Kenanga Research & Investment

Daily Technical Highlights – (FGV, OCK)

kiasutrader

Publish date: Fri, 21 Dec 2018, 08:47 AM

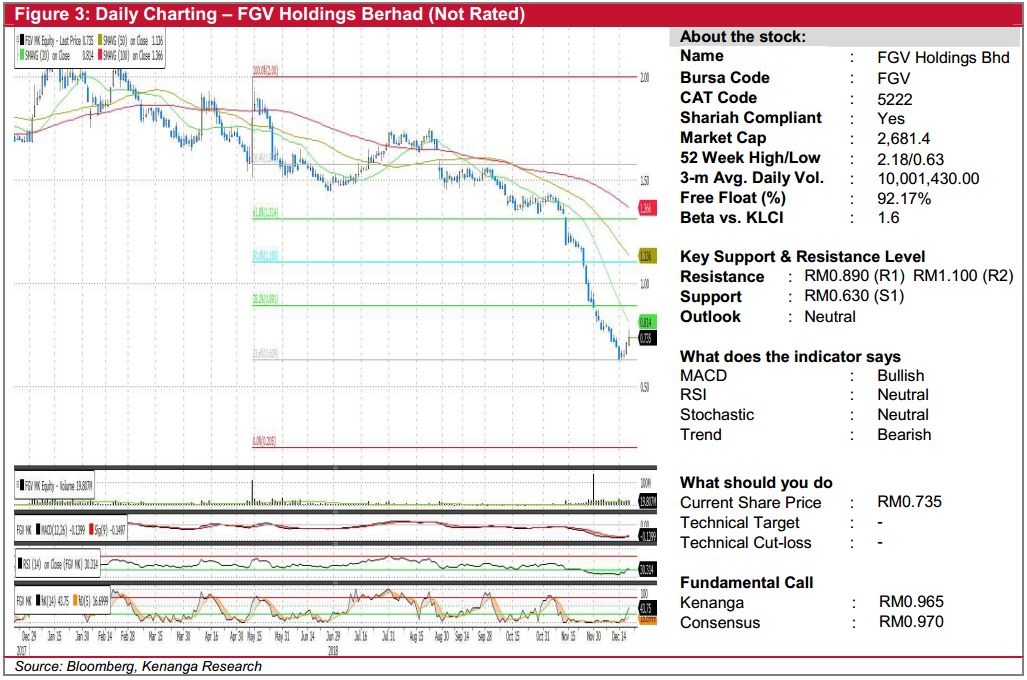

FGV (Not Rated)

- Yesterday, FGV went up 2.5 sen (+3.52%) to close at RM0.735.

- Chart-wise, the share seems to be recovering from its downtrend that started a month ago, noting the four consecutive bullish candle sticks. Additionally, yesterday’s candlestick displayed an inverted hammer which could signify the emergence of buying interest.

- Key momentum indicators continue to show positive upticks coupled with a bullish MACD crossover occurrence.

- Should buying momentum continue, we expect the share to test resistances at RM0.890 (R1) and RM1.100 (R2)

- Conversely, downside support can be found at RM0.630 (S1).

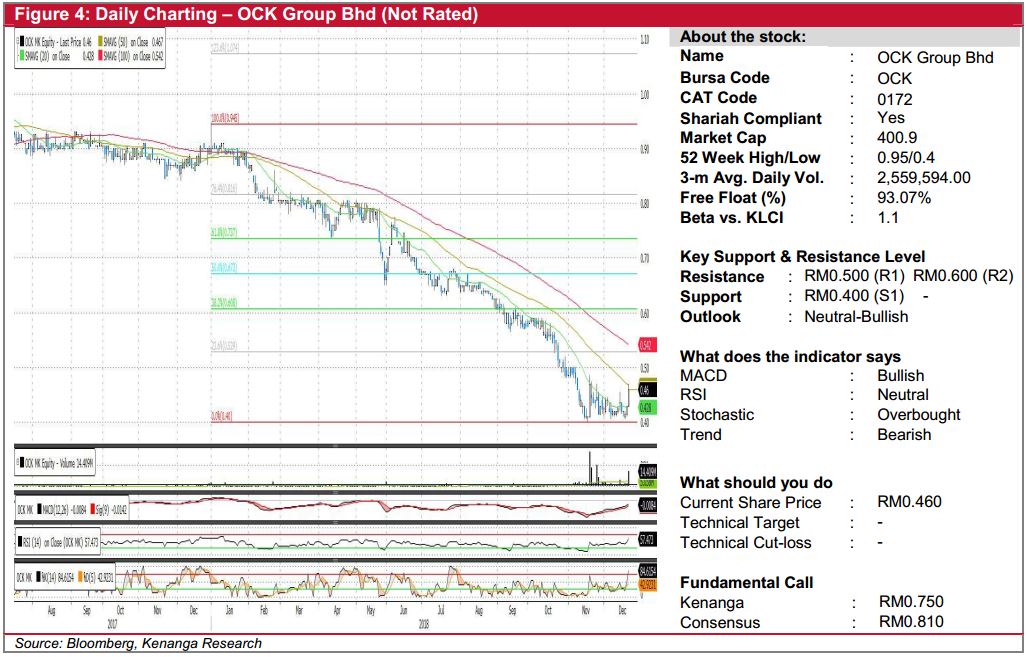

OCK (Not Rated)

- OCK grew by 3.0 sen (+6.98%) to close at RM0.460 yesterday on the back of higher-than-average trading volume with 13.3m shares exchanging hand-almost 3 fold to its 20-day average.

- Technically, yesterday’s bullish candlestick could suggest a downtrend reversal as the share appears to have bottomed out.

- Momentum indicators appears leaning towards the upside with bullish MACD crossover while other oscillators showing upticks.

- From here, should buying interest be sustained, we expect next advancement towards RM0.500 (R1) and RM0.600 (R2) next.

- Conversely, support level to watch out for can be found at RM0.400 (S1), where a break below is deemed negative.

Source: Kenanga Research - 21 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments