- Yesterday, UNISEM rose 9.0 sen (+2.97%) to close at RM3.12.

- Chart-wise, the UNISEM has been trending up since May with the share currently hovering above all key SMAs.

- Technical indicators appear in supportive for a bullish as indicated by the bullish MACD and upticks seen in RSI and Stochastic.

- Should buying momentum be sustained, we expect the share price to advance towards RM3.50 (R1) before trending higher towards RM3.80 (R2).

- Meanwhile, downside supports can be seen RM3.00 (S1) and RM2.80 (S2) further down.

Source: Kenanga Research - 14 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

BAT2024-11-25

UNISEM2024-11-25

UNISEM2024-11-25

UNISEM2024-11-25

UNISEM2024-11-25

UNISEM2024-11-25

UNISEM2024-11-25

UNISEM2024-11-25

UNISEM2024-11-25

UNISEM2024-11-25

UNISEM2024-11-21

UNISEM2024-11-21

UNISEM2024-11-21

UNISEM2024-11-21

UNISEM2024-11-21

UNISEM2024-11-21

UNISEM2024-11-19

UNISEM2024-11-19

UNISEM2024-11-19

UNISEM2024-11-19

UNISEM2024-11-19

UNISEM2024-11-19

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEMMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments