Daily technical highlights – (GCB, LONBISC)

kiasutrader

Publish date: Wed, 05 Dec 2018, 08:53 AM

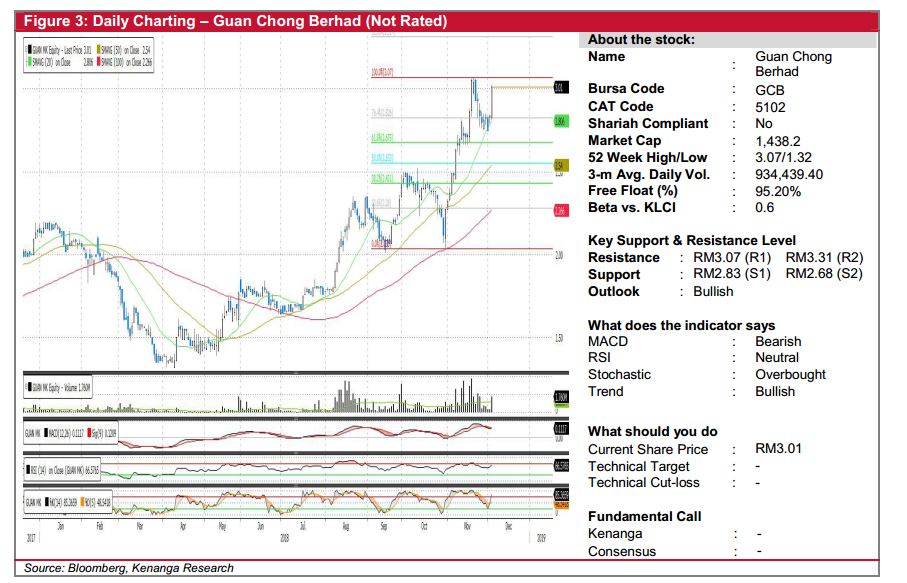

GCB (Not Rated)

• GCB gained 17.0 sen (+5.99%) to close at RM3.01 yesterday.

• Technically, GCB has been on a rally since its retracement to its 200-day SMA in late-October. Recent price action has seen GCB retrace and finding buying interest close to its 20-day SMA. This is evidenced by yesterday’s long bullish candlestick.

• Coupled with positive upticks from key momentum indicators, we believe that there may be more upside potential for GCB.

• From here, we look towards RM3.07 (R1) and RM3.31 (R2) as key areas of resistance.

• Conversely, support levels can be identified at RM2.83 (S1) and RM2.68 (S2).

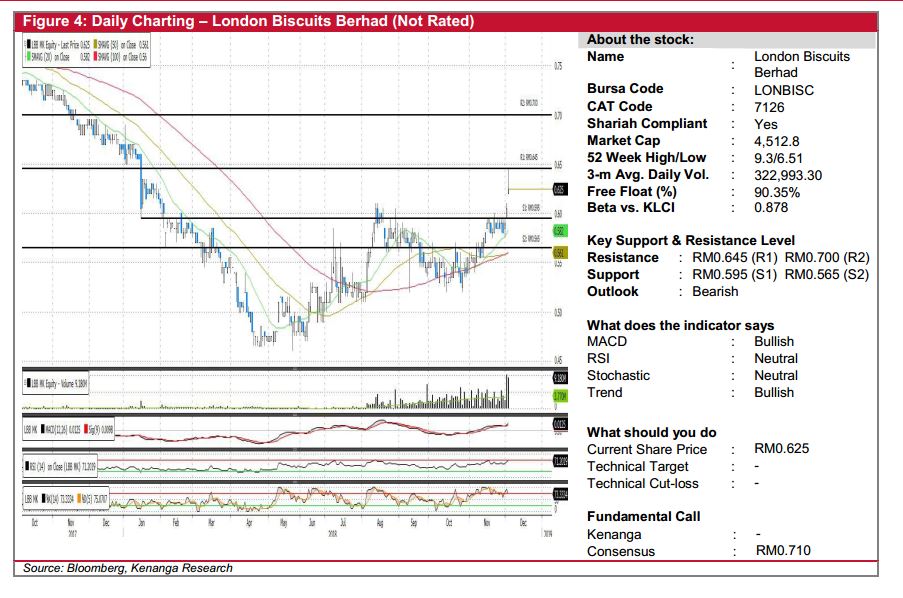

LONBISC (Not Rated)

• LONBISC grew by 2.0 sen (+3.31%) to end at RM0.625 yesterday.

• The share has been inching upwards slowly since finding support close to its 100-day SMA in mid-October. However, yesterday’s candlestick closed to form a shooting star, which indicates strong selling pressure, coupled with the near overbought signals from both RSI and stochastic indicators suggested that selling pressure may yet to be over.

• Immediate support level can be identified at RM0.595 (S1) and further down at RM0.565 (S2). Conversely, should the buying momentum able to overtake the selling pressure, we opine overhead resistances should be at RM0.645 (R1) and RM0.700 (R2).

Source: Kenanga Research - 5 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|