Daily technical highlights – (INARI, AEON)

kiasutrader

Publish date: Wed, 19 Dec 2018, 09:07 AM

INARI (Not Rated)

• Yesterday, INARI rose 2.0 sen (+1.24%) to close at RM1.63.

• Notably, yesterday’s move saw the share attempted to break below RM1.58, which has proven to be a sturdy support level as two previous rebounds were observed from this level.

• Furthermore, stochastic indicator is seen hovering in the oversold area coupled with a positive MACD crossover that occurred earlier this month, prompting the possibility for another rebound.

• Should follow-through buying continue, it is expected the share to trend higher towards RM1.70 (R1) and RM1.90 (R2).

• Conversely, downside pressure will see supports at RM1.50 (S1) and RM1.26 (S2).

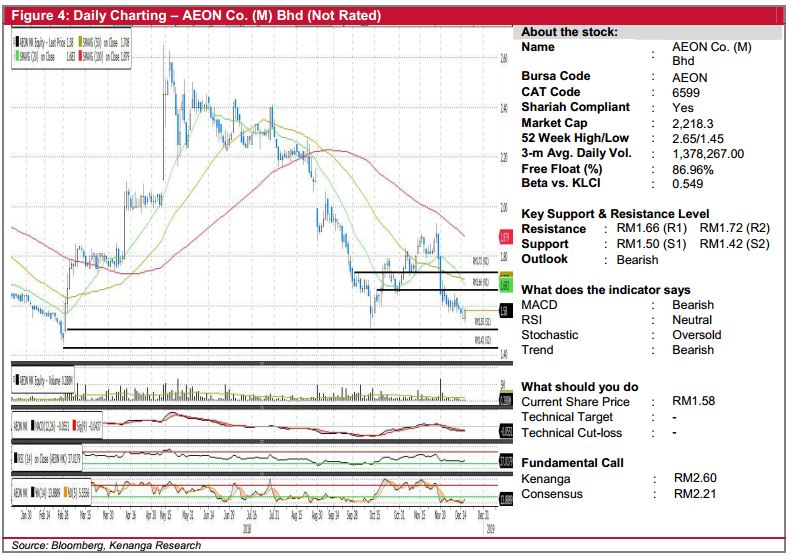

AEON (Not Rated)

• AEON grew by 3.0 sen (+1.94%) to end at RM1.58 yesterday.

• The share has been on a downtrend since late-November with the formation of a ‘Three Black Crows’ that broke below both the 20 and 50-Day SMAs, signalling strong selling pressure.

• Since then, key technical indicators have been depressed, giving us reason to believe that there are more downsides.

• Should the selling momentum persist, the share may test its immediate support at RM1.50 (S1) and RM1.42 (S2) before heading to overhead resistance at RM1.66 (R1) and RM1.72 (R2).

Source: Kenanga Research - 19 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

INARI2024-11-25

AEON2024-11-25

AEON2024-11-25

AEON2024-11-25

AEON2024-11-25

INARI2024-11-22

AEON2024-11-22

AEON2024-11-22

AEON2024-11-22

AEON2024-11-22

AEON2024-11-21

INARI2024-11-20

AEON2024-11-20

INARI2024-11-19

AEON2024-11-19

INARI2024-11-18

INARI2024-11-15

AEON