Kenanga Research & Investment

Daily Technical Highlights – (HIBISCS, QES)

kiasutrader

Publish date: Thu, 03 Jan 2019, 09:32 AM

HIBISCS (Not Rated)

- HIBISCS declined by 1.0 sen (-1.19%) to close at RM0.830 yesterday.

- The share has been on a downtrend since late September coupled with the formation of a “Death Cross” in late December.

- Yesterday’s candlestick gapped up 1.0 sen. Despite the "gap", the share failed to hold its gains and closed lower indicating strong selling pressure. As such we believe the downtrend is yet to be over coupled with poor signals from key SMAs and momentum indicators.

- Should selling momentum persist, we look at RM0.760 (S1) and RM0.700 (S2) as key support levels.

- Conversely, overhead resistance can be found at RM0.895 (R1) and RM0.980 (R2).

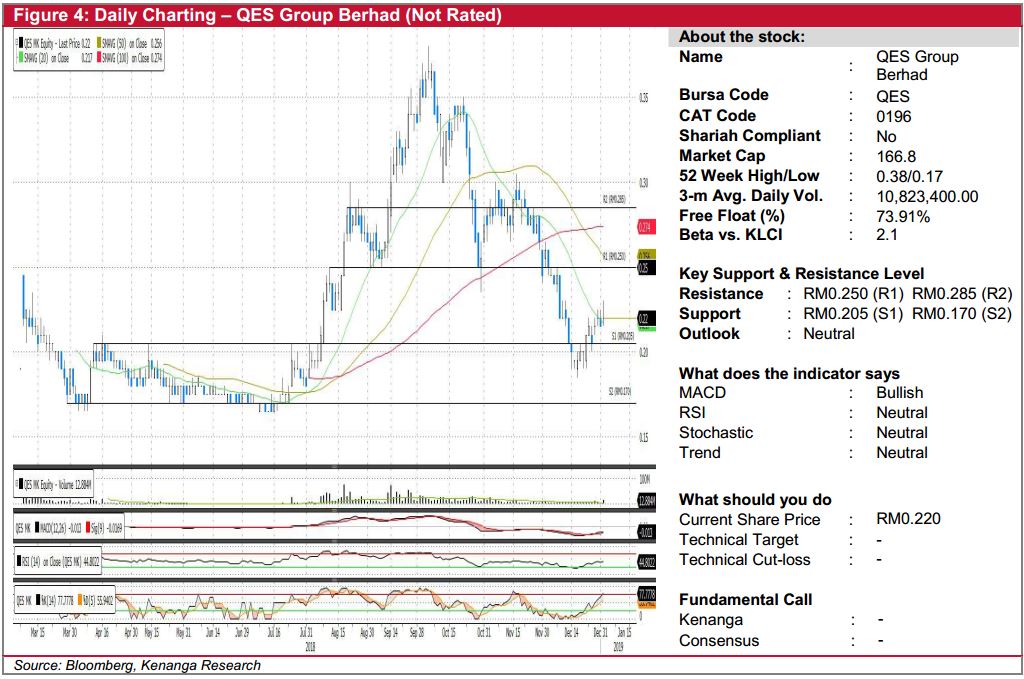

QES (Not Rated)

- QES rose 0.5 sen (+2.33%) to close at RM0.220 on the very first trading day of 2019.

- Chart-wise, the share appears to be staging a rebound in mid of December 2018 after sustaining heavy sell-down that started in October 2018.

- Overall technical outlook is positive as MACD indicator is bullish while the share had just trended above the 20-day SMA.

- Expect the positive momentum to continue to the next resistance at RM0.250 (R1) and RM0.285 (R2).

- Conversely, support levels can be found at RM0.205 (S1) and RM0.170 (S2).

Source: Kenanga Research - 3 Jan 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

HIBISCS2024-11-26

HIBISCS2024-11-26

HIBISCS2024-11-25

HIBISCS2024-11-25

HIBISCS2024-11-25

QES2024-11-22

HIBISCS2024-11-21

HIBISCS2024-11-20

HIBISCS2024-11-20

HIBISCS2024-11-20

QES2024-11-19

HIBISCS2024-11-19

HIBISCS2024-11-19

HIBISCS2024-11-19

QES2024-11-18

HIBISCS2024-11-18

QESMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments