Daily technical highlights – (AMBANK,SANBUMI)

kiasutrader

Publish date: Tue, 11 Dec 2018, 08:54 AM

AMBANK (Not Rated)

• AMBANK dropped by 1.0 sen (-0.23%) to end at RM4.39 yesterday.

• The share has been on a rally since late-October. However, we believe that the rally is overextended and that retracement is likely to happen given that both the stochastic and RSI indicators are in the overbought region.

• From here we see possibilities of retracement to its immediate support level at RM4.31 (S1) and RM4.22 (S2).

• Meanwhile, overhead resistances can be found at RM4.46 (R1) and RM4.53 (R2).

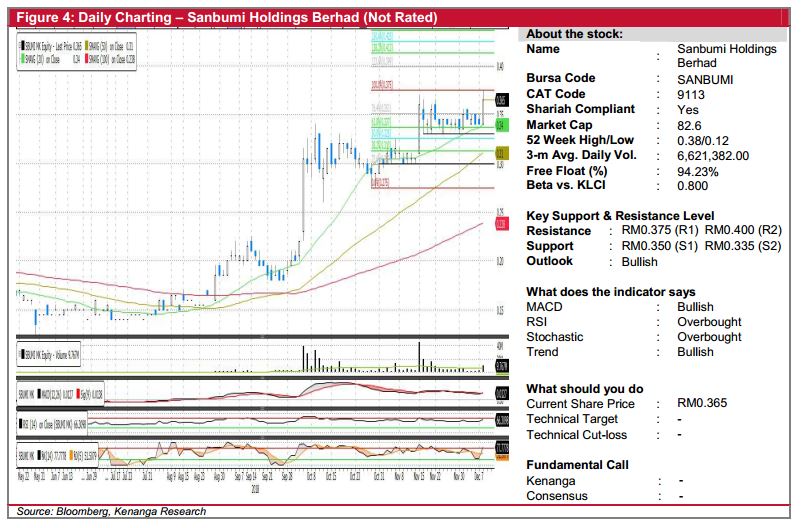

SANBUMI (Not Rated)

• SANBUMI gained 2.5 sen (+7.35%) to close at RM0.365 yesterday.

• Chart-wise, SANBUMI has been on an uptrend since early-September. We believe the uptrend may continue given that recent candlestick developments were backed by higher trading volume. Its shorter term SMAs are also above the longerterm SMAs indicating that the uptrend is still intact.

• Coupled with key momentum indicators showing positive signs, the share may be poised for a breakout with immediate resistance at RM0.375 (R1) and next resistance level can be found at RM0.400 (R2).

• Conversely, downside support level can be found at RM0.350 (S1) and RM0.335 (S2).

Source: Kenanga Research - 11 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|