Daily technical highlights – (SENDAI, PADINI)

kiasutrader

Publish date: Thu, 13 Dec 2018, 08:58 AM

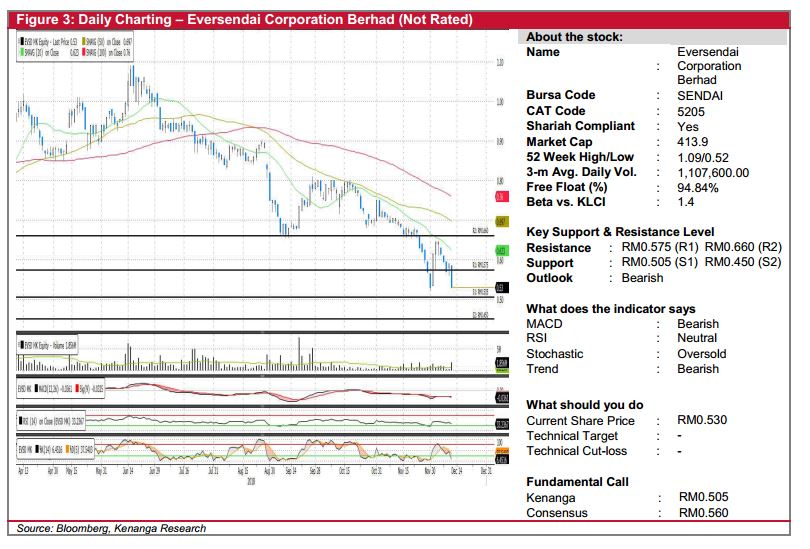

SENDAI (Not Rated)

• SENDAI slipped 6.0 sen (-10.17%) yesterday to close at RM0.530.

• Chart-wise, the share has been on a decline since breaking below its 100-days in mid-July 2018. Yesterday’s candlestick close to form a long bearish candlestick.

• Given that the shorter term SMAs are trading below the longer-term SMAs and coupled with lacklustre signals from key momentum indicators, we believe that there may be a further downside risk.

• Supports can be identified at RM0.505 (S1) and RM0.450 (S2). Conversely, we observe resistance levels at RM0.575 (R1) and RM0.660 (R2).

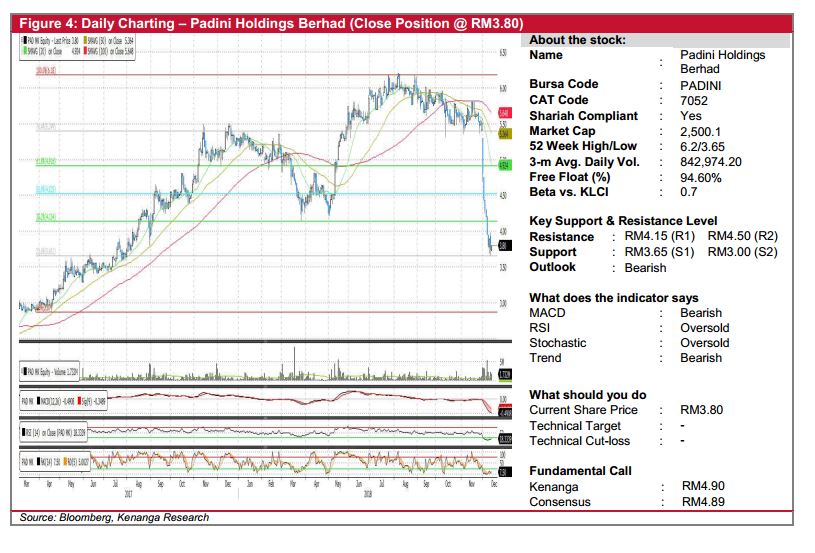

PADINI (Close Position @ RM3.80)

• We are bringing a closure to our ‘Trading Buy’ call on PADINI in view of the recent dip in price.

• Since our ‘Trading Buy’ call on 18 May 2018, the share rallied and hit a high of RM6.20. However, the share plunged since the start of December following the disappointment in its quarterly result coupled with an overall negative global sentiment.

• Overall technical outlook is bearish as it has broken below the RM4.10 support level and momentum indicators are all negative with no sign of a reversal.

• From here, the share may continue to plunge to its support levels at RM3.65 (S1) and RM3.00 (S2). Should there be a positive change in sentiment for PADINI, resistances can be found at RM4.15 (R1) and RM4.50 (R2)

Source: Kenanga Research - 13 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|