Daily technical highlights – (HIBISCS, RANHILL)

kiasutrader

Publish date: Thu, 15 Nov 2018, 09:36 AM

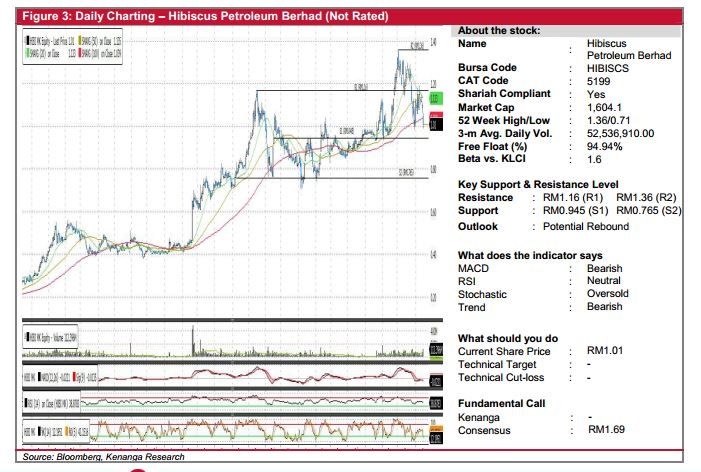

HIBISCS (Not Rated)

• Yesterday, HIBISCS dropped 9 sen (-8.18%) on increased volumes to close at RM1.01, on the back of weakening crude oil prices of late.

• Chart-wise, the share has been trading in a downtrend after peaking in early-Oct 2018. The share did attempt a mini rebound early this month, but has once again succumbed to selling pressure after failing to decisively break past its crucial resistance at RM1.16.

• However, we noticed its stochastic indicator has proven to be a reliable signal in the past, having managed to show some rebounds when the indicator dipped into the oversold territory. With that, the support levels at RM0.945 (S1) or RM0.765 (S2) could provide attractive entry points for keen investors.

• Conversely, aforementioned resistance at RM1.16 (R1) needs to be decisively taken out before its outlook can be outright bullish, with a higher resistance identified at RM1.36 (R2).

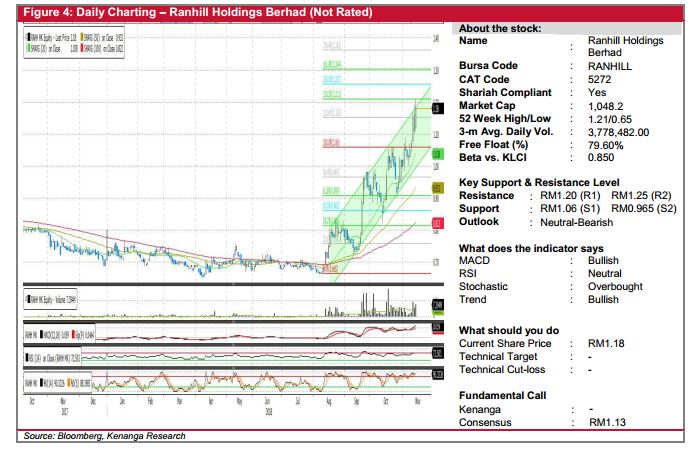

RANHILL (Not Rated)

• Yesterday, RANHILL gained 2.0 sen (+1.72%) to close at RM1.18. This comes after its 3Q18 results release, which saw the company’s reported net profit dropped by 35% YoY.

• Chart-wise, the stock has been trading within an uptrend channel since mid-Aug 2018. However, yesterday’s close saw the share closing in on the upper limit of the trend channel, which we think could signify that the share may be toppish.

• Coupled with a slow-down from key momentum indicators as evidenced by the overbought stochastic and RSI, we foresee a possible retracement happening soon.

• From here, we anticipate support levels at RM1.06 (S1) and RM0.965 (S2) while resistance levels can be identified at RM1.20 (R1) and RM1.25 (R2).

Source: Kenanga Research - 15 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|