Daily technical highlights – (MAGNUM, SUPERLN)

kiasutrader

Publish date: Wed, 28 Nov 2018, 08:57 AM

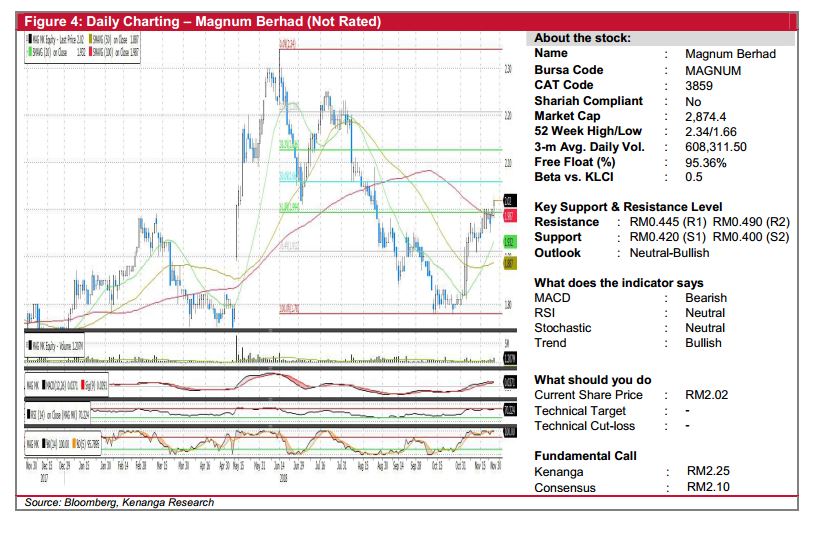

MAGNUM (Not Rated)

• MAGNUM gained 2.0 sen (+1.00%) to close at RM2.02 yesterday. This was as the company announced its 3Q18 quarterly results yesterday evening, seeing an uptick in core net profits by 14% YoY.

• Chart-wise, MAGNUM appears to have bottomed-out in October and has since been trending upwards with the share currently hovering above key SMAs.

• Momentum indicators appear in supportive for the next bullish move with the MACD continuing its bullish movement.

• From here, should buying interest be sustained, we expect next advancement towards RM2.06 (R1) and RM2.13 (R2) next.

• Conversely, immediate support level can be found at RM2.00 (S1) and 1.91 (S2) further down.

SUPERLN (Not Rated)

• SUPERLN grew by 1.0 sen (+0.82%) to end at RM1.23 yesterday.

• Chart-wise, the share has been on an uptrend since late-October staging an emergence of “Golden Crossover” among key SMAs.

• Meanwhile, yesterday’s gap-down open has also indicated strong support levels at its 20-day SMA. Coupled with positive indicators, the share seems poised for a move higher from a technical standpoint.

• Immediate overhead resistance to look out for can be identified at RM 1.25 (R1) and RM1.29 (R2).

• Conversely we see support levels for at RM1.19 (S1) and RM1.14 (S2).

Source: Kenanga Research - 28 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|